I have a new format for you this week! We are — right out of the gate — going to discuss some of the most interesting moves made by market whales, corporate insiders, and the wonderful folks up on the hill (politicians).

As always, I appreciate your feedback. Let me know what you thought of the newsletter today using the link below:

Guru Trades

What you are looking at above are the most bought stocks in the S&P 500 by gurus. Use this at your digression, I am supplying it so you can stay up to date with the overall action in the markets right now.

The only major guru trades we saw over this past week came from Warren Buffet & the VA Partners I fund. Both trades saw the effected stocks decrease in value after their initial sells.

Neither trade is worth noting in any major way. Buffett only reduced his holdings in DVA by 0.59%. This is a relatively small amount relative to VA Partners I who sold 17.33% of their holdings in NSIT.

NSIT is down 33.87% over the past year, so the reduction in holdings is likely due to profit taking in the short term and expectations of underperformance in the short run.

Insider Trading

Insiders — as usual — we much more active than the market Gurus. Typically, this means more buys, and great news about market movements.

As of June 2025, the Insider Buy/Sell ratio is 0.39. The previous monthly ratio was 0.39 showing a neutral sentiment.

For the past 5 years, the highest overall Market Insider Buy/Sell ratio was 0.81 in May 2022, while the lowest ratio was 0.17 in February 2023.

This week, however, we are seeing seas of red.

Staying up to date on insider trades can help you find market trends and opportunities that most people will never hear about.

I would first like to highlight the immense amount of selling happening from major market players. The top 5 largest trades from this past week are all sales worth over $150 million a piece.

Let’s talk about the largest trade: a $554 million dollar sell of HESM.

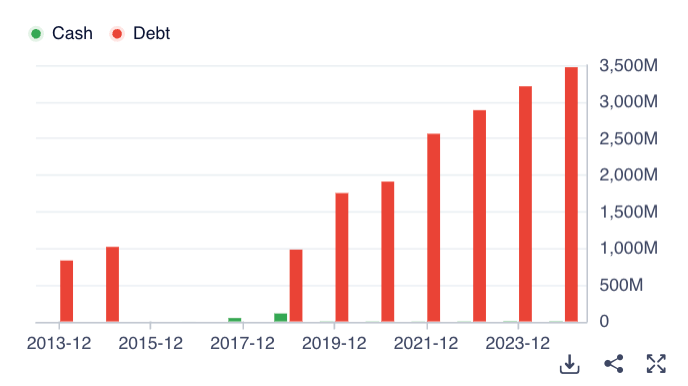

There are probably a few reason for the large sell… this might be one of them. HESM has taken on ludicrous amounts of debt to fuel their growth. There could also be some issues with a lawsuit that’s on the horizon (article here).

If you are a holder of HESM — it might be worth following and listening to the $500M moves made by Blackrock.

The buy worth paying attention to is the $48M buy of LION (Lionsgate Studio). The stock is already up 10% since the insider bought, but us still down 8.85% YTD.

Now, I think the LION purchase is a great lesson in the world of following insiders: not everyone always makes the best decision.

The stock, and company as a whole, look like a terrible purchase to me — this is why you shouldn’t blindly follow every large buy you see.

The company is struggling to generate revenue on a regular basis (let alone grow it). They have also taken on massive amounts of debt with low cash coverage. Did I happen to mention that their ROIC — WACC is terrible too? Their cost of capital (8%-ish) heavily outweighs theirs returns (just over 3%).

Who, and why would someone buy into a company with underperformance and no clear path to revenue growth? I have no idea — but maybe these insiders do.

Politician Trading

The final thing we have to talk about is politician trading. For those of you that don’t know, politicians can sometimes handily outperform the market; however, not all of them do. When watching politician trades, you need to be smart about the moves that you make.

As of June 2025 , the current Overall Market Politician Buy/Sell ratio is 16.40, which is higher than the 5-year average of 1.29. This is a strong buy signal coming in from the political world.

Maybe all of the folks up there in Washington believe in Trumps plan? (Yes, that is a question mark on purpose)

FIVE MOST RECENT TRADES

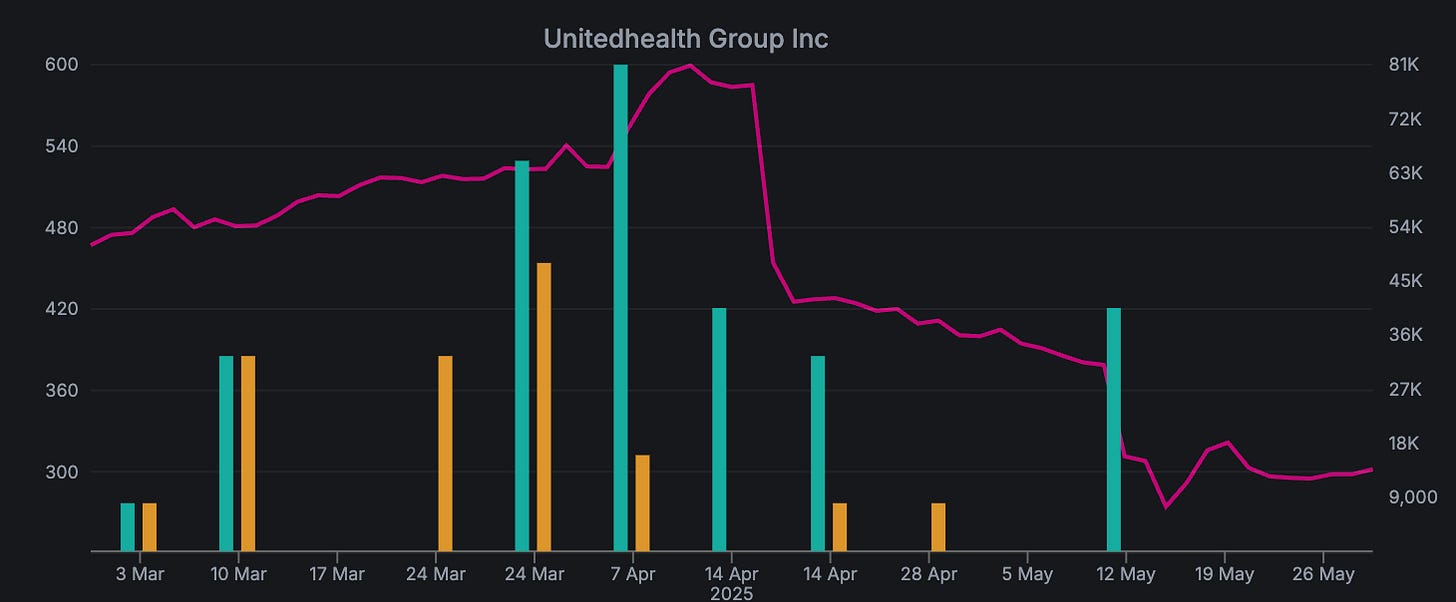

One of the buys that caught my eye this past week was Marjorie Green’s purchase of UNH. Right at the bottom? Seems too perfect… let’s take a look at who else has been buying.

It seems like all politicians seem to be either holding or buying more of their UNH stock. Interesting as the stock is down around 50% from highs in April after reports of fraud.

Why would policy makers be buying stock in a company that they are going to have to litigate? Well… it seems that they make have a bit more knowledge of what is happening behind the scenes (looks like UNH is poised for a comeback).

If you read my newsletter on Saturday you would know that we also saw over $10 billion in inflows to UNH in Q1 of 2025 showing a surprising amount of bullish sentiment going into Q2. It could be the stock of the year if UNH returns to its prior highs.

Website Coming Soon

I have some great news for paying subscribers — you will all be getting early access to some incredible trading tools very very soon… See a sneak peak down below…

Listen to this episode with a 7-day free trial

Subscribe to The Simple Side to listen to this post and get 7 days of free access to the full post archives.