No Investment Advice or Brokerage; Disclaimer. For the avoidance of doubt, The Simple Side does not provide investment, tax, or legal advice. The value of any asset class can go up or down and there can be a substantial risk that you lose money buying, selling, holding, or investing in any asset. You should carefully consider whether trading or holding assets is suitable for you in light of your financial condition.

Good afternoon, simple investors! See below for some quick updates before we get into this week's returns.

Quick Updates

If you like quick, short-form stock updates and analysis daily, check out my daily newsletter (only costs $10 a year or $1 a month).

I am currently working with a brokerage allow paying subscribers to copy my exact portfolios without making any trades!

This will allow you to buy my portfolios in one click!

I am working on building out our 2024 letter to investors

This should cover the Q&A I have been promising, along with a FAQ.

I am also building out the new Flagship portfolio for 2025

This portfolio returned +44% this year.

Feel free to send me an email by replying to this message, or emailing my other email: thesimplesidenews@gmail.com.

You can also click the button below and let me know anonymously about anything!

Past Performance: ≈ 50% Annualized Return

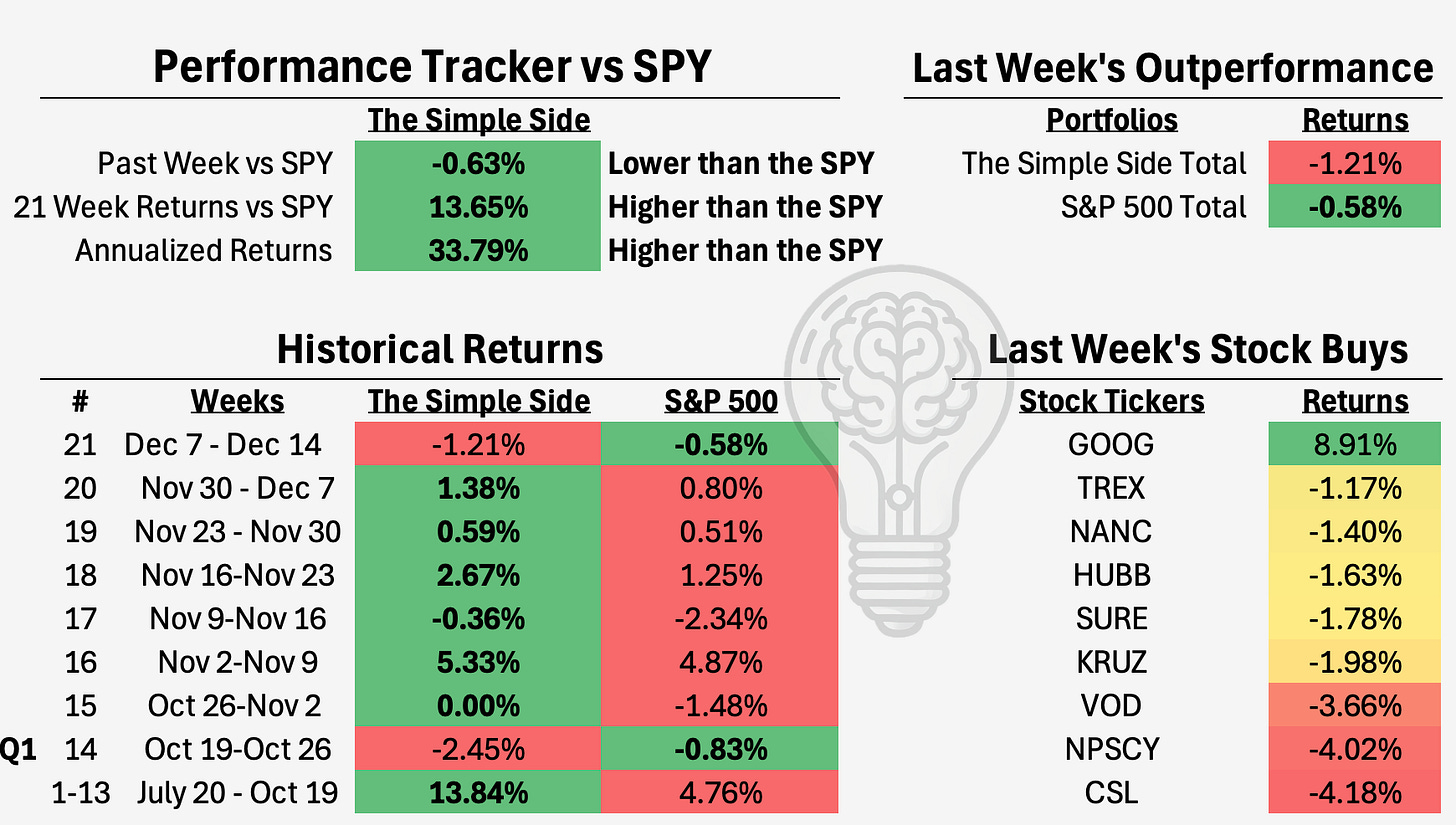

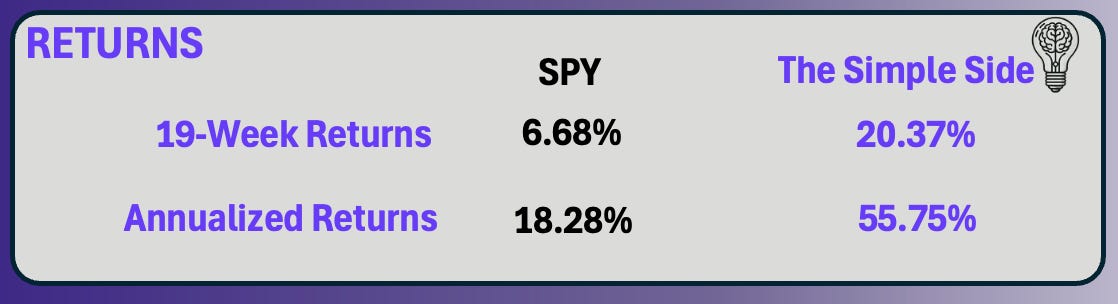

This section of the newsletter tracks the past performance of this weekly newsletter. As you will see, on average we have outperformed the S&P 500 from Monday to Friday, market open to market close.

The graph shows the growth of a $10K investment which began on July 20, 2024. You can find every newsletter dating back to July 20th here by CLICKING HERE.

Here is a summary of the past few weeks of performance and a comparison of returns that this newsletter has had relative to the SPY.

If you haven’t joined already, you can click this button below to join the paid newsletter and get these weekly picks sent to your inbox every Saturday!

Today’s Reporting Overview

Politician Trading Report

Politician Stock Highlight

Insider Trading Report

Insider Stock Highlight

Executive Trading Report

Executive Stock Highlight

Investing for Next Week (For Paying Subscribers)

Next Week’s Buy Opportunities *Updated Format*

Now includes predicted returns.

Mergers and Acquisitions

Top Investment Ideas

Contrarian Bets

Flagship Portfolio Updates

Micro-Cap Picks

Expected Stock Movements From Options Trading

Politician Trading Report

This report tracks the five most recent politician trades and two large holdings in my portfolio — ETFs NANC 0.00%↑ (which tracks democrat trading) and KRUZ 0.00%↑ (which tracks republican trading).

NANC is down 1.40% this week, 0.24% this past month, and up 30.61% YTD.

KRUZ is down 1.98% this week, 1.09% this past month, and up 18.82% YTD.

Contributing to these gains — over the past 30 days — 13 politicians made 276 trades moving over $20.95 million.

Politician Stock Highlight

This week, we observed transactions from Ro Khanna, who actively traded by buying shares of Nasdaq Inc (NDAQ) and selling shares of Abbott Laboratories (ABT). Despite these activities in well-recognized companies, neither of the trades stands out as an attractive buy opportunity under the current market conditions.

Khanna's decision to buy Nasdaq might indicate a strategic positioning in a leading technology-driven exchange, while his sale of Abbott Laboratories could suggest reallocation or profit-taking, yet neither move suggests an urgent buy signal for our purposes. We recommend keeping an eye on broader market trends and potential opportunities beyond these individual transactions.

Here are the most recent politician trades:

Insider Trading Report

This report tracks the five largest insider buys from the past week and a new ETF in my portfolio — ticker SURE — which tracks insider trading.

SURE is down 1.78% this week, 0.21% this month, and 16.17% YTD.

The top 5 insider buyers bought around $25 million worth of stock.

The top 5 insider sellers sold over $6 billion worth of stock.

Insiders were net sellers this week with an approximate buy/sell ratio of 1:280.

Insider Stock Highlight

This week, our focus is on Aurinia Pharmaceuticals (AUPH), highlighted by insider Kevin Tang's substantial purchase of 500,000 shares for $4.5 million. Despite the significant downturn in the stock year-to-date, this insider activity might signal an undervalued opportunity. Aurinia has demonstrated robust growth metrics, notably in three-year revenue and EBITDA growth rates. However, the company's profitability remains a concern, with a net margin of -10.23%.

Analysts forecast a 15.64% upside to $10.84, but my model is even more optimistic, suggesting the stock is 34% undervalued with substantial potential for growth. My rating stands strong at 8.5/10, reflecting both growth potential and significant insider buying. Nonetheless, given the financial metrics and market volatility, this stock is a 🟡RISKY BUY 🟡. Investors should consider the high growth prospects against the risks associated with the company's current financial health.

Here are the largest trades from this past week:

Our premium subscribers get access to long-term, mid-term, and short-term strategies that all beat the market. You can too, join now!

Executive Trading Report

This report tracks the five most recent stock trades from company executives.

Total executive ownership in our top 5 companies grew by over 85% — one of the highest growth weeks we have had.

Executive Stock Highlight

Burke & Herbert Financial Services Corp. (BHRB) stands out this week with a significant insider purchase by Julian Forrest Jr., who bought 376,823 shares at $68.75 each. This move reflects a +1% change in ownership, indicating a substantial bet on the company’s future by a key insider.

Financially, BHRB presents a mixed picture. The company maintains a solid net margin of 10.3% and a respectable ROE of 4.49%, showcasing a decade of profitability which bolsters its financial reputation. Despite these positives, BHRB's liquidity and financial strength metrics indicate potential concerns, with a low cash-to-debt ratio of 0.39 and a concerning Benish M-Score of -1.53, suggesting possible earnings manipulation.

The company's growth rank is notable with a three-year revenue growth rate at 2.8% and a future three to five-year EPS growth rate estimated at 35.4%, reflecting optimism about its earnings potential. However, its current momentum rank is low, which might raise red flags about its short-term performance prospects.

Analysts see a modest 12% upside for BHRB, aligning with a steady but unspectacular growth trajectory. However, my model rates BHRB as fairly valued, assigning a 7.4/10 score. The mix of strong insider buying against the backdrop of financial and momentum concerns labels this stock as a 🟡RISKY BUY 🟡.

Let’s take a look at the other executive trades:

You can join the +100 others who have seen our returns go from 0 to this…

Next Week’s Trades

Key Opportunities and Insights

The TLDR Summary

Quick PSA: We treat the trades as buys on Monday’s Market open and sells on Friday’s Market close.

Listen to this episode with a 7-day free trial

Subscribe to The Simple Side to listen to this post and get 7 days of free access to the full post archives.