Shareholders,

Welcome back to another weekly edition of The Saturday Sendout from !

Like always you can use the button below to tell me what you’d like to see more of — I cannot see who writes these, but I do read them and try to implement them in my writing!

Cool Recent Newsletters

The Weekly Recap

This section tracks 🟢Buy Opportunities🟢 I saw in last week’s newsletter. These opportunities are recorded in all of the sections below this one for the upcoming week!

We treat each opportunity as a “one-week-only” investment and track them as such. That being said, many of the stocks we discuss are EXCEPTIONAL long-term buys! You do not have to copy this weekly newsletter 1:1 to make money in the market and doing so should be done at your own risk!

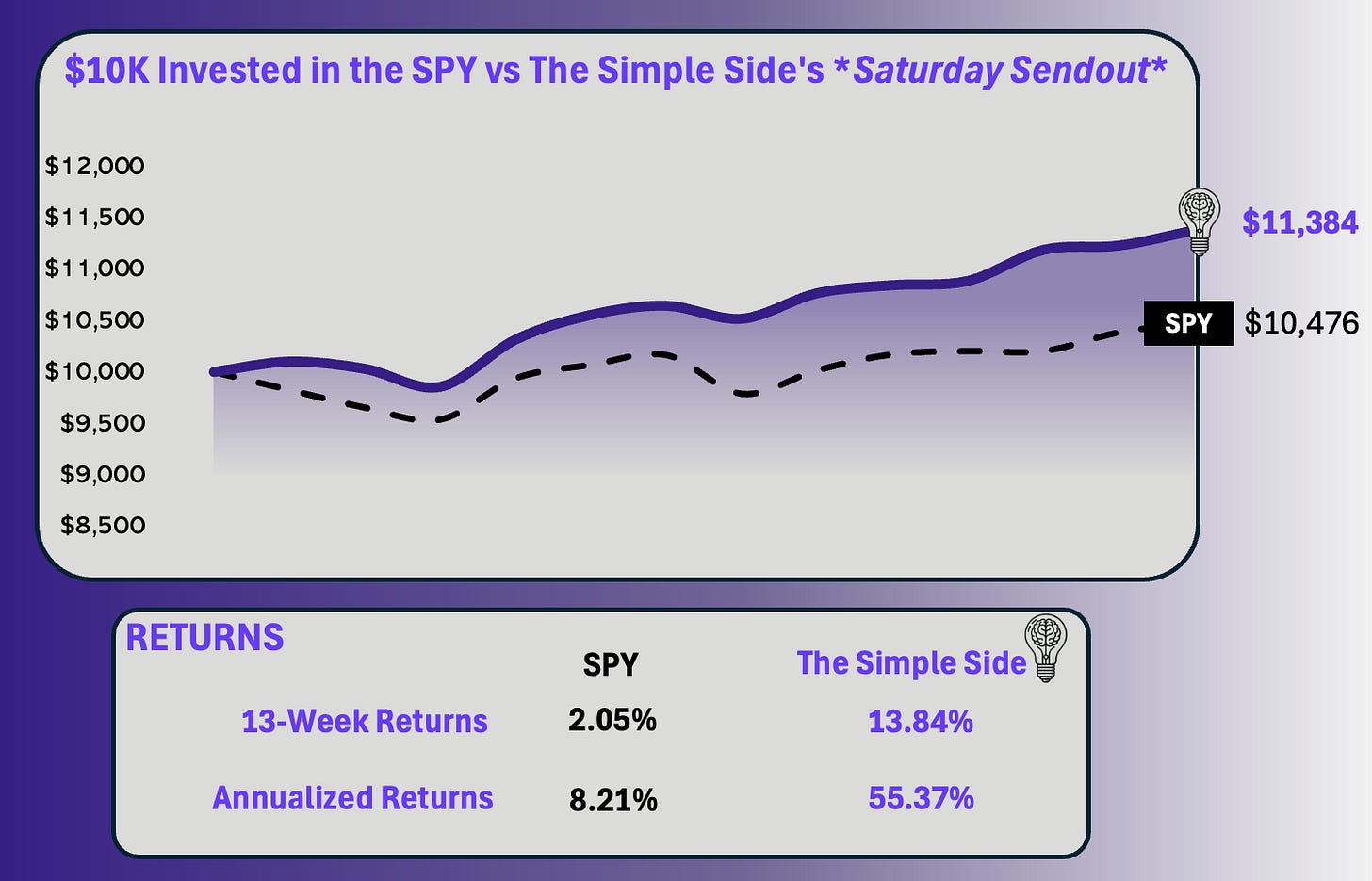

Here is how we have performed historically:

You’ll notice that the weekly returns for MOH and GLOB look off. MOH ended the week down 12% and GLOB ended the week up over 7%. You’ll see that we have tracked these returns as +2.86% and +2.59% respectively. Well, we told our shareholders to sell out early on Monday, as seen below!

Up above you’ll notice we beat to the SPY this week… it’s like a curse, I just can’t seem to go on a winning for more than two weeks in a row here.

This week we beat to the market by 0.48%

Over 13 Weeks we have beat the market by 11.79%

Annualized we are expected to beat the market by 47.16%

The graph shows the growth of a $10K investment which began on July 20, 2024.

We are currently averaging a 13.84% return over 13 weeks! That translates to 55.37% a year.

Just over 1% a week! Not too shabby! Again, I want to reiterate how proud I am to be the most transparent weekly newsletter you can find on this topic!

If you are finding all of this valuable you can support me and my work by clicking that fancy button below!

Politician Trading Report & Politician ETFs

This report tracks the five most recent politician trades and two large holdings in my portfolio — ETFs NANC 0.00%↑ (which tracks democrat trading) and KRUZ 0.00%↑ (which tracks republican trading).

NANC is up 1.05% this week, 3.62% over the past month, and up 26.55% YTD.

KRUZ is up 0.59% this week, 2.79% over the past month, and up 16.56% YTD.

What’s fueled those sweet returns? Well, over the past 30 days, 12 politicians have made 129 trades moving over $3.01 million.

The most interesting trade from this past week?

Sadly, there wasn’t anything too crazy from this past week. None of the trades had super high values and nothing seemed unusual!

Here are the other most recent politician trades:

Insider Trading Report

This report tracks the five largest insider buys from the past week and a new ETF in my portfolio — ticker SURE — which tracks insider trading.

SURE is up 2.14% this week, 3.54% this month, and 16.11% YTD.

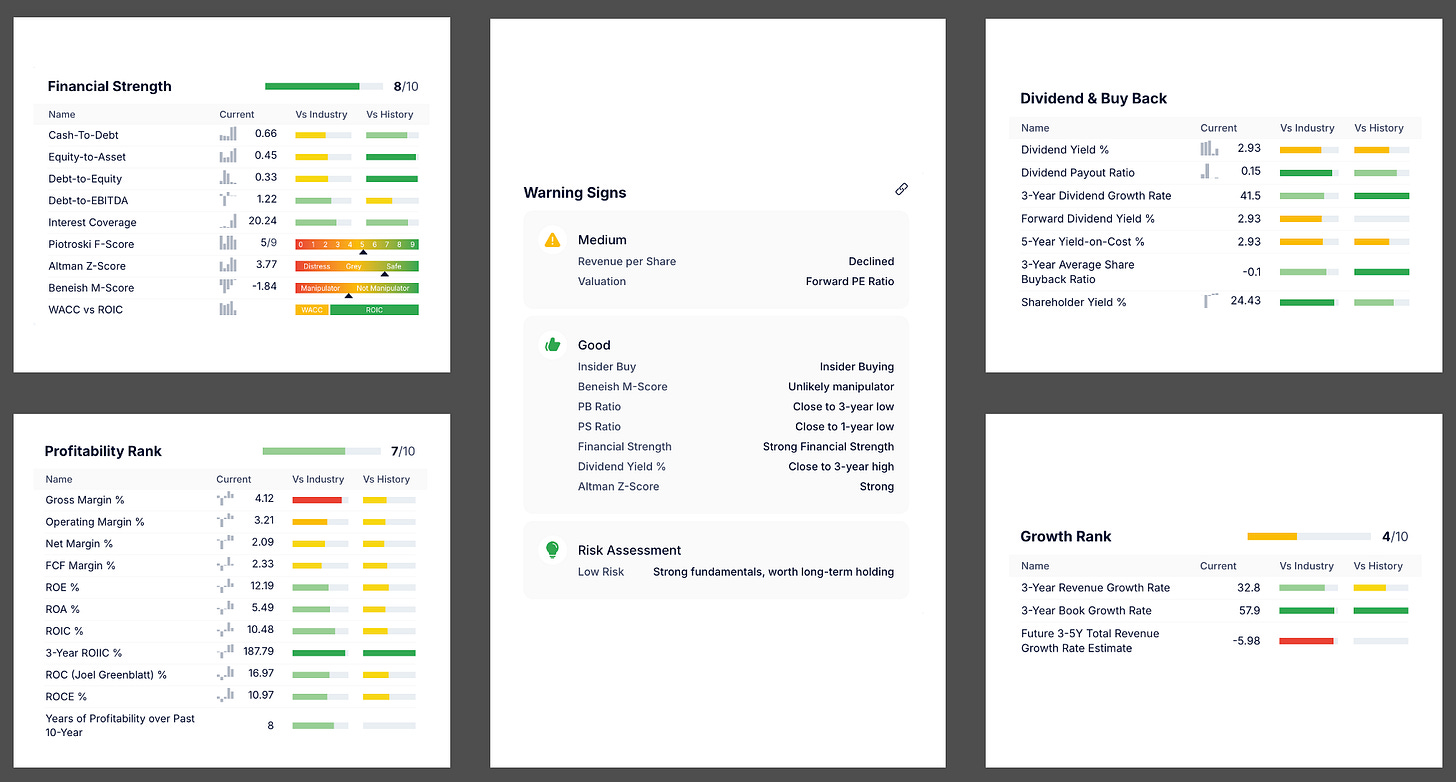

The most interesting insider buyer this week was a family office we have seen multiple times… Control Empresarial De Capitales. At this point, I can’t tell you the number of weeks that we have had the richest man in Mexico’s family office be the top insider trader here. If you have been following me for some time, then you know exactly what stock they bought: PBF Energy (ticker: PBF).

We had the stock listed as a buy opportunity before and this new purchase warrant another 🟢BUY OPPORTUNITY🟢 rating.

Here are the other four largest trades:

Still wondering if premium is worth it? Hundreds of people say that it is — you can join them here:

Executive Trading Report

This report tracks the five most recent stock trades from company executives.

Total executive ownership in our reported companies grew by over 21%. Marc Duey, a director at Aprea Therapeutics drove this increase.

Let’s take a look at the other four executive trades:

📈 Weekly Highs & Lows 📉

📈Top Two Gainers📈

========================================

Name: Bright Minds Biosciences Inc.

1 Week Change: 4,271.30%

Stock Price: 47.21

----------------------------------------

Name: Tevogen Bio Holdings Inc.

1 Week Change: 353.11%

Stock Price: 1.72

----------------------------------------

📉Bottom Two Losers📉

========================================

Name: CPI Aerostructures, Inc.

1 Week Change: -57.96%

Stock Price: 1.40

----------------------------------------

Name: Graphjet Technology

1 Week Change: -54.46%

Stock Price: 2.30

----------------------------------------

Weekend Reads For Weekday Trades

Let’s get into some of the most intriguing market-moving activities: mergers and acquisitions, top investment ideas for the upcoming week, upcoming contrarian bets, and earnings price volatility.

Did I mention all of the buy, watch, and sell opportunities?

Typically, information like this costs hundreds a month, but you can get it all here (plus more) for $20 a month. Did I happen to mention that our last two contrarian bets averaged 60% and 100% returns? Subscription starts to pay for itself real quick with numbers like that!

Listen to this episode with a 7-day free trial

Subscribe to The Simple Side to listen to this post and get 7 days of free access to the full post archives.