Welcome back to The Weekly Quintet from !

You’re reading about the only newsletter in the world that gives retail investors access to politician, insider, and company executive trading in one place. PLUS, we are the only newsletter that profit shares with its readers through raffles. We are currently raffling off a total of $1,000 ($2000 to paid subscribers) and will draw the three winners on August 17th!

Read more about the raffle here.

And in case you didn’t know, you can get access to even more information with a premium subscription — plus premium subscribers win double the raffle money! What does premium get you access to?

Stocks To Watch — Find hidden value!

Market Heat Maps — Follow the green!

Fear & Greed Index — When should you buy?

Rate Tracking — Inflation & interest rates + more!

Upcoming Market News — What’s on the horizion?

Daily Market Winners — Dollars making more dollars!

Mid-Week Congressional Trading — Politicians money makers!

Meme Stocks — Try to capitalize on short term trends!

Crypto Coins — The largest daily crypto winners!

What else do paid subscribers get?

At the end of every weekly newsletter, there are five sections. Each section discusses a different facet of the market: mergers, acquisitions, top trade ideas, alternatives, etc. In each of these sections, I offer actionable opportunities to “Buy, Watch, or Sell” particular stocks. Paying subscribers get access to this in real time when I post on Saturdays.

Over two weeks our weekly newsletter has outperformed the S&P 500 by 3.81%. But that’s not all… (see the stocks below).

Oh and by the way, if you work for a company and want multiple people to get these emails, buy in bulk and save!

The Weekly Recovery

The newsletter portfolio outperformed the S&P 500 again this week averaging a -0.69% return while the S&P 500 averaged a -1.75% return. We are still outperforming the market by vast margins. That being said, we expect these returns to normalize in the future as we collect more data!

Currently we are beating the market by 3.81%

Weekly this means we outperform by 1.91%

Annualized means we outperform by 99.06%What did our paying subs get to see buying opportunities for? Well…

Politician Trading Report & Politician ETFs

This report tracks the five most recent politician trades and two large holdings in my portfolio — ETFs NANC 0.00%↑ (which tracks democrat trading) and KRUZ 0.00%↑ (which tracks republican trading).

NANC is down 3.3% this week, 6.09% over the past month, and up 13.38% YTD.

KRUZ is down 3.55% this week, 2.20% over the past month, and up 6.95% YTD.

What’s fueled those poor returns? Well, over the past 30 days, 9 politicians have made 21 trades moving over $6.87 million. The best part of this week?

NANCY PELOSI HAS MADE MORE TRADES! She sold Microsoft and rolled that position into Nvidia, and in all honesty, I’m extremely surprised. Although Microsoft is down 11.44% this month, Nvidia has matched the poor performance with a -12.7% performance over the past month. As the saying goes, Roses are red, violets are blue; when Pelosi trades, I do too!

Here are the other most recent politician trades:

Insider Trading Report

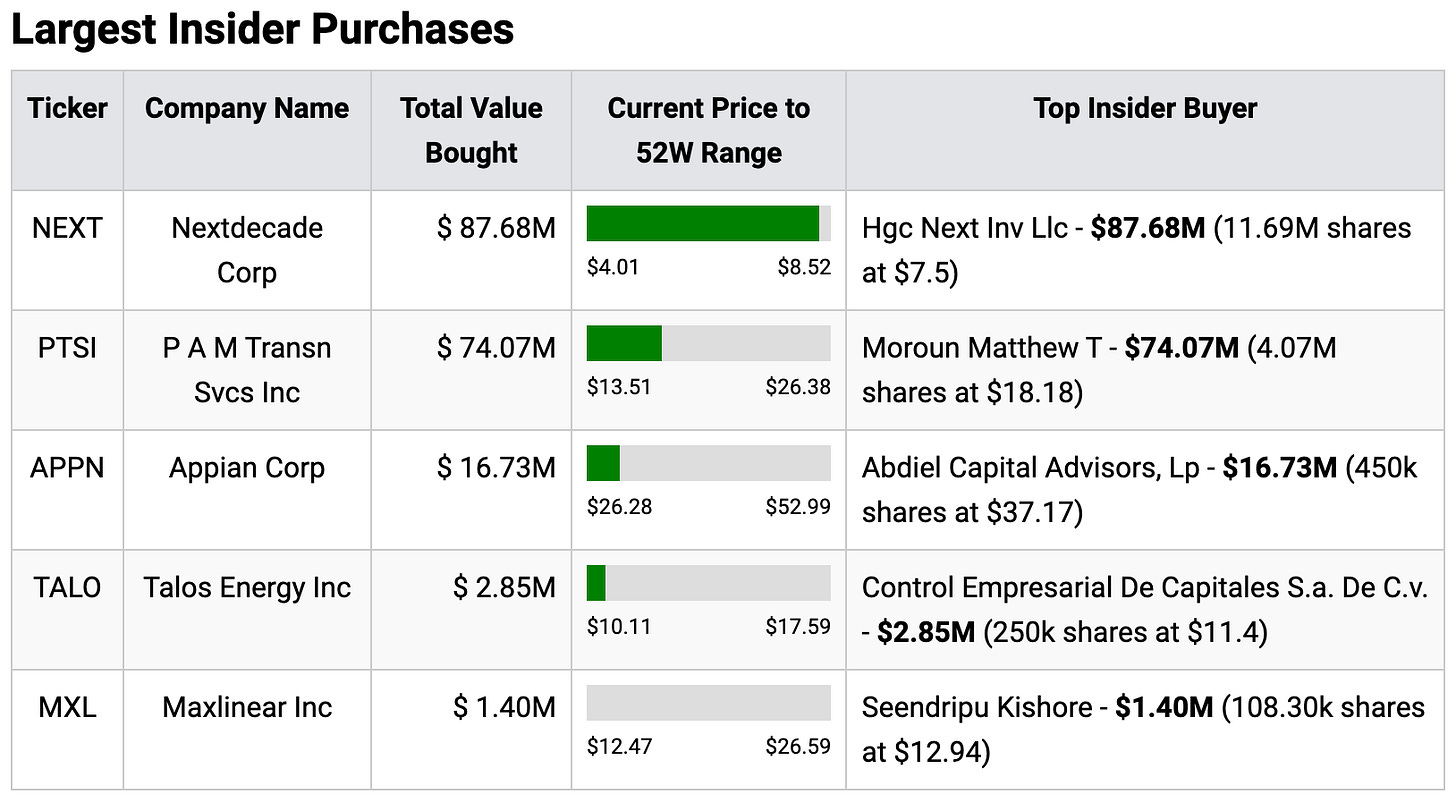

This report tracks the five largest insider buys from the past week and a new ETF in my portfolio — ticker SURE — which tracks insider trading.

SURE is up 1.27% this week, 3.26% this month, and 10.83% YTD.

The most interesting insider buyer this week was Abdiel Capital Advisors who has now been the most interesting buyer for three weeks in a row. They have been throwing MILLIONS into Appian (ticker: APPN 0.00%↑). This week, they spent another $16.73 million. The stock is down 20% over the past week and is nearly at its 52-week low.

Here are the other four largest trades:

Still wondering if premium is worth it? Hundreds of people say that it is — you can join them here:

Executive Trading Report

This report tracks the five most recent stock trades from company executives.

Total executive ownership in our reported companies grew by 130%. NB Bancorp NWBI 0.00%↑ had the most notable increase in ownership as the CFO increased his ownership by over 88%.

I want to make a note about NB since the stock was recently listed (December 2023) and has returned 72% to investors since then. Over the past week, the stock dipped by 7% and the insider buy today could represent a possible buying opportunity.

Let’s take a look at the other four executive trades:

📈 Weekly Highs & Lows 📉

📈Top Three Gainers📈

========================================

Name: Cassava Sciences, Inc.

1 Week Change: 95.11%

Stock Price: 29.11

----------------------------------------

Name: Inspirato Incorporated

1 Week Change: 81.03%

Stock Price: 6.30

----------------------------------------

Name: Lumen Technologies, Inc.

1 Week Change: 73.45%

Stock Price: 3.07

----------------------------------------

📉Bottom Three Losers📉

========================================

Name: QXO Inc

1 Week Change: -84.76%

Stock Price: 11.99

----------------------------------------

Name: AEON Biopharma, Inc.

1 Week Change: -60.08%

Stock Price: 1.05

----------------------------------------

Name: Graphjet Technology Sdn. Bhd.

1 Week Change: -54.36%

Stock Price: 2.31

----------------------------------------

Weekend Reads For Weekday Trades

Let’s get into some of the most intriguing market-moving activities: mergers and acquisitions, alternative investments, significant news, top investment ideas, and earnings price volatility.

Did I mention the TLDR summary with buy, watch, and sell opportunities?

Typically websites or newsletters charge HUNDREDS monthly for this information. I pay and subscribe to them all, sift through all the BS, and simplify it for all you paying folk.

Listen to this episode with a 7-day free trial

Subscribe to The Simple Side to listen to this post and get 7 days of free access to the full post archives.