A Limestone Mine With The Government's Data and Princess Diana's Will Could Be My Next Investment

Oh, and I might be adding the stock to my Flagship Fund. The same fund that has returned over 311% since 2020 and is up 6% YTD.

Our first addition to our Flagship Fund this year is one of the largest moat companies I have ever seen in my life.

With over 10 years of profitability behind it, over the past 5 years is up over 300%, and is owned almost entirely by major institutions.

The stock is down nearly 14% from it highs this year and I am going to start opening my position here.

A Quick Company Update

I never would have guessed in million years that I would be talking about investing in a company that owns a limestone mine. Especially a limestone mine that has all of the Government’s data, and Princess Diana’s will…

WHAT? Sounds like the start of a Bond film, or maybe a 007 movie — but it isn’t.

I haven’t been 100% honest either, it isn’t just a limestone mine with gov secrets and famous people’s wills. This company is a record management service provider, and while it sounds just as boring as your mom’s file cabinet at home I promise that the company’s $6 billion in revenue would starkly disagree.

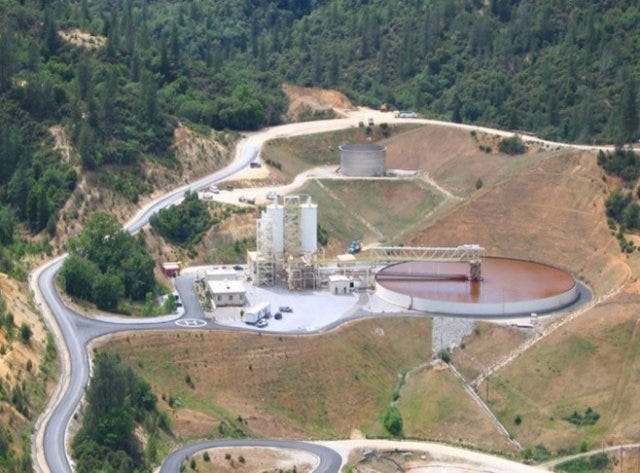

The company owns data centers, cloud software, governments contracts, and yes — a limestone mine turned storage facility that is 1.7 million square feet…

again… WHAT?

The company puts up impressive numbers too, just like Lebron in his prime.

Q4 Earnings reported

All-time record highs in revenue, adjusted EBITDA, and adjusted funds from operations.

All company businesses growing at a 20% CAGR.

A 10% quarterly dividend increase.

Massive growth of 25% in its data center business

Over a 119% revenue increase driven by organic demand and successful acquisitions.

So what is this limestone mine company that I seem so feverishly interested in?

Well, paying subscribers can scroll right on down and view the stock in its glory! If you’re a free subscriber, take advantage of our current subscription prices before prices go up! You get tons of value, like access to my website, access to our stock portfolio tracking sheet, and access to portfolios that fit any investor’s risk tolerance and time horizon!

Alright, it’s time to dive into…

Keep reading with a 7-day free trial

Subscribe to The Simple Side to keep reading this post and get 7 days of free access to the full post archives.