To Simple Side Shareholders — good morning! I am glad to have you join me for another Saturday Sendout.

If you are new here or unfamiliar with our content, you can see the layout of everything below!

SATURDAY [free]

Market Commentary

Weekly Picks Performance

An Interesting Trade Idea *NEW*

Total Portfolio Performance

SATURDAY [paid]

Our Weekly Picks

Mergers & Acquisitions Picks

Top Stock Picks

Micro Cap Stock Picks

Earnings & Options

The Saturday Sendout (commentary)

I realized that my weekly commentary should make you the most knowledgeable person in the room about everything happening in the markets. I can do that by either diving into one issue or going a mile wide and an inch deep. Today, we are going to be testing the mile-wide and inch-deep update!

Please let me know what you think by using the button below!

Now, into the weekly news…

Markets spent the week playing hopscotch with record highs. The S&P 500 flirted with a new peak, buoyed by mega-cap muscle (thanks, NVDA & GOOG) and an AI-fueled rally, but profit-takers kept things grounded. Semiconductors popped, small caps flopped, and bond yields dipped as rate-cut hope flickered.

Big Picture:

The S&P 500 hit a new record high early in the week, driven by a Nike-fueled rally and U.S.-China trade optimism. But by week’s end, it cooled — still just 0.9% off its all-time high.

Fed Chair Powell didn’t rock the boat during Senate testimony. Yields slid (2Y at 3.72%, 10Y at 4.25%) as durable goods surprised to the upside and home sales… didn’t.

Market breadth struggled: the Nasdaq 100 soared thanks to Big Tech, while small caps (Russell 2000) and midcaps dragged.

Europe wobbled; Asia was mixed. Oil was volatile, gold shimmered slightly, and copper did copper things (i.e., not much).

Sector & Stock Standouts:

Communication services led with a 1.8% lift, and semis stayed hot — the Philly Semi Index is now up 28.6% for the quarter.

NVIDIA (+4.33%), Alphabet (+2.24%), Apple (+0.63%), and Microsoft (+0.44%) kept the index afloat. These four now account for more GDP than some continents.

Micron (MU) surged after an AI-powered beat, Microsoft got a price target bump thanks to its $13B AI biz, and Tesla staged a robotaxi rally despite a European sales slide.

On the flop side: FedEx (-3.27%) delivered disappointment, and Tesla's EU sales were down 40% YoY. Ouch.

Earnings & Headlines:

Nike ran up 15% on solid earnings and a new supply chain game plan.

Unilever splashed $1.5B on Dr. Squatch to soap up Gen Z.

RTL bought Sky Deutschland from Comcast for €150M — streaming wars go continental.

Concentrix doubled down on AI and beat expectations.

Carnival raised yield guidance; FedEx outlined $1B in cost cuts; Walgreens posted a beat while navigating an acquisition.

M&A Mayhem:

SpartanNash sold for a 52.5% premium.

Shift4 expanded Down Under with Smartpay.

Rubrik scooped up Predibase to level up its AI game.

Vision Marine acquired a Florida boat dealer; Hive Digital grabbed a Toronto data center for AI horsepower.

The Strugglers:

BYD delayed expansion. Altimmune cratered 64% on trial results. Wolfspeed and Meyer Burger flirted with bankruptcy.

Tesla’s Europe lead was sacked. Boeing faced crash probe headlines. Ambarella is exploring a sale.

Odds & Ends:

Palantir inked a $100M deal to help build nuclear reactors.

Pfizer made hemophilia news, while Eli Lilly launched its obesity drug in India.

General Motors recalled 62,000 trucks for brake issues.

Xiaomi launched a cheaper EV than Tesla and got 200K orders in minutes.

Weekly Picks Performance

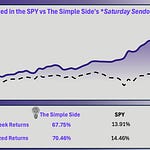

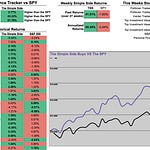

For weeks, maybe months now, I have been saying that short-term trading outperforms when there is instability and volatility in the markets. This is directly in line with what I mentioned before: people are overbuying good news and overselling bad news.

This is why our weekly trades portfolio has been performing so well. If you look at our returns, you’ll notice that our weekly picks portfolio size has begun to separate itself from the SPY over the past few weeks.

Keeping Up With Our Interesting Trade Ideas

We have been following two stocks closely: UNH & AAPL.

We have also been a proponent of “IPO-flipping”

UNH has been experiencing heavy buying from insiders, institutional buyers, and politicians while the stock is down 39% YTD on reports of fraud. UNH stock rose by around 2.5% last week.

AAPL was the recipient of personalized Trump tariff attacks and is one of the few stocks that is still down drastically from the beginning of the year: -16.37% YTD. AAPL was up over 2.6% last week (including pre-market trading).

This week both UNH and AAPL followed general market trends this week rising with the rest of the market. UNH in particular had some great news helping with that gain. The recent healthcare spending cuts in the “Big Beautiful Bill” haven’t been “popular” with the Senate. This had most healthcare companies and care operators rising on the news. UNH also recently announced a new CEO within their OPTUM health system: DR. Patrick Conway.

Dr. Conway is previously led Optum Rx and formerly headed Blue Cross Blue Shield of North Carolina. He also once led the Center for Medicare and Medicaid Innovation at CMS. We likely won’t see any tangible results in the next earnings call with UNH, but over the next 3-4 quarters, we will likely start to see whether or not Conway is the man for the job.

Apple, of course, saw a bump this week, partly from the news that broke about their potential purchase of Perplexity AI. The thing that kept AAPL from continuing its run? The EU-mandated app store changes. Essentially, the EU is requiring Apple to provide developers with more flexibility in payment handling and app promotion. To avoid any fines from the EU, Apple announced new app store fees, including a 5% commission on any digital purchase made outside of the App Store (current in-store commissions are 15% - 30%).

I think this could bring the stock back below 200 and possibly 190, offering attractive investment opportunities for those looking at a future dividend cash cow.

My remarks about IPOs have been right on the money. I said if you want to buy IPOs, you’re buying alongside a lot of “dumb money” in the market. CRCL stock was down 24% this past week, after an over 700% rally from the IPO earlier this month. Other IPOs were up on the week but are down all-time YTD (MNTN: -16.5% | CHYM: -10.91% | BULL: -6.8%). All of the aforementioned IPOs had massive stock pops in the first few days/weeks of trading.

I am going to continue to watch UNH, AAPL, and IPOs for opportunities.

Total Portfolio Performance

Now, I know that many of my subscribers are looking for longer-term plays and don’t care too much about the weekly picks. I think that is just fine — our longer-term holdings have also been outperforming (given that you are following the DCA approach that I recommend).

We utilize a dumbbell portfolio approach. With one side offering a long-term “safe” portfolio (our Flagship Fund & TSS 50), and the other going for growth (Contrarian Trades, Weekly Picks).

This balanced approach has proven effective time and time again. We also offer paying subscribers the ability to look at any and all of our stocks and portfolios with real-time updates here: Check it all out here (for paying subscribers).

My portfolio average return is up to 37.95% YTD.

Our contrarian portfolio is up over 67% YTD, followed closely by our weekly picks at +44% returns year to date (these are the picks found in today’s newsletter).

The lagging portfolio (based on a buy-and-hold basis) is the Flagship Fund. We expect performance to pick up in the later parts of the year when markets stabilize.

Weekly Picks

Okay, let’s get into the picks that have returned 44% YTD and 67% over the past 49 weeks. As always, what you see below is a summary of our investments for this week!

🟢THE BUYS🟢

Listen to this episode with a 7-day free trial

Subscribe to The Simple Side to listen to this post and get 7 days of free access to the full post archives.