No Investment Advice or Brokerage; Disclaimer. For the avoidance of doubt, The Simple Side does not provide investment, tax, or legal advice. The value of any asset class can go up or down and there can be a substantial risk that you lose money buying, selling, holding, or investing in any asset. You should carefully consider whether trading or holding assets is suitable for you in light of your financial condition.

Welcome to The Simple Side — one of the only financial newsletters with a proven track record of success.

Let me know what kind of content you would like to see changed, added, or removed from this weekly newsletter by clicking the button below!

Good morning, Shareholders — here are today’s quick updates!

The Simple Side website is in the process of being updated. Here is a quick picture of the progress. These numbers are not accurate currently. This is just for examples sake.

We are in the final sprint of copy trading being released as well, I have signed documents with a group

This will allow subscribers to copy my exact portfolios (the same ones that have returned over +310% since 2020.

Reminder: paying subscribers have access this spreadsheet with all of our trades and their returns.

When you request access, please tell me the email address that holds the paying subscription with The Simple Side so I can add you faster!

Here is what the dashboard looks like!

Past Performance of Weekly Trades

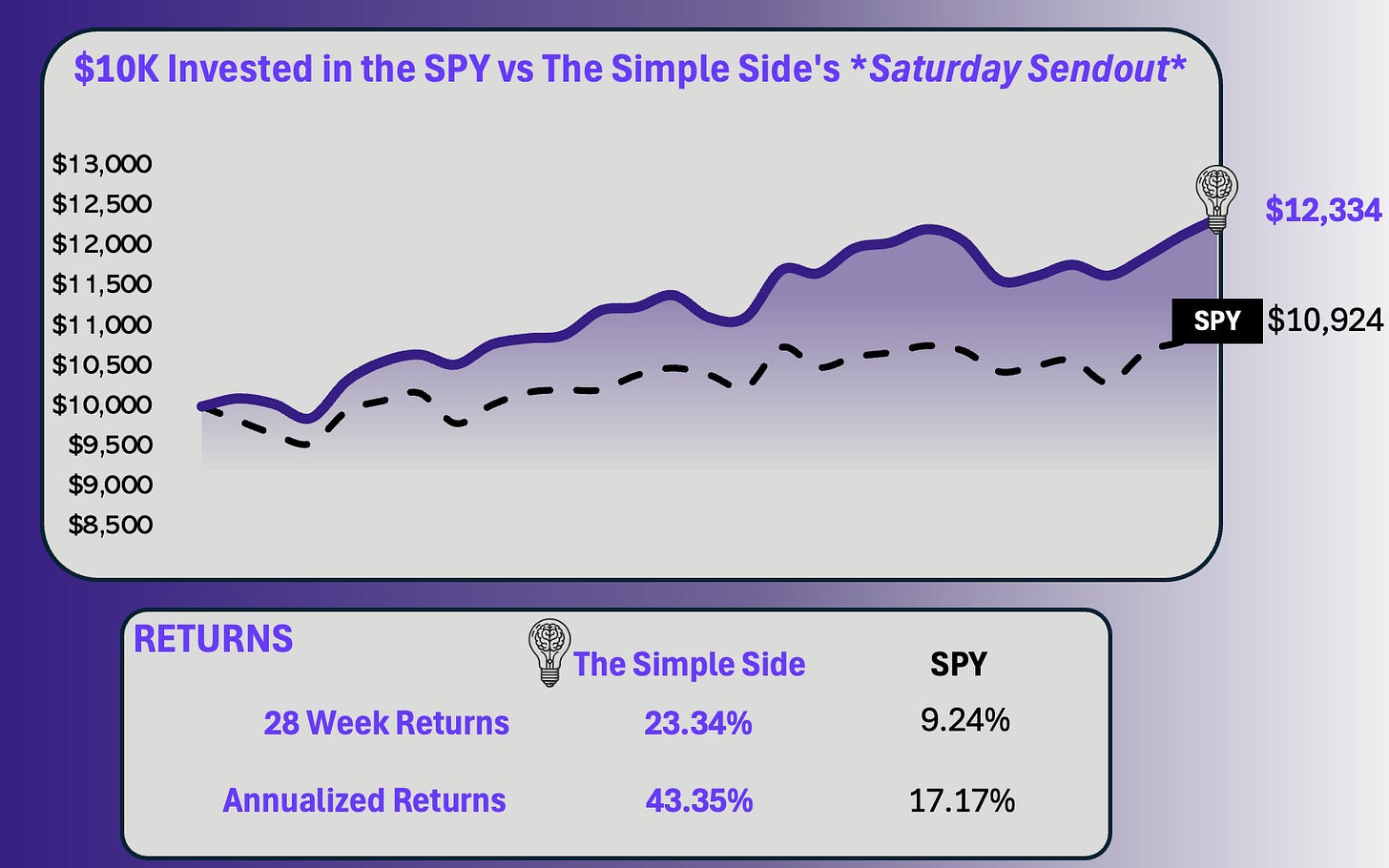

This section of the newsletter tracks the past performance of this weekly newsletter. As you will see, on average we have outperformed the S&P 500 from Monday to Friday, market open to market close.

The graph shows the growth of a $10K investment which began on July 20, 2024. You can find every newsletter dating back to July 20th here by CLICKING HERE.

Here is a summary of the past few weeks of performance and a comparison of returns that this newsletter has had relative to the SPY.

If you haven’t joined already, you can click this button below to join the paid newsletter and get these weekly picks sent to your inbox every Saturday!

Today’s Reporting Overview

Politician Trading Report

Politician Stock Highlight

Insider Trading Report

Insider Stock Highlight

Portfolio Updates

Premium Content (paid subscribers only) — Thank you all so much for the support!

Weekly Buy Opportunities

Includes take profit %’s

Mergers and Acquisitions

Top Investment Ideas

Micro-Cap Picks

Upcoming Earnings & Options Trades

Politician Trading Report

Politician trading matters… a lot. In 2024, the top-gaining politician was republican David Rouser who returned 104.1% — followed closely by democrat Pelosi who returned 70.9% over the year.

This report tracks the five most recent politician trades and two large holdings in my portfolio — ETFs NANC 0.00%↑ (which tracks democrat trading) and KRUZ 0.00%↑ (which tracks republican trading).

Over the past 30 days, 11 politicians made 107 trades with a total trade volume of $2.81 million.

NANC was up 1.63% this week, 4.41% this past month, and 4.83% YTD.

KRUZ is up 0.52% this week, 3.57% this past month, and 3.87% YTD.

Politician Stock Highlight

For those of you who don’t know, Marjorie Green may be one of the worst politician traders in the market. Well, worst might be a stretch but she isn’t great. She made all five of the most recent politician trades this week.

Out of everything she did, I found her Devon Energy (DVN) purchase most interesting.

The stock has a complex investment profile with its strong fundamentals contrasted by negative short-term momentum. The stock's negative 3-1 month momentum (-15.38%) and today's decline (-2.71%) highlight recent challenges, despite a solid operating margin of 29.96% and a low PE ratio of 6.33 suggesting undervaluation.

Given the mixed signals—where the stock is trading below its 20-day, 50-day, and 200-day SMAs by -4.71%, -3.26%, and -19.71% respectively—Devon Energy may not see immediate price recovery next week. However, the long-term outlook remains promising with a potential upside of +45.13%, assuming market stabilization and ongoing operational performance. For this week it isn’t a buying opportunity.

Here are the most recent politician trades:

Insider Trading Report

This report tracks the five largest insider buys from the past week and a new ETF in my portfolio — ticker SURE — which tracks insider trading.

SURE is down 0.07% this week, up 3.89% this month, and 3.78% YTD.

The monthly buy/sell ratio is currently 0.20 which is below the average of 0.40 and lower than last week’s ratio of 0.29. This indicates a slight sell in the markets.

Insider Stock Highlight

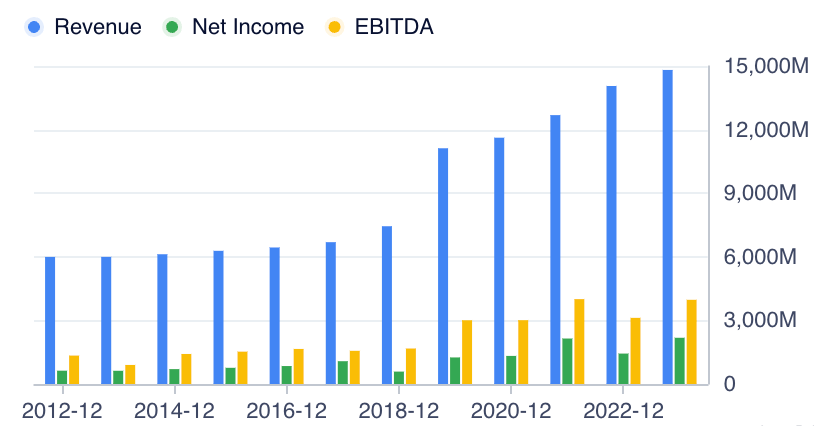

The buy I liked from top insiders this week was Keurig Dr Pepper (KDP). They have been on a revenue growth run since 2018, and while EBITDA hasn’t been expanding as much as an investor would like, recently their margins have been growing.

Basically, the company is making more profit from its revenues.

The stock exhibits minor discrepancies in its short-term technical performance, currently trading just below its 20-day SMA by -2.37% and essentially at parity with its 50-day SMA (-0.02%).

These metrics suggest some recent underperformance, which might inhibit immediate price gains but I think there is some possibility for the stock to grow as coffee prices continue to rise.

🟢This week I am putting KDP on my buy list.🟢

Here are the largest trades from this past week:

Our premium subscribers get access to long-term, mid-term, and short-term strategies that all beat the market. You can too, join now!

Portfolio Updates

All of our portfolios have been outperforming the SPY which is only up 2.11% YTD.

As I have discussed with paying subscribers before, I feel comfortable with all of our current holdings and their positioning in the market.

Our flagship portfolio remains strong at 6.12% returns YTD. Top performers have returns of +16%, +16%, and +10% while the worst performers have -6.81%, -6.94%, and -2.96% returns.

The contrarian trades portfolio has remained strong with our portfolio leader (which makes up half the portfolio) up over 51.25% YTD. I expect these returns to continue, but am actively watching the stock looking to exit with total returns sitting at over 125% from our initial buy in 2024.

The weekly stock picks remain a good solution for anyone who is paying close attention to the markets daily. The market remains volatile which makes these picks continually valuable. We are able to capture the premiums from stocks running high while capping individual losses at -1%.

Key Portfolio Changes

In 5 days some of the key stocks in our portfolio will be put in the spotlight to either be cut from the portfolio or to have additional shares purchased. There is one stock in particular that I am paying attention to.

My models have the stock undervalued by over 27% and analysts think the stock has 17% upside in 2025.

The stock that makes up 4.73 of my portfolio is…

MKTX: MarketAxess Holdings. MKTX.

Now, you may remember that I have talked about MKTX before. The company has in 2024 Q4 earnings report happening on Feb 6 and this is a key moment for the stock in my portfolio.

It is down 2.96% since I bought the stock on Jan 2, but I really like the comapny. They sell bonds to institutional investors through their online platform, but why do I like the stock so much?

Well, the market is getting increasingly volatile, increasingly risky, and increasingly overpriced. Investors are paying huge premiums for companies with high growth expectations. When the expectations are hit, there is little change to the stock price; however, when expectations are missed, there is a major downside.

I think a risky landscape will force investors to shift to bonds as market conditions worsen. I want to see this thesis proven in the earnings of MKTX before I put in more capital.

Updates will come in a few days, so stay tuned.

Our current flagship portfolio sits at a return of over 312% since the beginning of 2020.

Next Week’s Trades

Key Opportunities and Insights

The TLDR Summary

Listen to this episode with a 7-day free trial

Subscribe to The Simple Side to listen to this post and get 7 days of free access to the full post archives.