To Simple Side Shareholders — good morning! I am glad to have you join me for another Saturday Sendout. We are finally back on all podcasting platforms as well!

If you are new here or unfamiliar with our content, you can see the layout of everything below!

SATURDAY [free]

Market Commentary

Weekly Picks Performance

An Interesting Trade Idea *NEW*

Total Portfolio Performance

SATURDAY [paid]

Our Weekly Picks

Mergers & Acquisitions Picks

Top Stock Picks

Micro Cap Stock Picks

Earnings & Options

**** Paying subscribers — I will be sending you an email about the plan forward since Double Finance is closing its doors ****

The Saturday Sendout (commentary)

Weekly Market Commentary

The last full week of July delivered new closing highs for the S&P 500 and fresh intraday peaks for the Nasdaq, but the real story was what sat beneath the index-level calm: an epic tug-of-war between exuberant AI spending, profit warnings in health care, and a surge of big-ticket deal-making that could redraw several industry maps.

Big picture

Equities ground higher—Monday’s trade-deal optimism with the EU and Japan set the tone—and never broke, even as Treasury yields inched back toward 4.4 percent. The VIX slipped under 15 on Friday, suggesting traders have once again written off summer volatility. Breadth, however, stayed thin: more than half of S&P 500 members finished the week in the red, and chipmakers that carried the spring rally paused for breath. Oil drifted toward $65 despite OPEC+ export cuts, helping the inflation narrative but pinching energy shares.

Three themes that mattered

1. The AI infrastructure arms race just went global.

Google’s $1.2 billion, five-year cloud win at ServiceNow clarifies how aggressively hyperscalers will buy share; ServiceNow is obligated to spend almost $5 billion on cloud services through 2030. T-Mobile, Verizon and Crown Castle, meanwhile, all cited President Trump’s expedited permitting order for data-center build-outs as a direct earnings tail-wind. Intel tried to keep pace by unveiling an $18 billion cap-ex plan and a pivot to contract manufacturing. The consequence is two-fold: back-end providers—from Digital Realty to Baker Hughes’ turbine unit—have visibility they haven’t enjoyed since shale’s heyday, but every CFO now faces a capital allocation dilemma as AI costs collide with shareholder-return promises.

2. Reshoring and the tariff carousel.

Apple’s $500 million pre-payment to MP Materials for U.S-made rare-earth magnets and BHP’s battery alliance with CATL and BYD tell the same story: supply-chain security is now a balance-sheet line item. Intel is consolidating fabs in Vietnam and Malaysia while freezing European projects until it sees what Brussels does with proposed chip subsidies. Meanwhile, the White House floated 15 percent reciprocal tariffs on the EU and Japan—temporarily soothed by talk of agriculture and auto quotas—but the message is clear: corporate planners should assume the 1990s trade framework is gone for good.

3. August could be merger month.

The FCC signed off on Skydance-Paramount, Union Pacific and Norfolk Southern began feeling out a trans-continental rail tie-up, and Union Pacific’s upgrade from Jefferies signals that investors believe regulators might bless at least one mega-rail combination to counterbalance Canadian Pacific–Kansas City. In health care, iTeos, ZimVie and Vicebio all accepted cash bids rather than soldier on alone, while Newmont doubled its repurchase authorization instead of buying another mine—evidence that boards are leaning either to consolidate quickly or buy back shares rather than gamble on elevated asset prices.

Sector scoreboard and consequences

Technology added just under one percent, cushioned by Google and ServiceNow but held back by chip profit-taking and by Samsung’s warning that AI-server demand is not yet big enough to absorb lost handset volume. If memory pricing does not improve by autumn, the semi rally could lose a second leg of support.

Communications services led the market thanks to T-Mobile’s blow-out subscriber guide and Alphabet’s cap-ex pledge. Longer term, pairing high wireless cash flow with low-latency data-center traffic puts the telcos back in the secular-growth conversation; the risk is that satellite ventures like T-Satellite balloon cap-ex just as rate cuts get postponed.

Health care endured a tale of two tapes. Abivax exploded higher on Phase 3 success, while Centene logged its first miss in four years and Sarepta agreed to pause gene-therapy shipments after three deaths. Investors snapped up contract researchers Medpace and IQVIA, betting that Big Pharma will outsource trials aggressively rather than cut R&D. The larger implication: dispersion inside the sector is widening, and stock pickers finally have something to do.

Industrials rode GE Vernova’s and Baker Hughes’ data-center orders, plus speculation that CSX or Kansas City Southern could end up the next rail target. If Union Pacific–Norfolk Southern proceeds, expect the Surface Transportation Board to demand divestitures—short-line operators could be the hidden winners.

Macro and the Fed

New-home sales ticked up, services PMIs accelerated, and initial jobless claims fell to 217 k—none of it weak enough to revive September rate-cut bets. Core inflation is easing, but a sub-15 VIX and record equity prices leave the FOMC little political cover for early easing. For now, the bond market appears willing to finance the AI-data-center boom at just under 4.5 percent on the 10-year; should that rate back up meaningfully, the equity rally’s narrow leadership becomes a bigger liability.

What to watch next week

Mega-cap earnings: Apple, Amazon and Meta must justify $300 billion of fresh AI cap-ex in the pipeline.

July payrolls, due Friday: consensus sits at 185 k. A hotter print will push December cut odds below 50 percent.

Capitol Hill: the Senate Commerce Committee holds a hearing on large-language-model copyright—watch for clues on potential AI liability rules.

DOJ’s 30-day window to appeal the FCC’s Paramount decision expires; any intervention would rattle the bubbling M&A trade.

Bottom line: Momentum, liquidity and an AI narrative continue to overpower valuation fatigue and policy risk, but leadership keeps getting thinner. Until breadth improves or bond yields break out, expect rallies to remain self-reinforcing—and vulnerable to single-headline reversals.

Weekly Picks Performance

Our weekly picks are made in this newsletter (behind the paywall) every week. Now, nearly all of my conventional investing wisdom says that trading stocks weekly on “news” is a terrible idea. One particular quote comes to mind:

“Buy bad news, sell good news.”

Yet, we are doing the opposite! We are following good news & capitalizing on it weekly. Why does this work? Well, in a “normal” market, they don’t work; however, we are in a “dumb money” market (read about dumb money here).

The main idea is that a significant amount of money is being allocated to equity markets without proper investment strategies (aka people trading the news). This creates ample opportunity to capture the alpha (excess returns) by making quick buys/sells in the market. Wondering if it works? See for yourself…

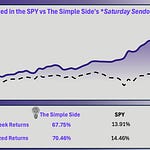

We have generated excess returns of 50% on these weekly picks alone.

Sadly, we haven’t started our 53rd week off with a bang, but I am still confident in the returns we can generate from the “dumb money” in the current markets.

Interesting Trade Ideas

Every once in a while, something strikes me as an opportunity in the market. Maybe I see an undervalued opportunity trending down on bad news, or an industry I want to talk about quickly. That is what you see here!

I have been discussing three main ideas over the past few weeks. UNH, AAPL, and IPOs.

United Health

We are watching UNH closely as earnings approach; we expect poor results on the day of reporting and a 5-15% drop in price. However, if things go well, upside looks like it will be a minimum of +10% gain within the day.

Apple

Apple has been crushing it since we last mentioned the stock was a buy at sub $200 levels. With earnings coming up after market close on the 31st, we could be looking at a rough or incredible August.

The IPO World

Major alert in the IPO world here: Figma (FIG) is set to IPO at $24 - $28 with a max price of $33.60 a share. This makes the company worth around $16 billion — a stark drop from the $20 billion buy offer Adobe made last year.

Based on Adobe’s buy offer, Figma has at least 25% upside in the short term. Based on Adobe’s market cap (as Figma is a competitor), there is 10x potential for the stock in the long run. Figma will make a great IPO flip, but I am likely going to hold a majority of the stock for the long run.

Total Portfolio Performance

Now, I know that many of my subscribers are looking for longer-term plays and don’t care too much about the weekly picks. I think that is just fine — our longer-term holdings have also been outperforming.

We utilize a dumbbell or barbell portfolio approach with one side offering a long-term “safe/slow” growth (cash, bonds, The Flagship Fund). The other side chases high growth potential (Contrarian Trades, Weekly Picks, Tech-Growth portfolios).

This balanced approach has proven effective time and time again. We also offer paying subscribers the ability to look at any and all of our stocks and portfolios with real-time updates here: Check it all out here (for paying subscribers).

My portfolio average return is up over 43% YTD.

Our contrarian portfolio is up over 80% YTD, followed closely by our weekly picks at +46% returns year to date (these are the picks found in today’s newsletter).

The lagging portfolio (based on a buy-and-hold basis) is the Flagship Fund. We expect performance to pick up in the later parts of the year when markets stabilize.

Weekly Picks

Okay, let’s get into the picks that have returned 46% YTD and 80% over the past 53 weeks. As always, what you see below is a summary of our investments for this week!

🟢THE BUYS🟢

Listen to this episode with a 7-day free trial

Subscribe to The Simple Side to listen to this post and get 7 days of free access to the full post archives.