Exposing My 'SAFE' Portfolio: 51 Stocks To Set and Forget!

The 51 holdings that have beat the S&P over the past 1, 5, and 10 year periods!

Quick Hint: Paying subscribers (shareholders) can go all the way down to the bottom of this email to see a summary of everything! If the post is too long to fit in an email, there should be a link to bring you to the website!

If you aren’t a shareholder, you can click this button to join them!

People treat investing like a game. They chase high scores, big wins, and make decisions as if they can click the “reset” button to try again. Emotions… not logic, lead the charge in the markets. The “buy” button is an adrenaline release for someone looking for a quick win because the media said ‘Game Stop’ would make them rich.

Boy does the media love to screw over retail investors. They induce fearful narratives to drive more clicks to their ad-filled websites trying to capitalize on the unknowing investor.

The game will always be rigged against you — until your frame of mind changes.

Part of what makes great investors great is the way they look at investing. The mental models they have developed over the years.

These savvy investors tend to do two things right (and these matter more than anything else):

They work within their circle of competence — they only invest in things they know to be true or they understand.

They build mental models — ways of thinking about things — that they use to analyze the market and the stocks they purchase.

The best mental model I built when I began investing was The Farmland Mindset.

The Farmland Mindset

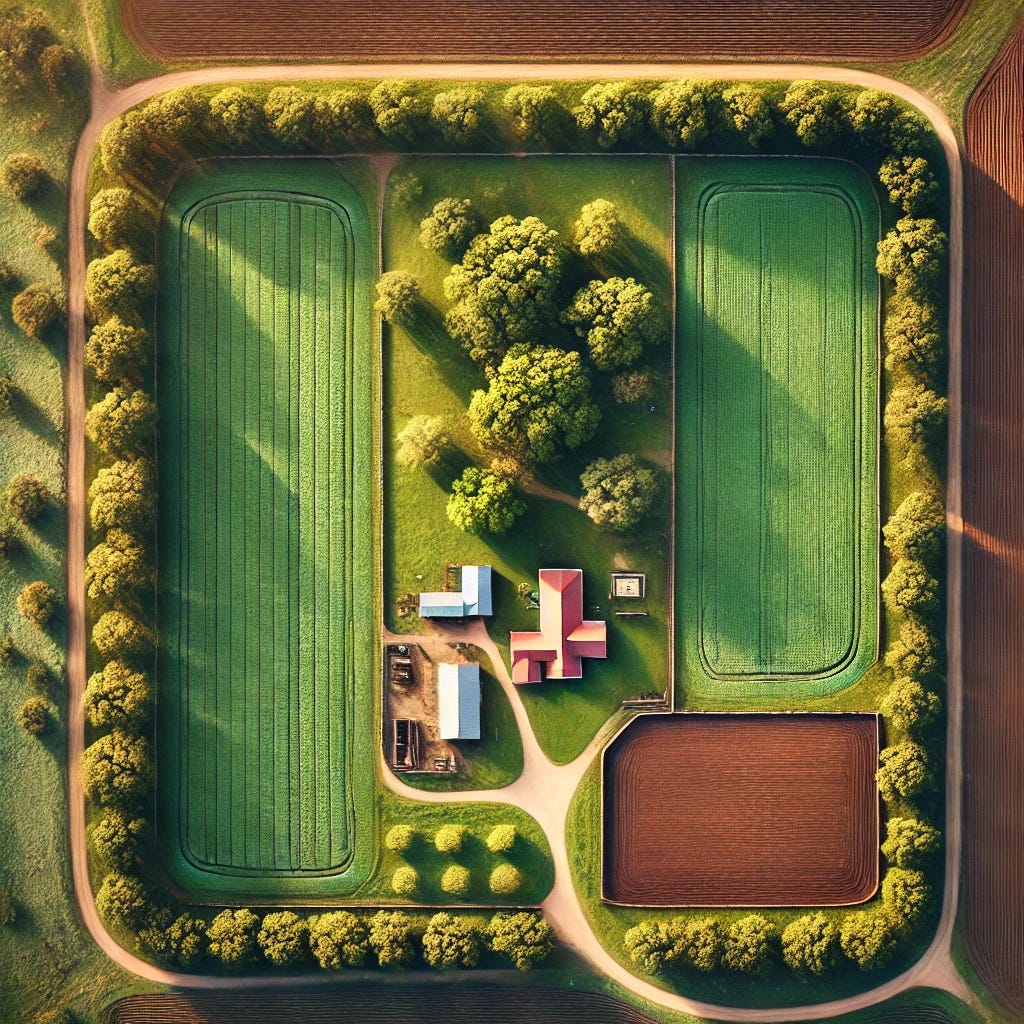

Remember this picture because it will serve as the basis for my investing strategies.

Think of yourself as a farmer and your investing portfolio as a farm. As a farmer, what do you want from your farm? Probably 2 main things:

Your farm needs to keep you safe

You shouldn’t have to always be worried about your portolio’s performance.

See how the trees around the outside the outside of the farm protect it? Part of your portfolio needs to do this for you!

Your farm should make you money

While you could live off the investments from #1, there are still big opportunities in the market and we want to capitalize on these.

See the one field that is being cultivated and has that dark brown soil? We want to find the right stock to plant here that will be our money maker for the year. These have been SG 0.00%↑ (76% return) and ZROZ 0.00%↑ (60% return) for us in the past.

Contrarian Trades - THIS IS THE FUN STUFF!

Exposing Portfolio #3: The Saftey Net

I am sure you noticed the trees are highlighted in the above picture; but do you know why these trees represent such an integral part of an investor’s portfolio? Well, these trees are called ‘windbreaks’ and they do much more than provide privacy from nosey neighbors. They slow the wind before it causes damage to your home, crops, livestock, etc.

The trees should make you feel safe as a farmer, just like this portfolio should make you feel safe to take risks in the market! Investing in a safe portfolio is a way to acknowledge that not everyone can be like Buffet.

We can’t all spend our days reading through company financials.

This portfolio saves you from having to do all of that work. It makes investing Simple.

The 51 ‘Windbreaker’ Stocks

Who would have thought that 51 holdings could give you better returns than the S&P 500 by vast margins?

When I was putting this portfolio together I did hours of analysis FOR EACH INDIVIDUAL STOCK. My requirements were simple:

High Quality

Good cash position & high profitability!

Low Capex

They spend their money wisely!

Good ROE & ROC

Good returns on the money they spend!

Stocks held and bought by major investors

I searched over 145 portfolios of major investors to do this!

The Shareholder Summary

Let me know if you want to see specific analyses for any of these particular stocks, and I will get it done for you. You can fill out the form to request a specific stock here:

You can find the information below for all 51 holdings.

You can find everything above grouped into sections of 9 below. You should be able to click on each section to take a better look at the group of stock!

Keep reading with a 7-day free trial

Subscribe to The Simple Side to keep reading this post and get 7 days of free access to the full post archives.