To Simple Side Shareholders — good morning! I am glad to have you join me for another Saturday Sendout.

If you are new here or unfamiliar with our content, you can see the layout of everything below!

SATURDAY [free]

Market Commentary

Weekly Picks Performance

An Interesting Trade Idea *NEW*

Total Portfolio Performance

SATURDAY [paid]

Our Weekly Picks

Mergers & Acquisitions Picks

Top Stock Picks

Micro Cap Stock Picks

Earnings & Options

**** Paying subscribers — I will be sending you an email about the plan forward since Double Finance is closing its doors ****

The Saturday Sendout (commentary)

I realized that my weekly commentary should make you the most knowledgeable person in the room about everything happening in the markets. I can do that by either diving into one issue or going a mile wide and an inch deep. Today, we are going to be testing the mile-wide and inch-deep update!

Please let me know what you think by using the button below!

Now, into the weekly news…

The first few days of Q3 brought a little turbulence, a few record highs, and a whole lot of EV headlines. Small and mid-caps stole the spotlight, while mega-caps took a breather. Tech slipped, materials surged, and Tesla… did both.

Market Overview:

The S&P 500 kissed a new record midweek but ended just as high: small-cap and value stocks led, tech cooled off.

Nvidia and Alphabet lost altitude, but Apple and Tesla came in clutch — Tesla with a surprise China delivery rebound, and Apple with a Jefferies upgrade.

Bond yields ticked higher, gold sparkled, and oil bounced above $66. Bitcoin? Still over $100K but under pressure.

Sectors:

Winners: Energy (+1.7%), Materials (+1.3%), Info Tech (+1.3%) early on

Losers: Health Care (-1.0%, thanks Centene), Comms (-1.2%), and Tech (-1.1%) on day one

Small and mid-cap indexes outperformed their heavyweight siblings.

EV Rollercoaster:

Tesla: June China sales rose for the first time in 8 months, but Denmark deliveries collapsed 62%. Shares whipsawed — down 5.8% Tuesday, up 4.97% Wednesday. Elon reportedly took over sales ops himself. Subtle.

XPENG: +224% YoY in June deliveries. Indonesia expansion. Global flex.

Zeekr: +113.9% YoY deliveries but slipped MoM.

Li Auto: -24% YoY. Forecast trimmed due to a system upgrade.

NIO: +17.5% YoY June; Q2 up 25.6%. Quietly steady.

Deal-Making & Drama:

Renault took an €11.2B accounting hit over its Nissan stake. Non-cash, but headline-grabbing.

Standard Chartered hit with a $2.7B lawsuit in Singapore over the 1MDB scandal.

KKR went shopping: £4.1B for Spectris, Stockholm housing deal with Reliwe.

PKG bought Greif’s containerboard biz for $1.8B — boring name, big box gains.

Zscaler raised $1.5B in convertibles. No interest. Literally.

Bombardier inked a $1.7B jet deal with 70-plane options. Sky’s the limit.

Baidu, Boeing, and BASF reshuffled their execs. Musical chairs, corporate edition.

Headlines You Might’ve Missed:

Alibaba launched a $7B subsidy war to fight PDD & JD in instant commerce.

Lockheed Martin scored nearly $3B for Aegis missile defense upgrades.

Verint jumped 16% on Thoma Bravo buyout talks.

Intel may ditch its 18A chip — 14A is the new hotness.

Foxconn pulled staff from Indian iPhone plants. Apple’s offshoring strategy might hit a snag.

Google owes $314M in a data misuse case. Appeal pending.

U.S. Bancorp bumped its dividend and kept the $5B buyback machine running.

Figma filed for IPO under ticker FIG. Coming soon to a terminal near you.

Last but not least:

Merck and Regeneron scored key FDA wins for Winrevair and Lynozyfic, respectively.

CAVA Group got the KeyBanc “Chipotle 2.0” nod — shares popped.

Coinbase acquired LiquiFi to boost its crypto infrastructure game.

Weekly Picks Performance

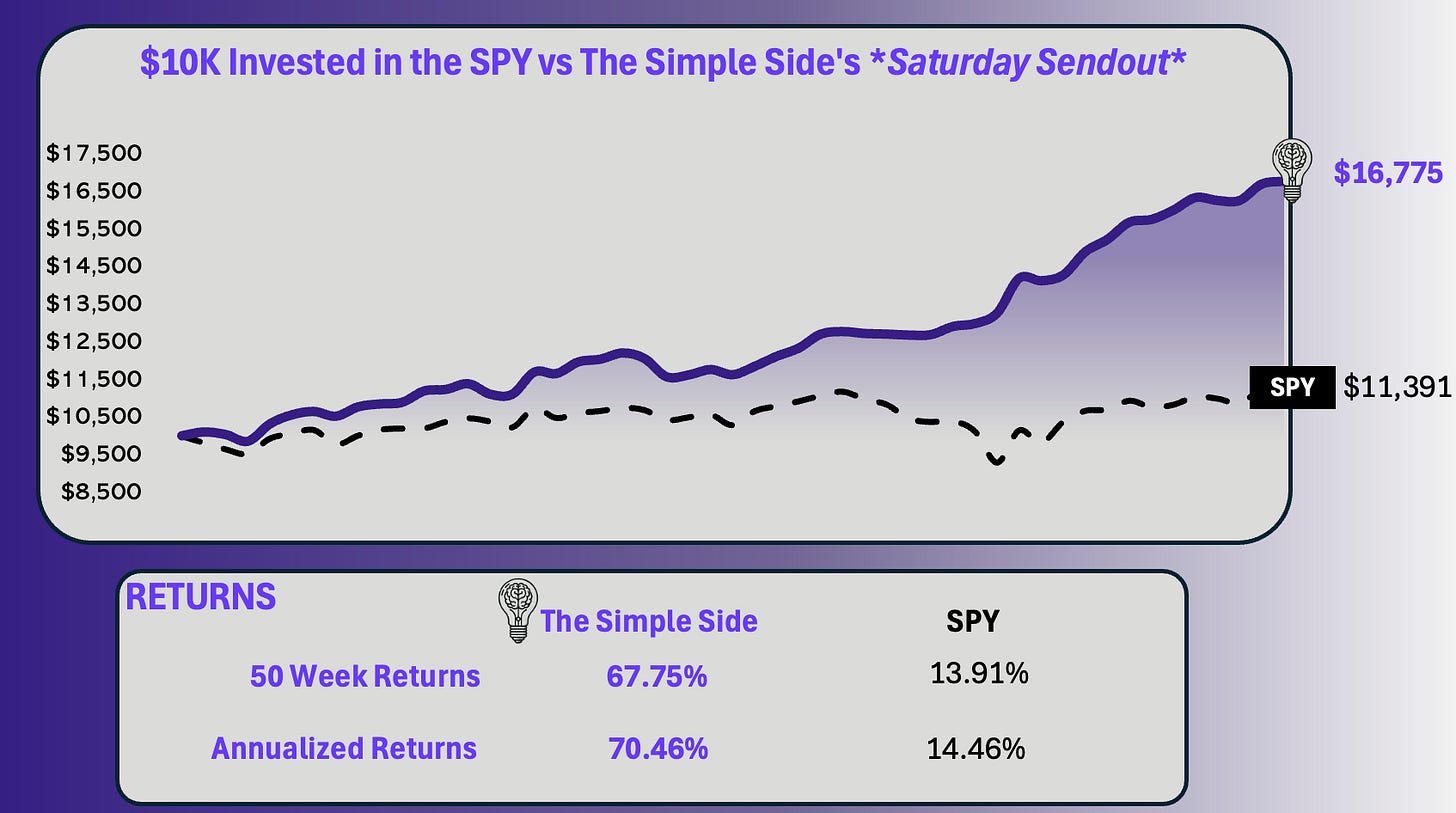

For weeks, maybe months now, I have been saying that short-term trading outperforms when there is instability and volatility in the markets. This is directly in line with what I mentioned before: people are overbuying good news and overselling bad news.

This is why our weekly trades portfolio has been performing so well. If you look at our returns, you’ll notice that our weekly picks portfolio size has begun to separate itself from the SPY over the past few weeks.

Interesting Trade Ideas

We have been following two stocks closely: UNH & AAPL.

We have also been a proponent of “IPO-flipping”

UNH has been experiencing heavy buying from insiders, institutional buyers, and politicians while the stock is down 39% YTD on reports of fraud. UNH stock was basically even this week, though it did run up to $328 before returning to $308.

AAPL was the recipient of personalized Trump tariff attacks and is one of the few stocks that is still down drastically from the beginning of the year: -16.37% YTD. AAPL was up around 6% this past week.

This week, major news came out that affected both UNH and AAPL stock — just in very different ways. Let’s start with the bad and end with the good.

Why did UNH run up to $320 just to get crushed and drop to $308 before the end of the week? Well, we can thank Centene and Medicaid cuts. The quick and dirty explanation of what happened is that Centene spent more money and made less. They insured patients for cheaper premiums and those patients ended up being more sick than they expected. This, in addition to Medicaid cuts, means that Centene (CNC) is going to take massive losses (at least in the short-term). For this reason, they had to pull their annual guidance which resulted in a 40% drop in their stock price.

By the way… Medicaid programs account for over 57% of CNC’s revenue. The drop in their stock price is absolutely warranted as Medicaid cuts will directly affect their bottom line. This news negatively affected most other players in the space, like UNH and OSCR. UNH only derives 15% of its revenue from Medicaid, so the stock’s drop isn’t exactly warranted in this situation.

The good news, comes from AAPL’s side of things. Apple had a couple of things happen this week that have been driving it’s gains.

iPhone sales grew in China by around 8%

News that the AI-powered Siri is likely going to get assistance from an acquisition or strategic partnership

Stock upgrades from analysts at major firms

IPO news continues to show there is money to be made in quick IPO flips:

EMPG

Offer date: 7/2

Returns: 8.75%

GRAN

Offer date: 7/1

Returns: 4.91%

JCAP

Offer date: 6/26

Returns: 23.56%

I am going to continue to watch UNH, AAPL, and IPOs for opportunities. I am also looking at taking major positions in the health insurance space.

Total Portfolio Performance

Now, I know that many of my subscribers are looking for longer-term plays and don’t care too much about the weekly picks. I think that is just fine — our longer-term holdings have also been outperforming (given that you are following the DCA approach that I recommend).

We utilize a dumbbell portfolio approach. With one side offering a long-term “safe” portfolio (our Flagship Fund & TSS 50), and the other going for growth (Contrarian Trades, Weekly Picks).

This balanced approach has proven effective time and time again. We also offer paying subscribers the ability to look at any and all of our stocks and portfolios with real-time updates here: Check it all out here (for paying subscribers).

My portfolio average return is up to 38.47% YTD.

Our contrarian portfolio is up over 66% YTD, followed closely by our weekly picks at +44% returns year to date (these are the picks found in today’s newsletter).

The lagging portfolio (based on a buy-and-hold basis) is the Flagship Fund. We expect performance to pick up in the later parts of the year when markets stabilize.

Weekly Picks

Okay, let’s get into the picks that have returned 44% YTD and 68% over the past 50 weeks. As always, what you see below is a summary of our investments for this week!

🟢THE BUYS🟢

Listen to this episode with a 7-day free trial

Subscribe to The Simple Side to listen to this post and get 7 days of free access to the full post archives.