Shareholders, welcome back to another weekly edition of The Saturday Sendout from !

I have had lots of new subscribers come in over the past month and I want to give everyone the opportunity to let me know what they think my newsletter needs!

Upcoming Newsletters

Releasing The Simple Side Stock Portfolio(s)

The ‘Safe Portfolio’ Comes Out Wednesday!

The ‘How To Trade My Newsletters’ ArticleMy Investing Strategies Updates

Profit Sharing w/ Founding Members

The Upcoming Paid Subscriber Giveaway

I don’t want to skimp on these newsletters so they may take some time to get out; however, they will be valuable. My current contrarian bets portfolio has returned over 17% monthly! This is something I am quite proud of and excited to share with you all!

Of course, if you’ve been a paying subscriber from the beginning, you have followed all these trades and seen their value.

The Weekly Recap

For those of you who don’t know, “The Weekly Recap” tracks the weekly 🟢Buy Opportunities🟢 contained within this newsletter. We treat each of the recommendations as a “one-week-only” investment and track them as such. We also report on the returns of these holdings monthly and in August these newsletters returned 27%.

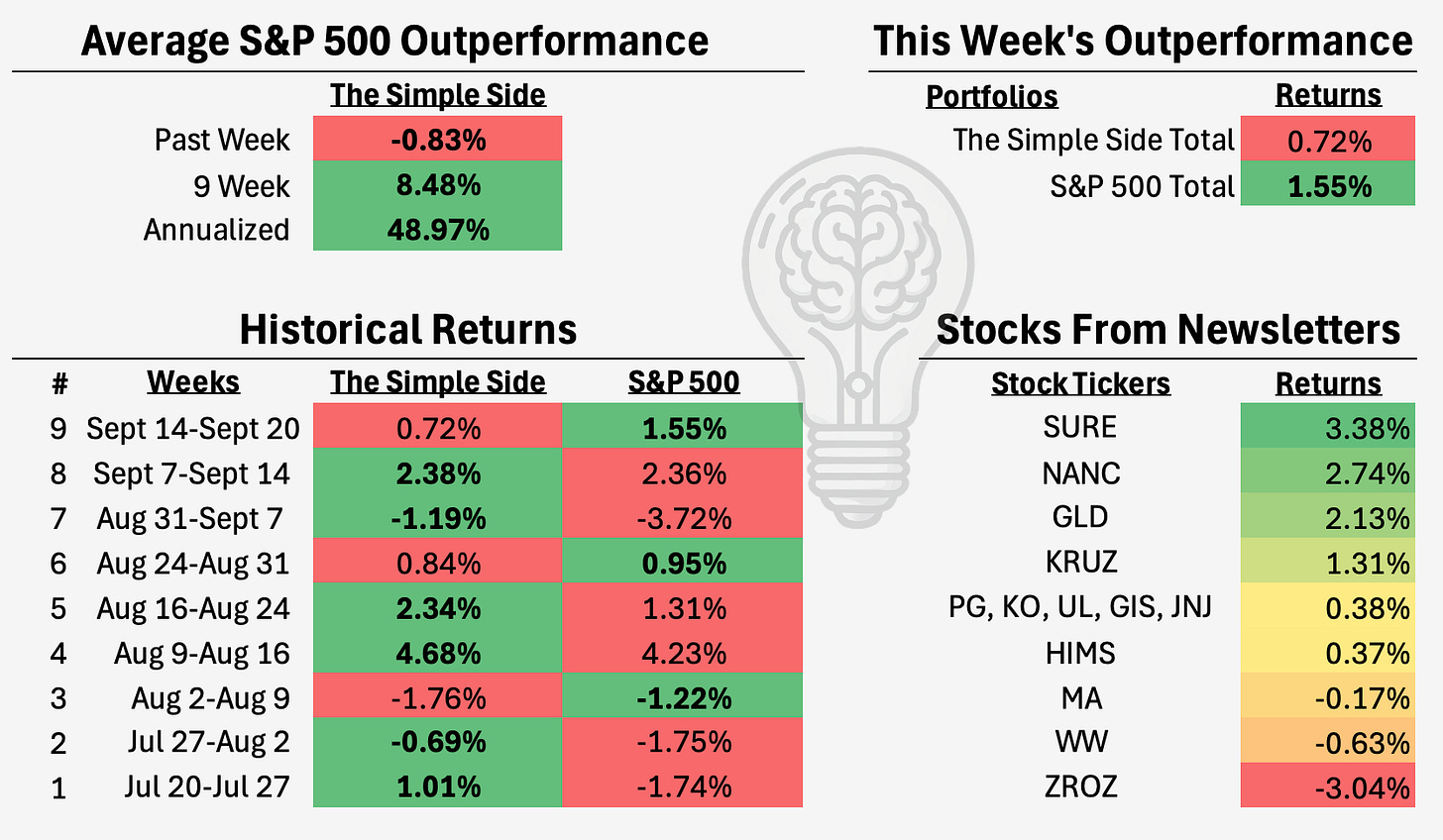

What you see below are the total returns if you were to buy our 🟢Buy Opportunities🟢 on Monday and sell on Friday. The graph shows the growth of a $10K investment.

It has been 9 weeks since we began tracking the returns from this weekly newsletter. In that time I have returned over 8.48% during these weekly sendouts. If I manage to continue at this rate then I will end the year with 49% returns.

I do this section of the newsletter to prove a couple of things. Number one is that I can beat the market weekly with hours of research and analysis. Secondly, I want to show that I am the most transparent newsletter on this platform. How many “financial gurus” out there claim to be “beating the market” with absolutely no weekly proof? The answer is ALL OF THEM. I am the only 100% transparent weekly newsletter you can find on this topic.

The newsletter portfolio was outperformed by the S&P 500 this week averaging a 0.72% return while the S&P 500 averaged a 1.55% return. We are still outperforming the market by vast margins over the last 9 weeks and look to continue doing so for the next 43 weeks.

This week we lost to the market by 0.83%

Over 8 Weeks we have outperformed by 8.48%

Annualized we are expected to outperform by 48.97%

If you are finding all of this valuable you can support me and my work by clicking that fancy button below!

Politician Trading Report & Politician ETFs

This report tracks the five most recent politician trades and two large holdings in my portfolio — ETFs NANC 0.00%↑ (which tracks democrat trading) and KRUZ 0.00%↑ (which tracks republican trading).

NANC is up 2.74% this week, 1.06% over the past month, and up 22.93% YTD.

KRUZ is up 1.31% this week, 0.98% over the past month, and up 12.49% YTD.

What’s fueled those poor returns? Well, over the past 30 days, 14 politicians have made 354 trades moving over $10.00 million. The best part of this week?

Now, you may be thinking “354 trades in a month seems like quite a bit” and you are right. Last week there were only around 200 trades and we thought that was crazy!

Wanna know what else is strange? Over half of the 354 trades were sell orders, seems like something fishy is on the horizon… that being said, there were a couple of buyers that appeared this past week. The largest buy came from Republican Laurel Lee, who bought between 50k-100k dollars worth of JP Morgan stock 🟢BUY OPPORTUNITY JPM 0.00%↑🟢

The graph you are looking at shows some of Lee’s most recent buys, and she seems to buy the dip quite well… I like JPM for the next week.

Here are the other most recent politician trades:

Insider Trading Report

This report tracks the five largest insider buys from the past week and a new ETF in my portfolio — ticker SURE — which tracks insider trading.

SURE is up 3.38% this week, 3.20% this month, and 12.14% YTD.

The most interesting insider buyer this week was Sumitomo Mitsui Financial Group. They bought 4.5% of Jefferies Financial Group (ticker: JEF) for $59.67 a share. Sumitomo is a financial group based out of Japan and has major holdings in multiple other US-based companies like ARES, CME, and lots of different bond ETFs.

Now, JEF has great profitability, but poor value ranking. I think the company deserves a B- rating. I do not feel comfortable giving JEF a buy rating, so I will be adding it to the 🟡WATCH LIST🟡 instead.

Here are the other four largest trades:

Still wondering if premium is worth it? Hundreds of people say that it is — you can join them here:

Executive Trading Report

This report tracks the five most recent stock trades from company executives.

Total executive ownership in our reported companies grew by 119% not including the ‘new’ purchase. Jonathan Buba had the most notable increase in ownership as the Director increased his ownership in Americas Carmart by over 75%. I see this as a terrible move. The comapny is planning to sell more stock because their cash flow is so bad. I do think this decision comes at a good time as we are likely to see more buyers enter the car market with the Fed 50bps cut.

Let’s take a look at the other four executive trades:

📈 Weekly Highs & Lows 📉

📈Top Three Gainers📈

========================================

Name: Innovative Eyewear, Inc.

1 Week Change: 119.76%

Stock Price: 10.79

----------------------------------------

Name: Battalion Oil Corporation

1 Week Change: 118.27%

Stock Price: 6.57

----------------------------------------

Name: REE Automotive Ltd.

1 Week Change: 94.27%

Stock Price: 5.76

----------------------------------------

📉Bottom Three Losers📉

========================================

Name: EQV Ventures Acquisition Corp.

1 Week Change: -100.00%

Stock Price: 9.95

----------------------------------------

Name: JBDI Holdings Limited

1 Week Change: -95.09%

Stock Price: 1.30

----------------------------------------

Name: Corbus Pharmaceuticals Holdings, Inc.

1 Week Change: -65.04%

Stock Price: 19.51

----------------------------------------

Weekend Reads For Weekday Trades

Let’s get into some of the most intriguing market-moving activities: mergers and acquisitions, top investment ideas for the upcoming week, upcoming contrarian bets, and earnings price volatility.

Did I mention all of the buy, watch, and sell opportunities?

Typically, information like this costs hundreds a month, but you can get it all here (plus more) for $200 annually — less annually than other cost monthly.

What’s down there today?

How to make money on a triple witching!

Early access to contrarian bets!

Actionable buying insights for the upcoming week!

Listen to this episode with a 7-day free trial

Subscribe to The Simple Side to listen to this post and get 7 days of free access to the full post archives.