Spain's Power Grid Disaster Just Made This Industry More Attractive Than It Has Been In Years

Sugar and spice and everything nice? How about oil and coal fatten the bankroll...

A good way to look at it is to try to focus on what is hated and unloved in the market. This is often a great starting point.

I will get into the reason for the article title and the stock investing ideas I have that could easily become some of the most profitable trades in your portfolio soon — just humor me for a moment.

That quote above about what is hated and unloved is from Monish Pabrai — a man who made billions emulating Buffett’s investment strategy. Well done, Monish.

I agree wholeheartedly with this philosophy, and my contrarian trades portfolio has been entirely based on this thesis.

Here is another strategy I like to follow when I make my contrarian trades:

“Heads, I win; tails, I don't lose much.”

Okay, you’re wondering what I am rambling on about and why I am talking about Spain.

Energy.

Spain’s Crisis

If you haven’t heard, or you need a quick refresher, Spain is currently trying to phase out fossil fuel and nuclear generation. Yes, both. They want to be entirely reliant on renewables by something like 2030.

While I have nothing but respect for them and their noble cause, they just exposed the largest issue with their massive shift. They recently suffered a massive power outage in late April that forced demand to drop by almost two-thirds in seconds. The effects of the blackout also affected Portugal, leaving the entire peninsula in the dark.

Sounds less than ideal.

Want to know what else sounds less ideal now that this happened to Spain?

Investing in renewable energy.

For better or for worse, anyone who has capital to allocate or invest has to see this as a major turn-off for any renewable energy investment. Who wants to invest in infrastructure that could fail without a moment’s notice, sending an entire country into a blackout?

Now, where there are issues like this, there are also solutions. Typically, those solutions make a few contrarian people a lot of money. I intend to be one of those people — at least in the eyes of the Spanish.

The Hated and Unloved Investment

What do people in Spain hate right now?

Gas, oil, and coal.

These are the exact places that I see the most opportunity right now. I won’t dive too deep into individual stocks at the moment, but I will quickly talk about each sector and throw a couple of possible tickers at you that might be worth investing in.

The Case For Fossil Fuel

Global producers are pumping out more crude than the market can handle, creating a glut and putting downward pressure on prices. Analysts are openly fretting about oversupply: 2025 could see oil supply exceed demand by about 1 million barrels per day at the peak, with firms like Wells Fargo slashing their price forecasts (think ~$70 Brent, ~$65 WTI for the year). But analysts on Wall Street aren’t the only ones expecting price declines.

, one of the top energy analysts (dare we say, of all time) has been calling for $50 a barrel for months. We think Doomberg is right.Oil prices have been sagging and taking oil stocks down with them. However, I want to remind you of something very important:

Fossil fuel companies build during republican presidencies and they make crazy money during democrat presidencies.

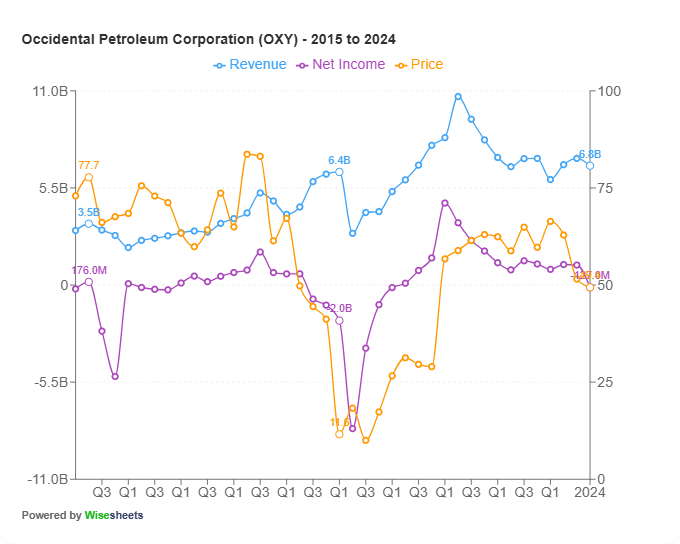

Starting a position in Oil & Gas now is a wonderful idea, assuming you are ready for the 3-4 year payoff period (of course, you’ll collect dividends along the way). My two picks are ConocoPhillips and Occidental Petroleum.

Let’s be clear: the herd is bearish on oil. Year to date, energy stocks have been hit hard – ConocoPhillips is off roughly 11%, and Occidental is about 20% in the red.

Wall Street’s narrative is all about demand worries (China slowing, EVs rising) and overflowing supply. To most, “too much oil” sounds like a nightmare. But to us contrarians, it’s a dream scenario. Oversupply-driven price dips tend to be cyclical and self-correcting, and in the meantime, they open up bargain entry points into quality companies.

Even investing legend Warren Buffett seems to agree: he plowed $10 billion into Occidental to grab a stake in the prolific Permian Basin, doubling down when others were shying away. If that’s not a contrarian signal, I don’t know what is.

As I stated earlier, don’t look for a quick flip on these companies, or on any Oil & Gas stocks, the money will be made in the next 4+ years.

The Case For Coal

The truth is that global demand for coal is surging even as the commodity is vilified. Case in point: China – which already consumes over half of the world’s coal – increased its coal burn by 6% last year to a record high ~4.9 billion tons.

Beijing is even greenlighting new coal-fired plants at a staggering pace to stave off power crunches. This insatiable appetite from China (and other emerging markets) provides massive tailwinds for coal producers, even while Western politicians claim coal’s days are numbered.

Keep reading with a 7-day free trial

Subscribe to The Simple Side to keep reading this post and get 7 days of free access to the full post archives.