April Showers Brought May Flowers - Markets Up +6.28%

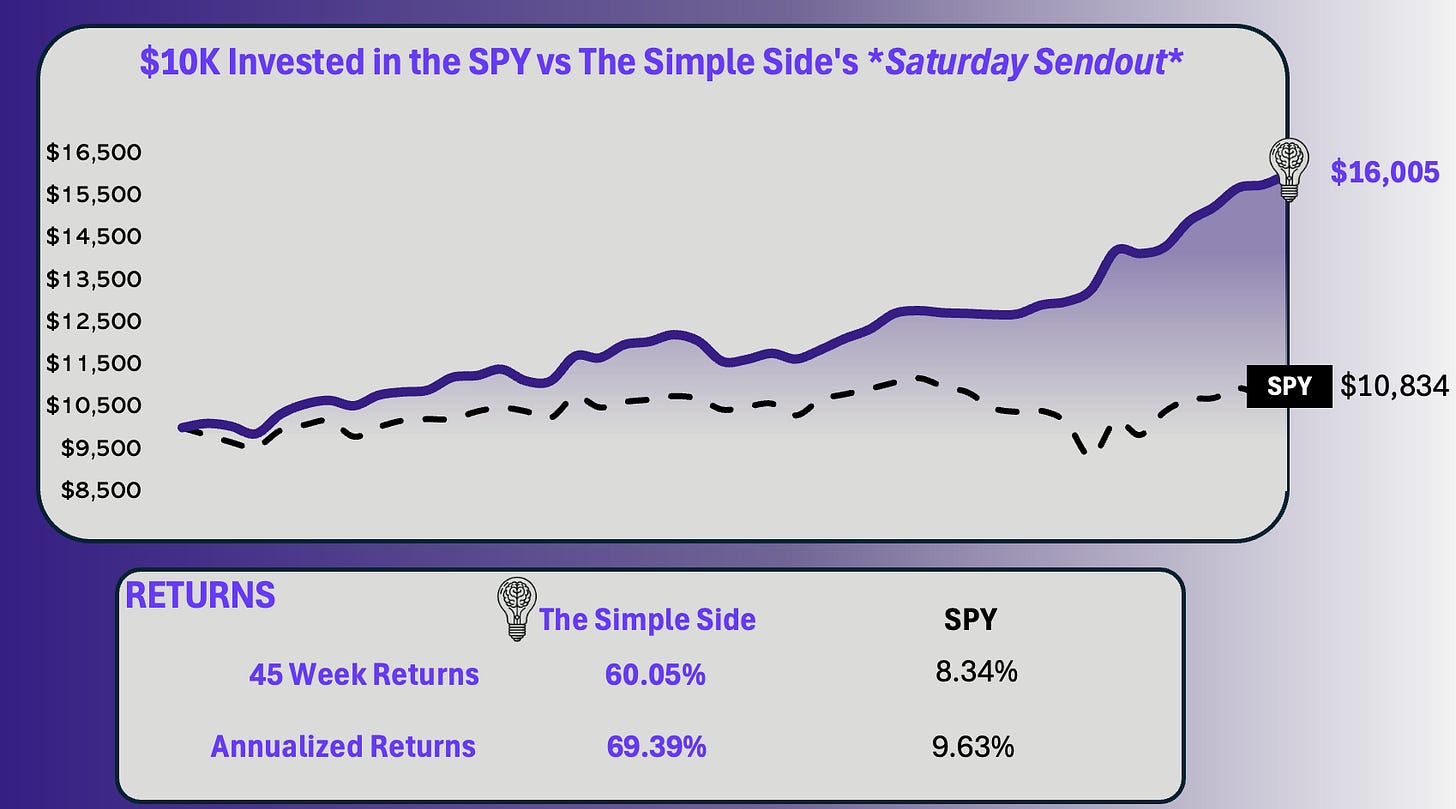

This is week 45 of reporting on and sending weekly picks to subscribers! Total returns are now +60%

To Simple Side Shareholders — good morning! I am glad to have you join me for another Saturday Sendout.

If you are new here or unfamiliar with our content, you can see the layout of everything below!

SATURDAY [free]

Market Commentary

Weekly Picks Performance

An Interesting Trade Idea *NEW*

Total Portfolio Performance

SATURDAY [paid]

Our Weekly Picks

Mergers & Acquisitions Picks

Top Stock Picks

Micro Cap Stock Picks

Earnings & Options

I want your opinions on the new format going forward. Let me know what you think by responding to this email or clicking the button below!

The Saturday Sendout (commentary)

We had a short week in trading (no Monday trading for Memorial day — thank you to all who have served.) This week also marks the final week in trading for the month of May, and what a month it has been…

We will jump into the month as a whole soon; let’s talk about this week and last week first.

You may recall that last week we saw Trump call for 50% EU tariffs and 25% tariffs on Apple. I said “nothing will stick” — well, the EU tariffs were delayed and Apple stock was up 1.21% on the week.

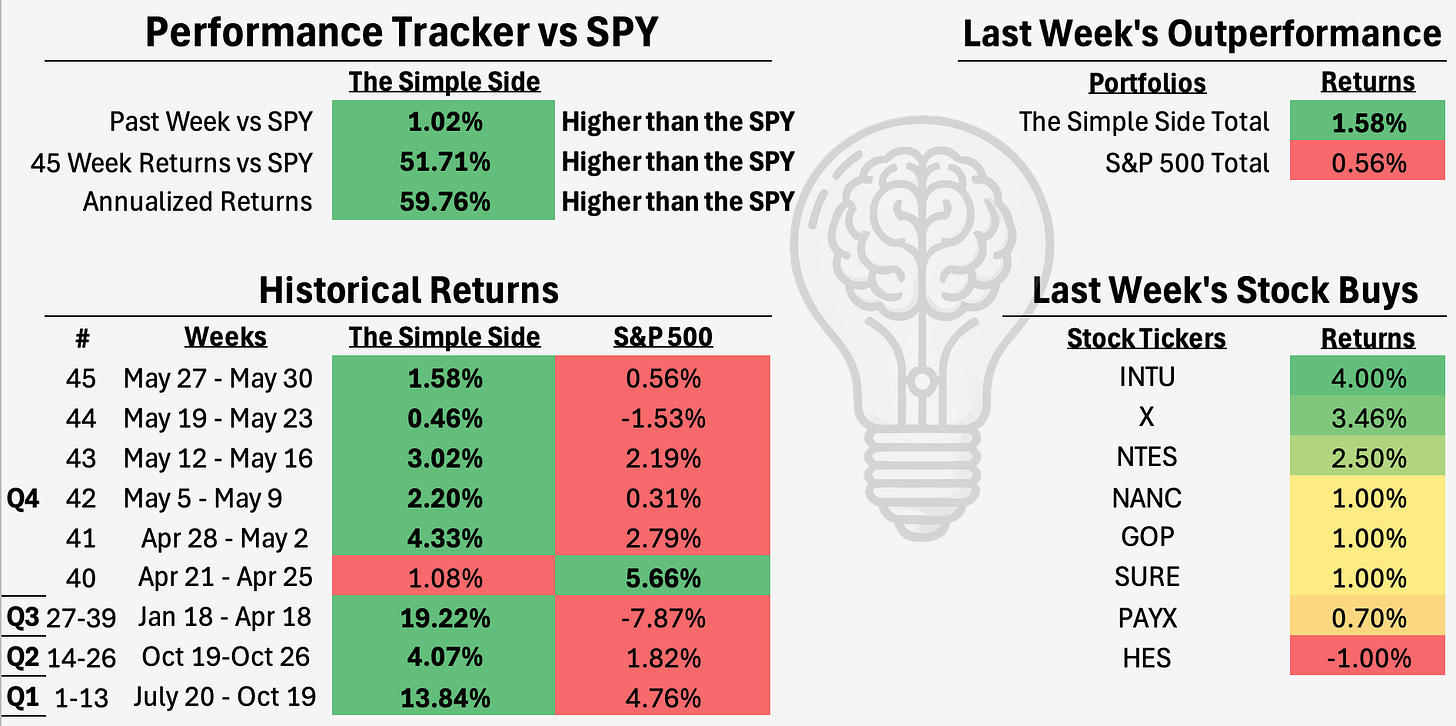

The SPY ended +0.56% this week (not including pre- and post-market action) and paying subscribers will be happy to know that our weekly picks ended up crushing the markets with a +1.58% gain this week!

One could argue that this week cemented normalization back into to the markets. We had tons of Tariff news (both good and bad), and ended up with marginally good performance. I made the statement before: “ignore the media and the tariff news” and so far, that has been great advice.

If you have been paying attention to the Tariff news, then you know that a judge ruled that Trump had no power to put tariffs in place, then that was overturned, then we went back to tariff-war with China… exhausting and not a darn thing worth discussing.

The month of May was interesting as a whole, and was great for investors — April showers really did bring May flowers. Overall, the market saw a 6.28% gain in the SPY, primarily driven by the overreactions to tariff news.

Weekly Picks Performance

For weeks, maybe months now, I have been saying that short term trading outperforms when there is instability and volatility in the markets. This is directly in-line with what I mentioned before: people are overbuying good news and overselling bad news.

This is why our weekly trades portfolio has been performing so well. If you look at our returns, you’ll notice that our weekly picks portfolio size has begun to separate itself from the SPY over the past few weeks.

Over the past 6 weeks, our weekly picks have averaged a 2.11% return vs the SPY’s 1.66% return.

Keeping Up With Our Last Interesting Trade Idea

Last Saturday, I mentioned two key stocks that looked interesting: AAPL and UNH.

For UNH (United Healthcare), I mentioned a few key reasons that the stock would be worth investing in:

Institutional buyers ($11bn in Q1 2025)

Overselling on bad news (down over 50% from highs in 2024)

The political state of the US overshadowing the company in headlines.

My one-liner for UNH was: “buy on bad news, sell on good.”

The stock is already up 17% from its lows this month.

Apple is another story — the company has also seen institutional buyers showing up for the discounted price ($15.77 billion) and has been growing its services revenue drastically (gotta love those subscription models).

The 25% tariffs from Trump are likely not going to stick — he would be crushing the company's largest income source and begging for a non-American company to take hold of the US phone market.

This isn’t something even Trump is willing to do. I suspect a deal will be made in due time, and Apple will remain the flagship phone provider within the US.

Total Portfolio Performance

Now, I know that many of my subscribers are looking for longer-term plays and don’t care too much about the weekly picks. I think that is just fine — our longer-term holdings have also been outperforming!

We utilize a dumbbell portfolio approach. With one side offering a long-term “safe” portfolio (our Flagship Fund & TSS 50), and the other going for growth (Contrarian Trades, Weekly Picks).

This balanced approach has proven effective time and time again. We also offer paying subscribers the ability to look at any and all of our stocks and portfolios with real-time updates here: Check it all out here (for paying subscribers).

My portfolio average return is up to 29.22% YTD.

Weekly Picks

Okay, let’s get into the picks that have returned 38% YTD and 60% over the past 45 weeks. As always, what you see below is a summary of our investments for this week!

Keep reading with a 7-day free trial

Subscribe to The Simple Side to keep reading this post and get 7 days of free access to the full post archives.