If You Think Bonds Are Boring, Think Again

Since October bonds have gained over 30-50% while the S&P 500 declines. Are bonds the best thing since sliced bread?

I apologize for so many posts being sent out in such a short time frame, however, I felt that this research and analysis needed to be sent out to subscribers before the market opens on Monday.

“Successful contrarian investing requires us to live with discomfort”

This quote embodies a trade idea I had on October 11, 2023: buy bonds. At the time there were news articles everywhere with headlines like…

“Bonds are at all-time lows — sell now”

“Bond markets are being hit hard — and it's likely to impact you” (LINK)

“…don’t buy debt and bonds” (LINK)

… the negative-nelly titles and quotes continued from there. So while the whole world of bonds was falling apart, what did I do? I thought contrarily. I lived in discomfort. I welcomed it like fresh bread at Sunday dinner.

So, what did I write to make me such a contrarian?

“I would caution, however, that the general population is usually, say it with me, WRONG. So while people are selling their bonds at record lows what should YOU the investor do? That is all to your digression - good luck.”

For those of you who don’t understand what I am stating in that line I will spell it out for you: BUY BONDS WHILE EVERYONE SELLS AT RECORD LOWS.

A trade that could have made you 40% returns in under a year. Instead of taking more time to brag about how right I was, how about I tell you what I did and what I am doing now instead? This way we can both capitalize on bonds while stocks continue their downward spiral!

Paid subscribers can scroll to the “A Summary” section of this article down below to get a quick 2-minute overview of everything in this article. If you want to do the same, go paid here: Get The Simple Side Premium Subscription Now

Bonds Are Much Simpler Than Stocks

Unlike bonds, stocks are complex. A stock’s price is based on a multitude of things, and to understand it all you need to watch millions of hours of lectures on economics, supply & demand, etc — is anyone else’s head starting to spin? Let me help you visualize the difference:

Okay, no more jokes. To understand why I recommended bonds back in October of 2023, and why they are great now, we need to understand what a bond is and how they work.

What In The Sam-Hell Is a Bond?

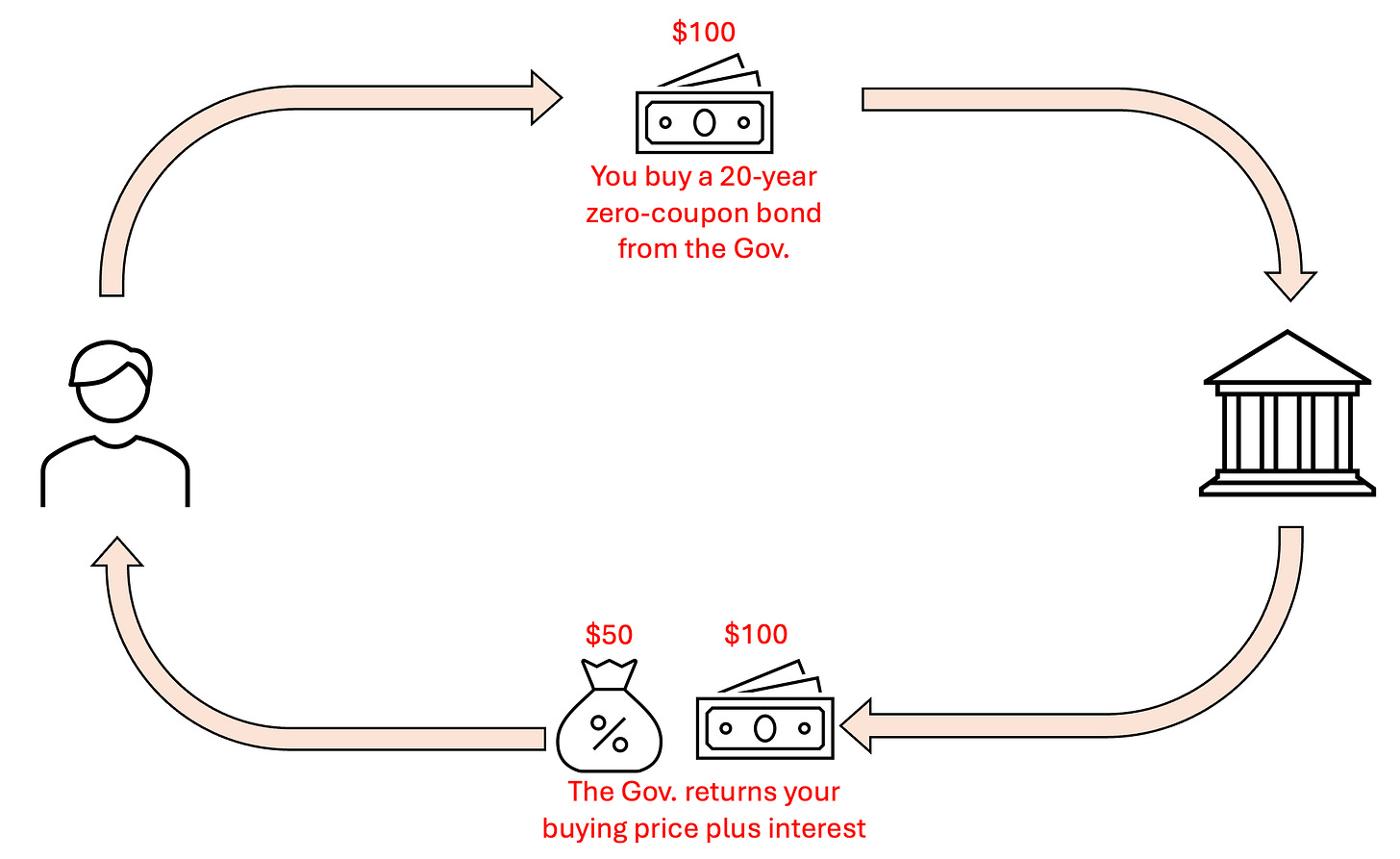

While there are many types of bonds, the only one you need to think about is a zero-coupon bond from the government. Now these types of bonds are EXACTLY like a loan. This is a bolded statement because once you understand this, you’ll understand everything about how these bonds work. So, bonds are like loans — one person borrowing money from another. Bonds have one more piece and that is a time component — think of this like the repayment time on a loan. It can be 6 months, 1 year, 10 years, or longer! Let’s look at how selling and buying bonds work:

Okay, so bonds are loans. They can come from the government, companies, or your city; but how does someone know what the price of a bond is?

I bet you know someone out there who has no idea what bonds are… you should probably send this to them to help ‘em out!

How Bonds Make (or lose) Money

Okay so now you know that a bond is basically a loan, but if people are investing in these bonds then they must make money somehow right? Zero-coupon bond prices are easy to understand basically, and interest rates change bond prices change in the opposite direction.

When rates go up — bond prices go down!

When rates go down — bond prices go up!

It really is as simple as that. Now, if you are a nerd like me and you want to understand the math of why, then look no further (if you’re normal and don’t care then skip past this section):

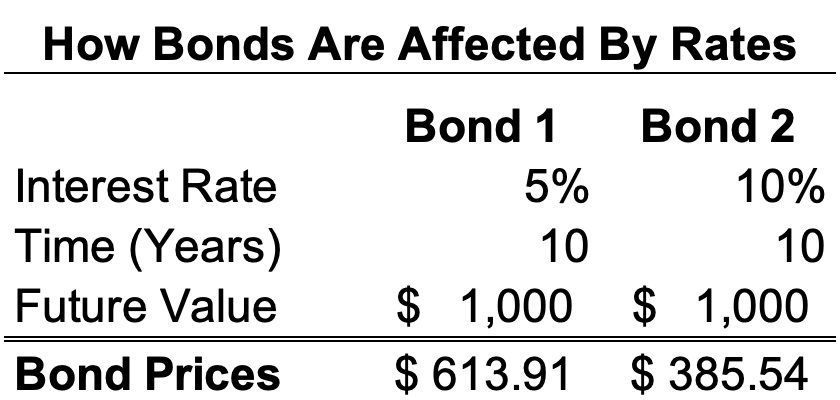

See that top formula, that is how bond prices are set. You take the future value (always $1,000), divided by 1 plus the interest rate raised to the power of time in years.

What you can see here is that the bond with the 5% interest rate is more expensive than the bond with the 10% interest rate. That is because when interest rates are high, bond prices are low. You can buy bond 2 for $385.54 even though it will be worth $1,000 in the future.

Bond Summary: What they are, how they are priced.

So as a quick recap:

Bonds are loans that we (the buyers) give to the government or corporations.

When interest rates are high bonds are low and when rates are low bonds are high.

We make money on these bonds by buying them when rates are high and selling them when rates are low.

Why I Liked Bonds When No One Else Did (And Still Do Now)

Okay, everyone hop in the DeLorean because we have to take it back to “The Covid Era.” When Covid happened and everything was locked down, a few things happened.

The economy was immediately crushed.

To help boost the economy, Trump gave people free money — whoop whoop.

The FED dropped interest rates to help bolster the economy.

This “free money” created inflation.

The excessively low rates also contributed to inflation.

This “low interest rate” actually began occurring in late 2018 and was then exacerbated (look at that fancy word) by Covid in late 2019. We then keep rates low until early 2022. During this period, from 2019 - 2022, rates remained below 2%. Levels we only saw during the housing market crash and the dot com bubble.

So while all of this was occurring, what was happening with bond prices? Well as you can see below, orange is bond prices and blue is interest rates.

In October of 2023, two big things happened. Rates hit their highest mark and similarly, bonds were at the lowest. During this period everyone was SELLING out of their bond positions. The prices were down, people didn’t see them recovering, and so they sold. They called bonds “bad investments” and everyone talked about their poor performance. However, I saw this as the greatest buying opportunity of all time, and I did just that.

What About Rates and Bond Prices Now?

The first thing is the September rate cut — betting markets predict a 94% chance of this happening, and futures trades have priced in a 100% chance of a rate cut. This will be the first driving factor of bond prices increasing.

I think we are in the beginning stage of a short-cycle recession. We are seeing markets decline consistently now and multiple market makers have said they see this trend continuing. If market makers see a downtrend, that means they won’t invest which brings the market down further. Eventually, this will drive further rate cuts and high bond prices.

If we aren’t in a recession, there is still reason to believe we will soon see rate cuts. For example, over the past year, we keep seeing economic data being adjusted down after it has been reported. When economic data (inflation, GDP, unemployment) gets reported, we hear a “forecasted” number. These values are then adjusted 2-3 months in the future. When these adjustments are happening, they always tend to happen in a negative direction. GDP in Q1 was adjusted lower, new jobs were forecast down, and Q2 GDP will likely experience the same downward adjustment.

If you take government spending out of GDP calculations, we are sitting at a -4% growth. This again is unsustainable, and will eventually lead to a large recession. It is legitimately bound to happen as we continually increase our credit and debt obligations.

You might be wondering, “What are you doing now?”

Well…

Keep reading with a 7-day free trial

Subscribe to The Simple Side to keep reading this post and get 7 days of free access to the full post archives.