Business Development Companies: The Overlooked Dividend Giants

BDCs are required to return 90% of their income to investors, but their profits rely on businesses borrowing money - are they a worthwhile investment?

The Quick and Simple on BDCs

BDCs are companies that stimulate economic growth in the economy and also benefit from preferential tax treatment. If a BDC pays out 90% of their income to investors, as dividends, they pay no corporate income tax (this is 21% for most companies).

Think of BDCs as loan providers for moderately large companies. Some names you might recognize include United States Steel, Etsy, Duolingo, Skechers, Ralph Lauren, and American Airlines. BDCs loan money to these companies which we could call “private credit.”

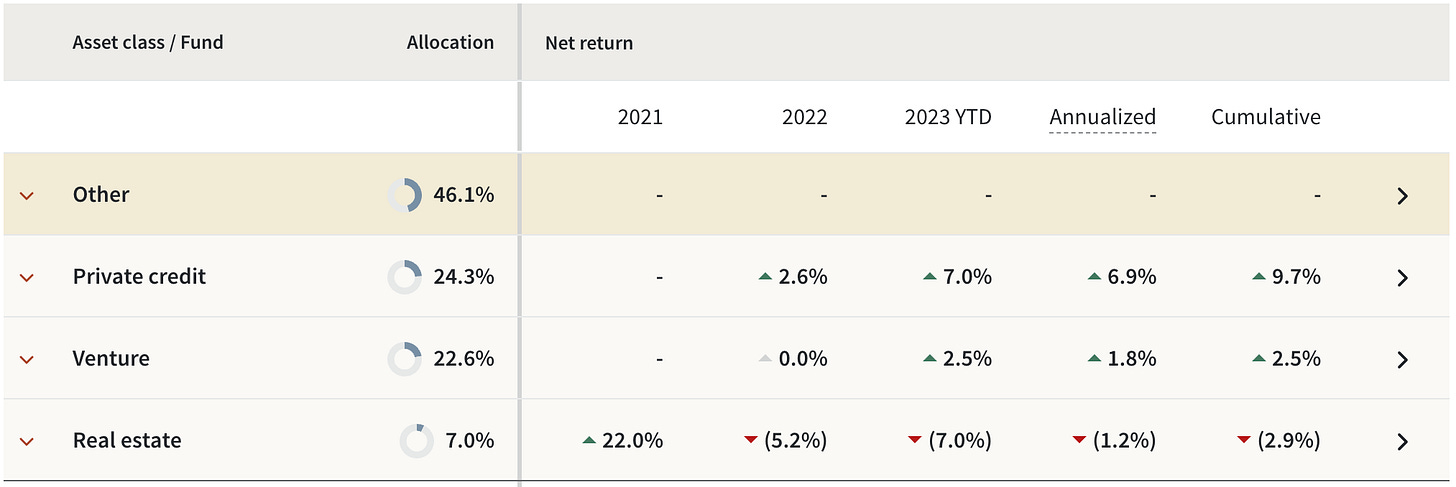

How has private credit performed?

This is an investment platform, which shall remain nameless, where I have money invested. As you can see, my returns for private credit outperform other sectors by vast margins. While this portfolio refers to real estate private credit (REITs), the market for business private credit is much larger and more profitable.

Simple Side of Investment Success: Unveiling the Power of Business Development Companies (BDCs)

So, you want income, dividend income, from your stock portfolio? Let’s start exploring an often overlooked yet potent avenue—the simplicity and effectiveness of Business Development Companies (BDCs).

Understanding BDCs: A Simple Approach to Investment

At their core, BDCs are financial entities designed to fuel the growth of small to mid-sized businesses (created by Congress in the 1980s with the Small Business Incentive Act, which amended the 1940 Investment Act). Think of them as the unsung heroes channeling capital into the veins of entrepreneurial endeavors. What makes them stand out in the complex world of investments?

Simplicity in Structure:

BDCs keep it simple. They raise capital from investors, often through the issuance of shares, and then deploy these funds to support a diverse portfolio of small businesses. This straightforward structure resonates with the ethos of "The Simple Side." For investors seeking a steady stream of income, BDCs present an attractive proposition. By investing in the debt and equity of small businesses, they generate interest payments and dividends, offering a reliable income source—a simple way to add a regular financial boost to your portfolio.

Why Choose BDCs?

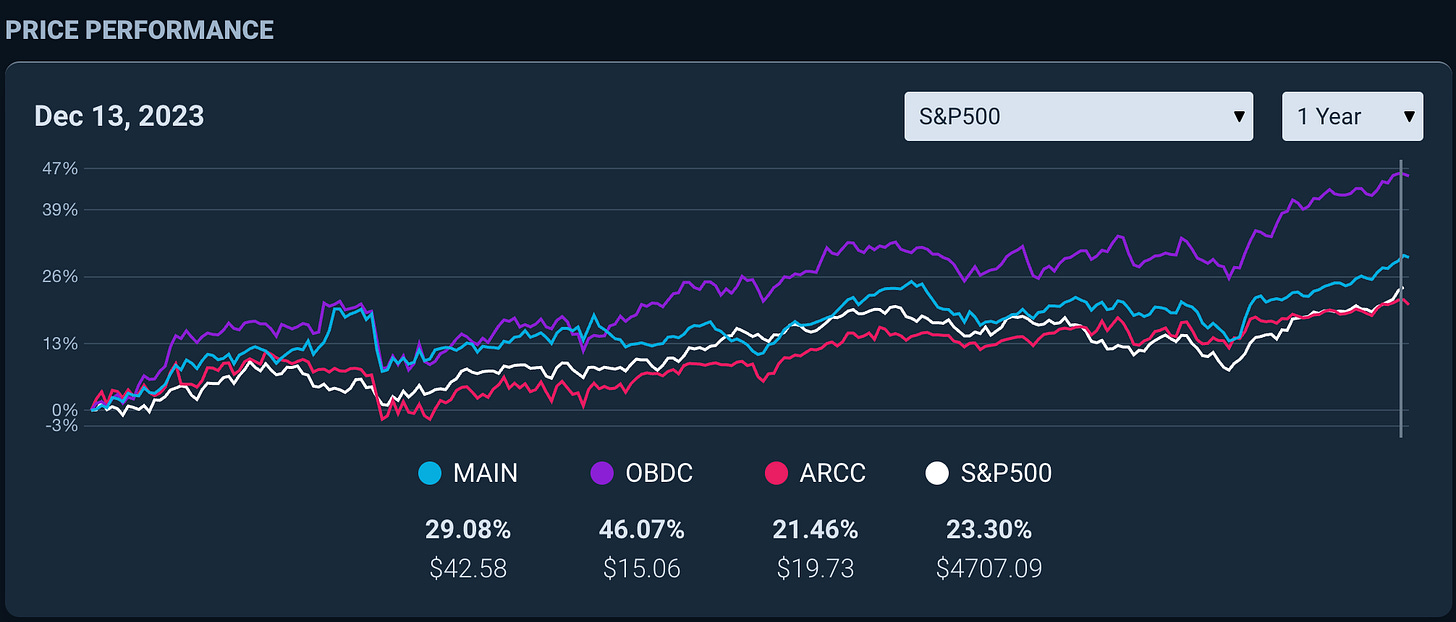

BDCs are going to be your stock portfolio’s income-producing asset with dividend yields ranging from 5%-10%. These companies, over the past year, have also performed well, with 2/3 outperforming the S&P500 over the past year. But wait, there’s more - BDCs can also offer a level of diversity to your investing that is usually hard to come by. Instead of taking the typical, stock-bond split, you can park your money with debt and equity investments which are usually not available to retail investors.

Caveats & Risks

BDCs are RISKY. While they have performed well in the past, they do carry high amounts of leverage. BDCs are also very sensitive to changes in interest rates, if interest rates were to spike, acquiring capital for these companies would become expensive and could hinder profits. Finally, tax rates. While BDCs get off from taxes free of charge, the investors do not. Capital gains on the paid dividends can be staggering since their dividends are charged at your annual tax rate and not the capital gains rate.

Business Development Company Stock Picks

The first BDC that seems to be a good buy is…

Keep reading with a 7-day free trial

Subscribe to The Simple Side to keep reading this post and get 7 days of free access to the full post archives.