NEW SATURDAY SENDOUT | Weekly Picks +3.02% Last Week | Total Portfolio +28.49% YTD

We are switching up our Saturday newsletter - we are making our weekly newsletter two sections. Stock picks on Saturday, market commentary on Sunday!

To Simple Side Shareholders — good morning! I am glad to have you join me for another Saturday Sendout.

If you are new to the newsletter, welcome! You picked a great week to join us as we have just decided to switch up our weekend format!

Here is our plan going forward:

SATURDAYS:

Saturdays will continue to be the day we send out our paid subscriber content. This will include things like…

Commentary On Our Portfolios

Our Weekly Picks

Mergers & Acquisitions Picks

Top Stock Picks

Micro Cap Stock Picks

Earnings & Options

SUNDAYS:

Sundays will be the day I send out my general market outlook and will be ENTIRELY FREE! It will include things like…

Interesting trends we see

Politician Trading Trends

Insider Trading Trends

Gold Trading Trends

I want your opinions on the new format going forward. Let me know what you think by responding to this email or clicking the button below!

The Saturday Sendout - V2

You will probably recognize this graph from last week. What we are looking at is the overall S&P 500 momentum (in blue) and the S&P 500 index in green.

You’ll notice that nearly every time we see a dip or a drop in S&P 500 momentum (blue line), there is a buying opportunity. While it may not be directly correlated with a huge drop in the S&P 500, there always seems to be large gains to follow.

This is exactly what we saw just a few weeks or months ago. The S&P 500 momentum indicator dropped greatly (buying opportunity), and we have since recovered in full!

Anyone who claims to know what direction the market is going over the next couple of weeks or months is lying. There is so much volatility in the markets right now that we could see +/- 8% in a week, typically the returns the market would see in a year, and no one would be surprised.

I expect stocks like PM & WM to continue to perform well over the coming weeks (until the volatility is gone).

The Effect on My Weekly Picks

As I have said before, instability in the market creates opportunity for traders & should be ignored by long-term investors.

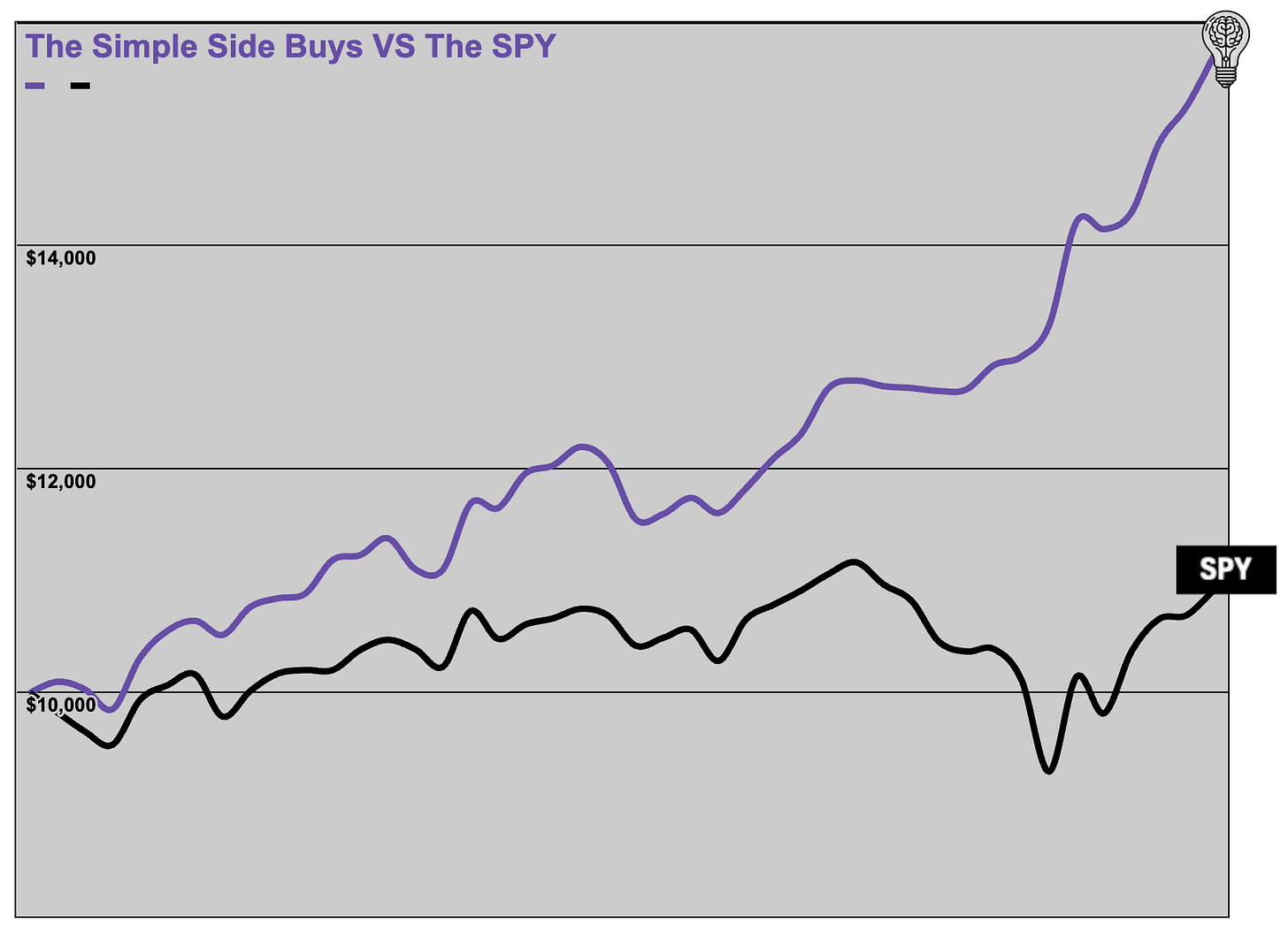

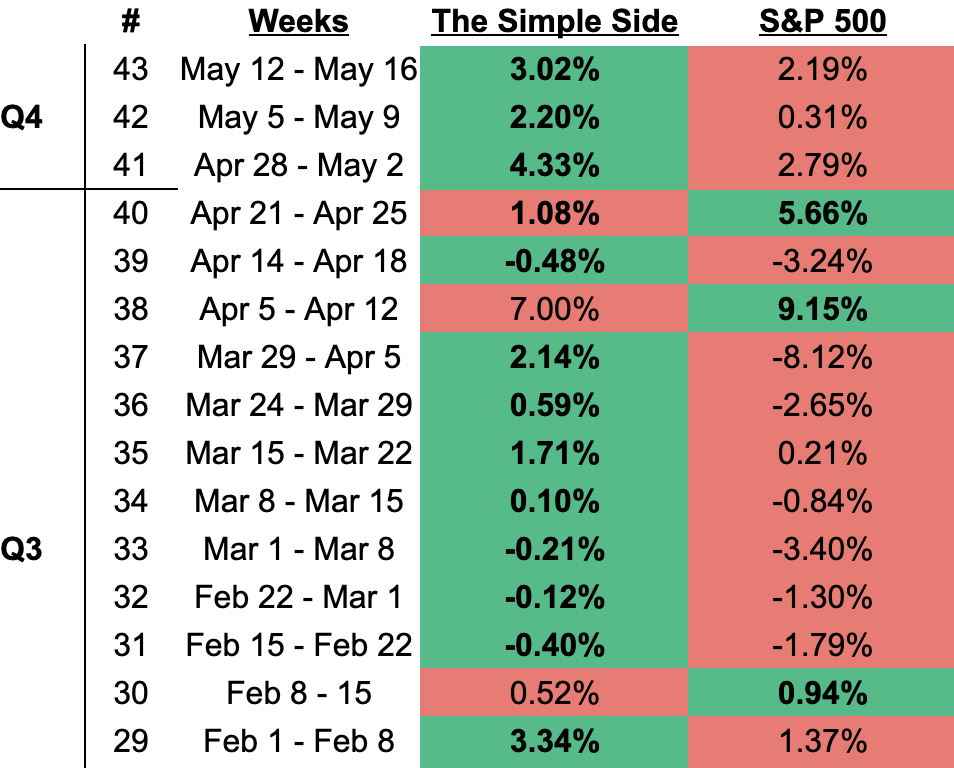

This is why our weekly trades portfolio has been performing so well over the past couple of weeks. In fact, if you look at our returns, you’ll notice that our weekly picks portfolio size has begun to separate itself from the SPY over the past few weeks.

From Feb 1st to now, the weekly picks averaged a 1.66% return per week.

Over the same period of time, the SPY has averaged a 0.08% return per week.

Total Portfolio Performance

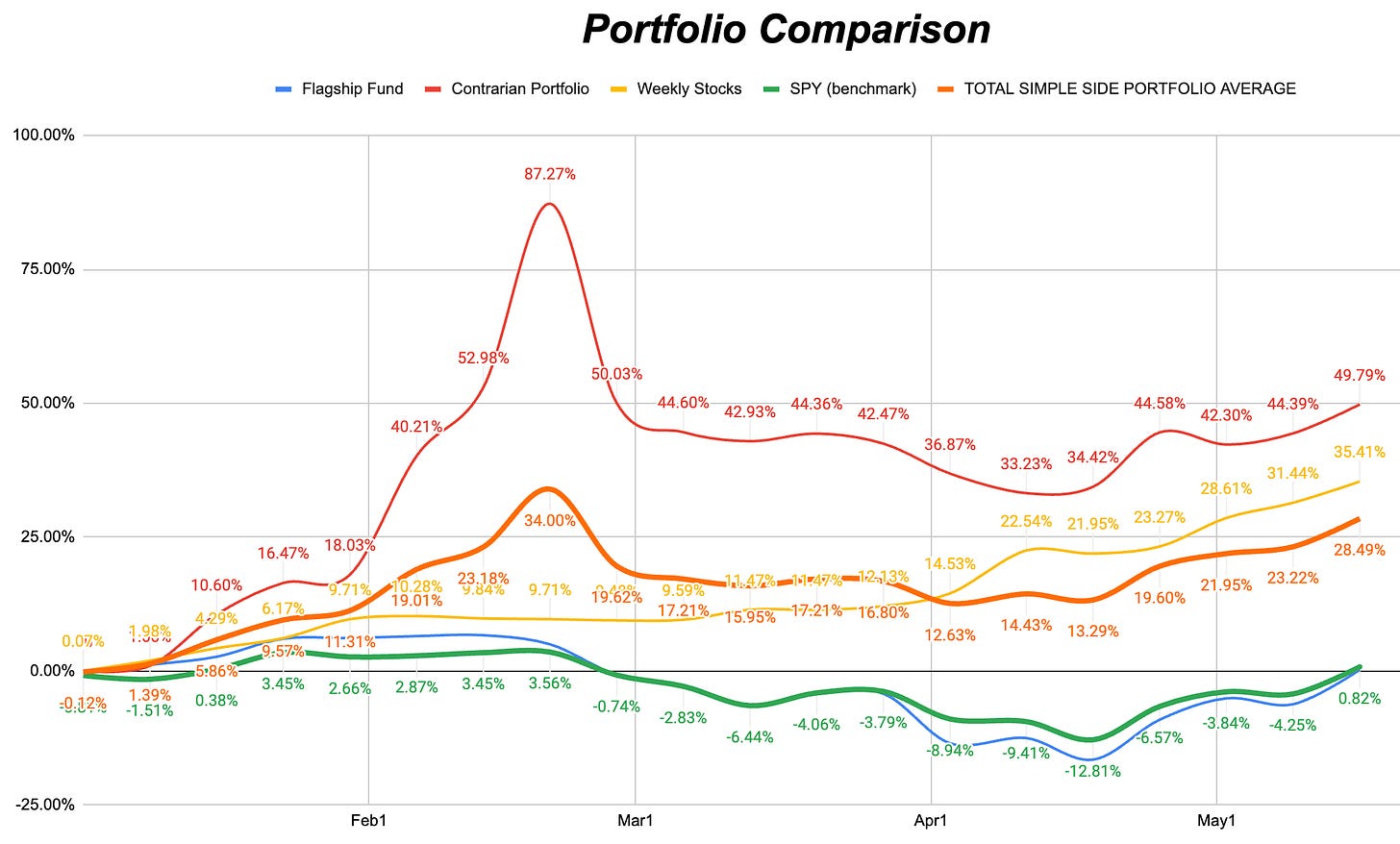

You may be uninterested in weekly picks, which is just fine! We utilize a dumbbell portfolio approach. With one side offering a long-term “safe” portfolio (our Flagship Fund & TSS 50), and the other going for growth (Contrarian Trades, Weekly Picks).

This balanced approach has proven effective time and time again. You can read about the other portfolios on our newsletter site here.

We also offer paying subscribers the ability to look at any and all of our stocks and portfolios with real-time updates here: Check it all out here (for paying subscribers).

My portfolio returns average return is up to 28.49% YTD.

Weekly Picks

Okay, let’s get into the picks that have returned 31.44% YTD and over 52.51% over the past 42 weeks. As always, what you see below is a summary of our investments for this week!

Keep reading with a 7-day free trial

Subscribe to The Simple Side to keep reading this post and get 7 days of free access to the full post archives.