Real Estate Status And Where To Invest

It's time we catch you up to date on everything RE. Read now, thank us later.

Updates From the Last Report

Our last real estate update came to you in late February and has been spot-on since. Let’s jump into each section from the previous newsletter and discuss where things currently stand, based on some of the most common indicators.

Interest Rates

We previously announced our belief that interest rates were not going to be coming down in the first part of this year and guess what, like a roofer laying down shingles, we nailed it. Rates are still high, well high relative to where they have been in previous years. The inflation numbers coming out aren’t supporting a rate cut for the foreseeable future either.

The high and sustained inflation numbers have also increased the price of living outside of home buying and mortgages. People look at their lifestyle first and then decide if they want to keep up their lifestyle or put it on hold to buy a house and pay a mortgage. The way prices have increased, people can’t maintain a lifestyle while simultaneously taking on mortgage payments.

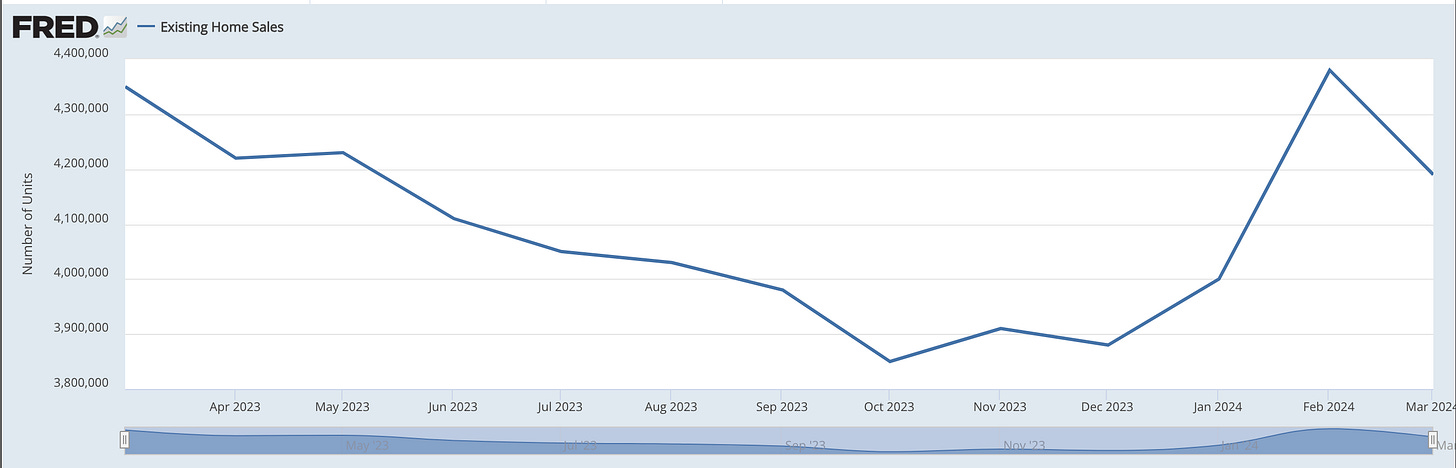

Existing Home Sales

I'm not sure what to say other than “I told you so.” In our previous release, I stated, in contrast with most major outlets, that housing sales were going to begin declining. While most people believed buyers outweighed sellers by vast margins — I starkly disagreed. I cited high inflation data, and high rates as deterrents for buyers. It’s like saying you want a cookie and then being offered oatmeal raisin — you don’t want oatmeal raisin.

We are holding strong on this assumption. Buyers are being hit hard by high rates and debt levels that are literally at the highest levels we have ever seen. Buying a new house just isn’t in the cards for most people.

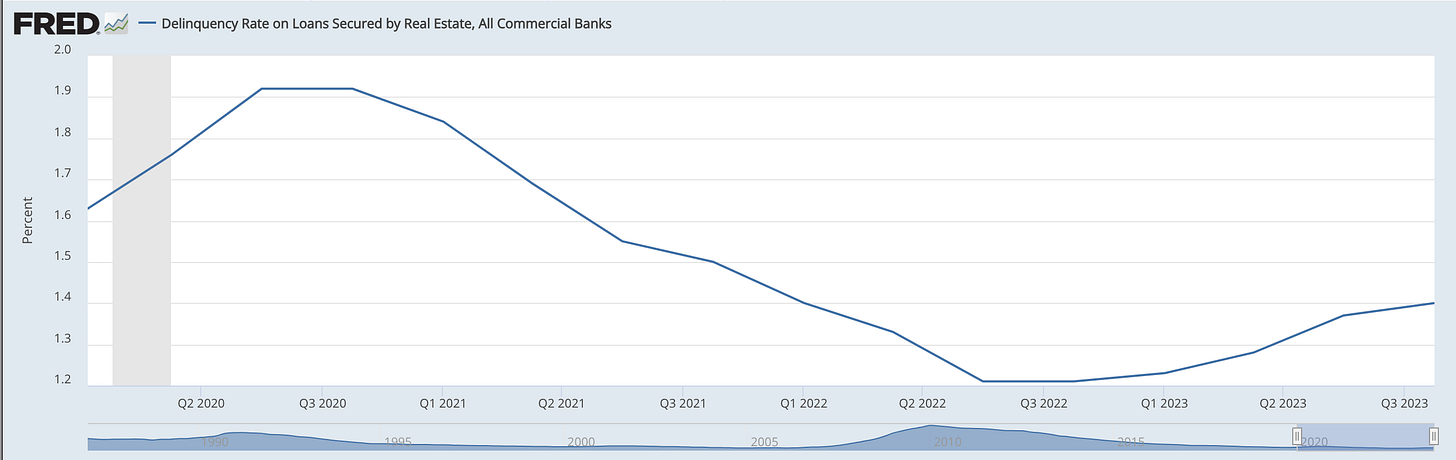

Delinquency Rate

We are starting to see the rough times with higher mortgages materializing in delinquency rates as well. After COVID, when everyone lost their jobs and people were just scraping by, there was a massive jump in missed payments. Now, after Q3 of 2023 and heading into 2024, we have seen this rate jump again. This could cause an eventual surplus of foreclosures — a great time for investors, but a bad time for the American people as a whole.

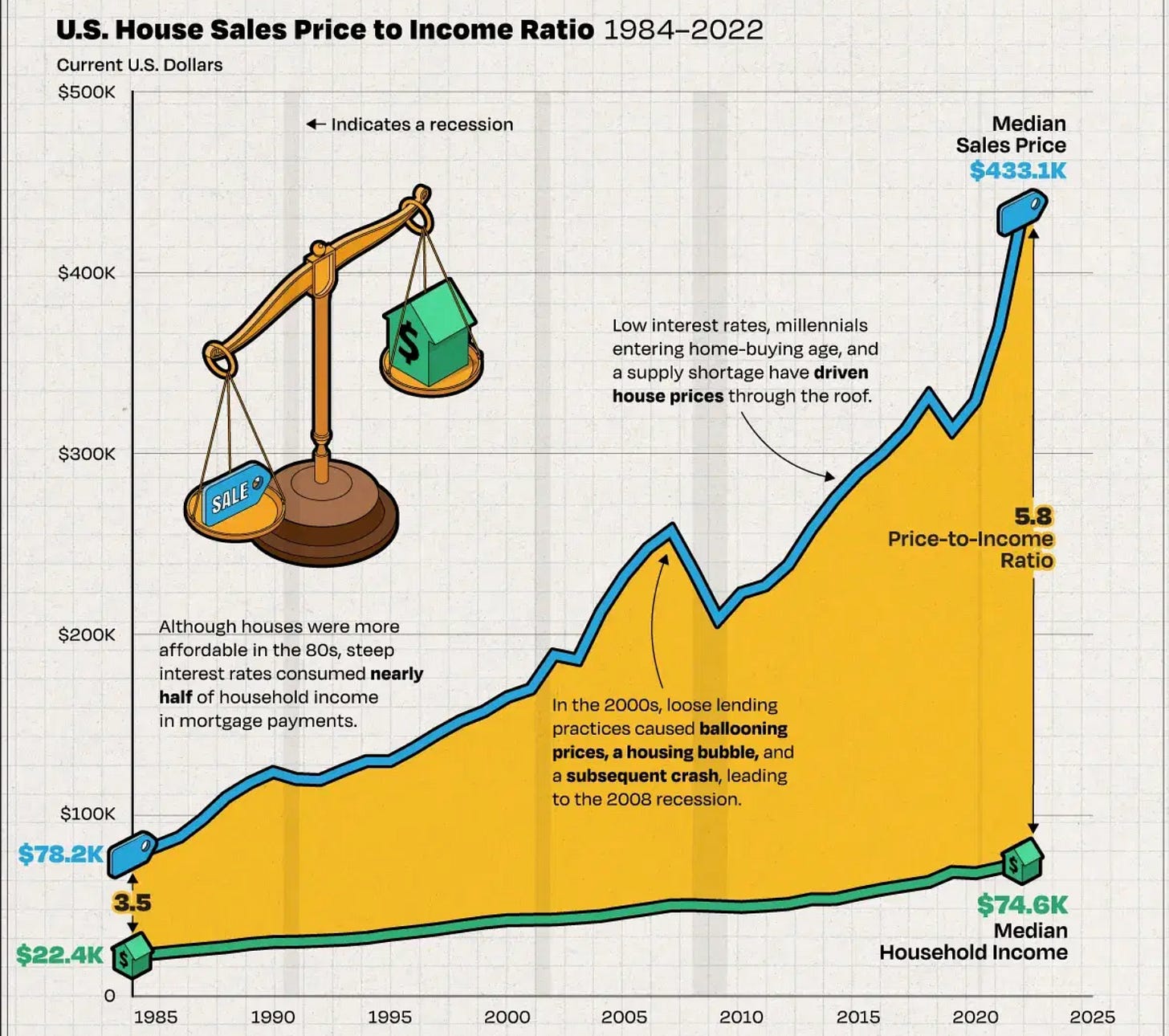

The Highest Mortgage Payments In History

So we have high interest rates, high delinquency, decreasing sales, and the highest median home prices in history. Do you know what that means (no need to be Sherlock to figure this one out) — I referenced it earlier. We also have the highest median monthly mortgage payment in history: $2,747. Should I give you some time to soak that in?

We are closing in on a median payment of $3,000 a month. That is 60% of the average salary in the US ($59,384) today. Whatever happened to the 50% debt-to-income ratio? Here’s some more information from Redfin:

Housing payments are soaring because home prices and mortgage rates are high. The median home-sale price is $378,250, up 4.5% year over year and just about $5,000 shy of the record high hit in June 2022.

The Worst News Of All

We have reached the HIGHEST level of housing price-to-income ratio ever. In 1985, it took you 3.5 times your salary to afford a house. That house’s price was only $78.2k. Now that same house is $433.1k. Houses have increased over 5.5 times from then to now. What about buyers’ income? Only increased by a value of 3.3 times that of 1985.

Basically, houses are priced over 1.5 times what they should be. Interestingly, this means a crash isn’t likely because the median home price could drop all the way to half of its current value and align to the same price-to-income ratio from ‘85. While that isn’t entirely true (the frenzy of losing 50% would cause a crisis/crash), it is a terrifying statistic to see.

Will The Market Crash?

Crash? Not likely anytime soon. Lose a couple of percent over the next while? Absolutely. It is definitely not the time to buy, and I believe anyone could tell you that.

As long as investors are finding it hard to make numbers pencil and homebuyers are being priced out of their American dream. The housing market will remain on rocky ground. Things will likely drop or stay stagnant for the foreseeable future. When things start to change I will be sending out another update to you all.

Where Is RE Investing Still Worthwhile?

I want to highlight the Utah market. Analysis available for paid subscribers.

Keep reading with a 7-day free trial

Subscribe to The Simple Side to keep reading this post and get 7 days of free access to the full post archives.