When Everybody Is Digging for Gold, Sell Shovels

The most recent gold rush has been AI - Nvidia sold shovels. Where's the next gold rush and what companies are selling shovels?

“The difference between playing the stock market and the horses is that one of the horses must win.” - Joey Adams

I recently stumbled upon the following graphic everywhere: LinkedIn, YouTube, Substack, and the list goes on. It’s a great meme and it’s violently accurate. Nvidia has become one of the largest companies in the US (in terms of market cap) because they sell something the other largest companies need: AI chips.

The good news? There are other ‘shovel’ companies out there.

I don’t know how you feel about Nvidia, but I think stocks like this lose their star status once everyone and their random Uncle Jim knows it’s out there. Companies that end up in the media limelight end up trading for crazy high multiples and have less “value add” than before (NVDA 0.00%↑ currently trades at a 62x value of their earnings).

‘What’s the point?’ you may be wondering.

Well, there are other ‘shovel’ companies out there that you can take advantage of BEFORE your Uncle Jim starts telling you to buy in.

Selling Picks and Shovels

The thought process for finding a ‘shovel’ company is actually quite simple, it just isn’t often that we tend to use this logic when searching for stocks. When researching what to buy you need to have the correct mental models. Two of the main people who talk about mental models are Shane Parrish and Naval Ravikant. I won’t dive into them or their work now, but they are both worth a listen, follow, subscription, read — you get the gist.

“Why mental models? There is no system that can prepare us for all risks. Factors of chance introduce a level of complexity that is not entirely predictable. But being able to draw on a repertoire of mental models can help us minimize risk by understanding the forces that are at play.

-Shane Parrish

The mental model you need to find ‘shovel’ companies is vertical reliance — it sounds like fancy investing jargon — but in reality, I just made that up. When miners flooded into California searching for gold, they relied on their pickaxes and shovels. Not dissimilar from companies racing for AI ‘gold’ needed their chip-axe.

Here is how the mental model process would have gone for Nvidia:

AI becomes popular → Large companies want market share → They build their own AIs → Their AIs need chips to run → Where do they get these from? → Nvidia!

Now, harnessing all of the words I read from Shane and Naval, I decided to model the ‘vertical reliance’ mental model to find some new shovel companies.

Vertical Reliance; Mental Models

I won’t bore you to death with all of my in-depth background thinking. I am trying to stay away from becoming like that high school chemistry teacher we all had. You know the one who was talking about ionic bonding while all you needed to know for the test was H2O = Water.

Enough lamenting, let’s get to the top 3 of this list:

Who supplies chip makers with the tools/materials to make the chips?

Semiconductor Tool Manufacturers/Suppliers

What do these new AIs need to run?

Data Centers

How do consumers/businesses access these AIs?

Screens

Between these three thought paths, I found some of the most intriguing stocks that have ever been presented in this newsletter.

Material and Tool Suppliers

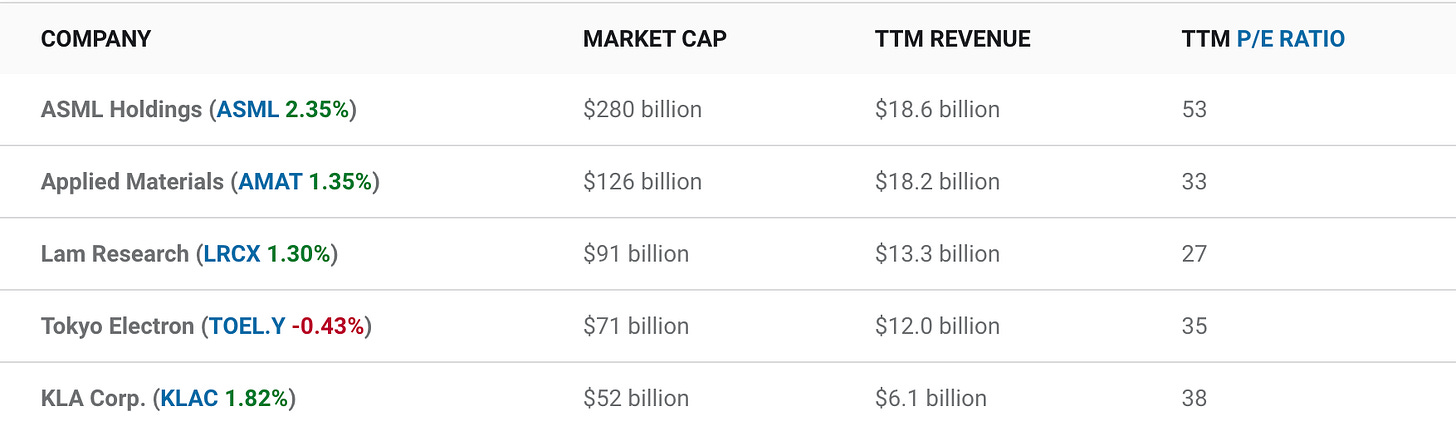

The above list contains just 5 companies that supply chip manufacturers with their required tools. Again, here we can see the reliance piece starting to play again. For the sake of time, I will take a look at just one of the stocks I find most intriguing: Applied Materials (AMAT 0.00%↑). They are a leader in materials engineering solutions that are used to produce virtually every new chip and advanced display in the world.

Basically, they sell what Nvidia needs to make its chips.

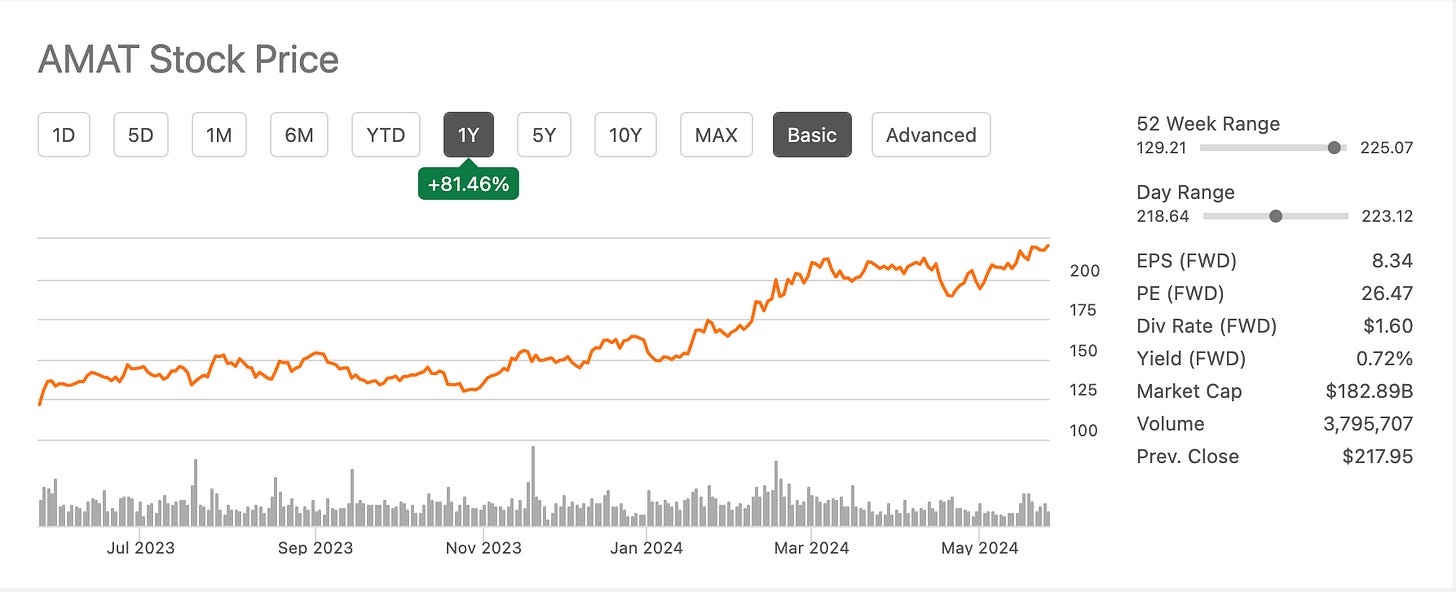

From this time last year, AMAT is up 81% and is riding next to its 52-week high. It also beat every quarterly revenue for 2023 and the first two quarters of 2024. They also offer a small but valuable dividend of 0.58%.

However, these aren’t the only things that make a stock like AMAT an attractive buy.

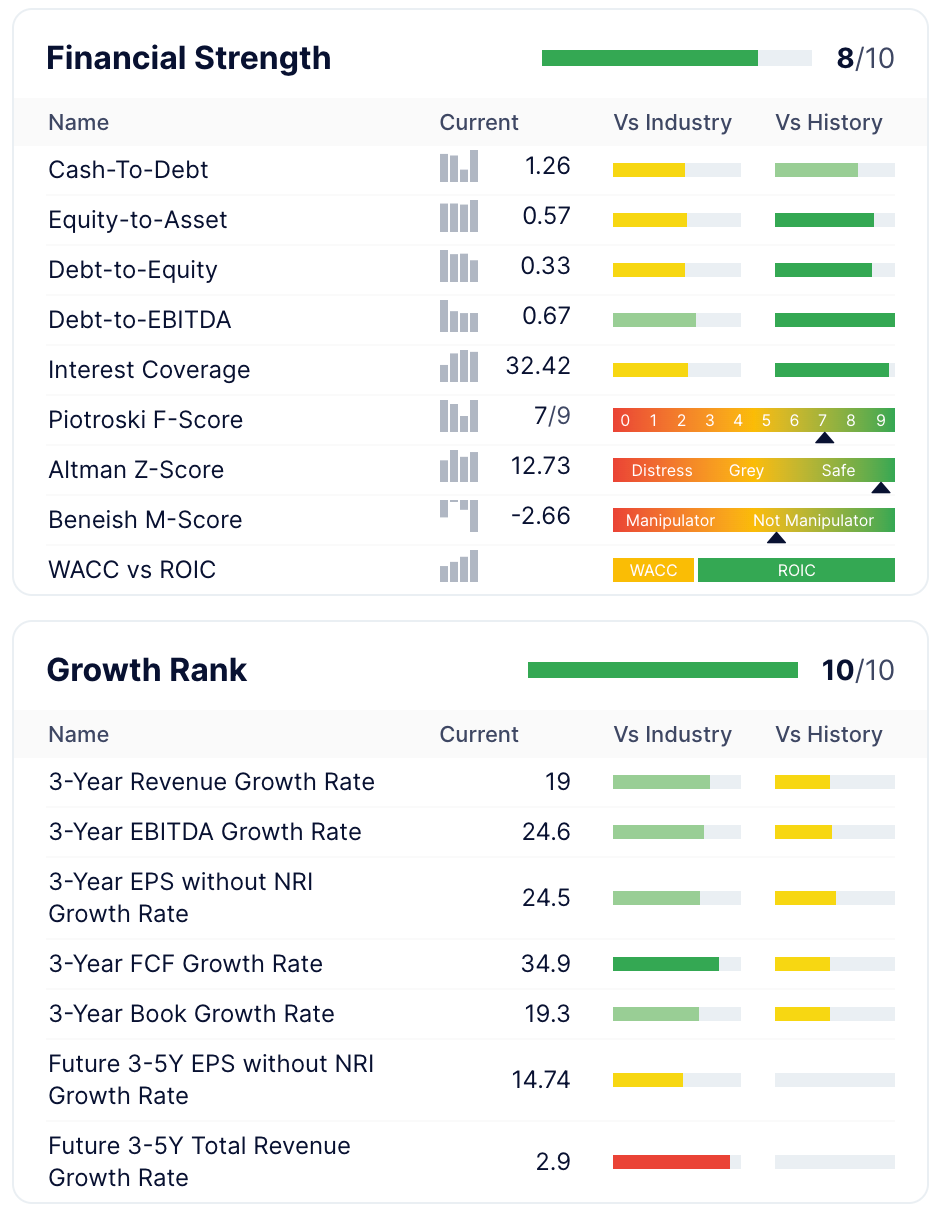

The company currently has the best financial health in its history, and it crushes the competition relative to industry standard growth rankings. This isn’t the reason for the conviction of AMAT or other tool manufacturers. The idea is buying based on other sector’s extreme reliance on tool manufacturers/suppliers. The semiconductor industry is worth over a trillion dollars and the companies that use semiconductors are worth trillions. Still, they all need one thing to survive: tools to make their semiconductors.

Plus, these tool manufacturers offer another upside through diversification — both geologically and industrially. Companies like Nvidia, Apple, etc., require lots of components to come from Taiwan, and if you are anything like me, you think that having a portfolio reliant on a country that China would love to take over makes that portfolio a VERY risky one. AMAT, for example, is based out of Austin, TX, and has notable locations in Singapore and Germany (sounds safer to me). These tool manufacturers also offer industry diversification as they serve multiple different horizontals (phones, computers, and solar to name a few).

Tool manufacturers, however, aren’t the only shovel company I see.

In fact, one of the companies I am about to discuss has returned 12% since I bought it on June 17th!

So, my premium subscribers, you can now enjoy what is below!

Keep reading with a 7-day free trial

Subscribe to The Simple Side to keep reading this post and get 7 days of free access to the full post archives.