No Investment Advice or Brokerage; Disclaimer. For the avoidance of doubt, The Simple Side does not provide investment, tax, or legal advice. As with any asset, the value of any asset class can go up or down and there can be a substantial risk that you lose money buying, selling, holding, or investing in any asset. You should carefully consider whether trading or holding assets is suitable for you in light of your financial condition.

"Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble." — Warren Buffett

Happy Saturday simple investor! See below for some quick updates before we get into this week's returns — which outperformed the S&P 500 again!

Quick Updates

If you like quick, short-form stock updates and analysis daily, check out my daily newsletter (only costs $10 a year or $1 a month).

(LINK) Paying subscribers have access to the $2,000 giveaway in December!

Copy Trading and Profit Sharing For Paying Subscribers

The homepage of my website has been rearranged. I am in the process of adding missing posts. I now have the following sections:

I will be doing a podcast Q&A to answer any and all questions that people have emailed to me or that they have sent to me with the button below!

Feel free to send me an email by replying to this message, or emailing my other email: thesimplesidenews@gmail.com.

You can also click the button below and let me know anonymously about anything!

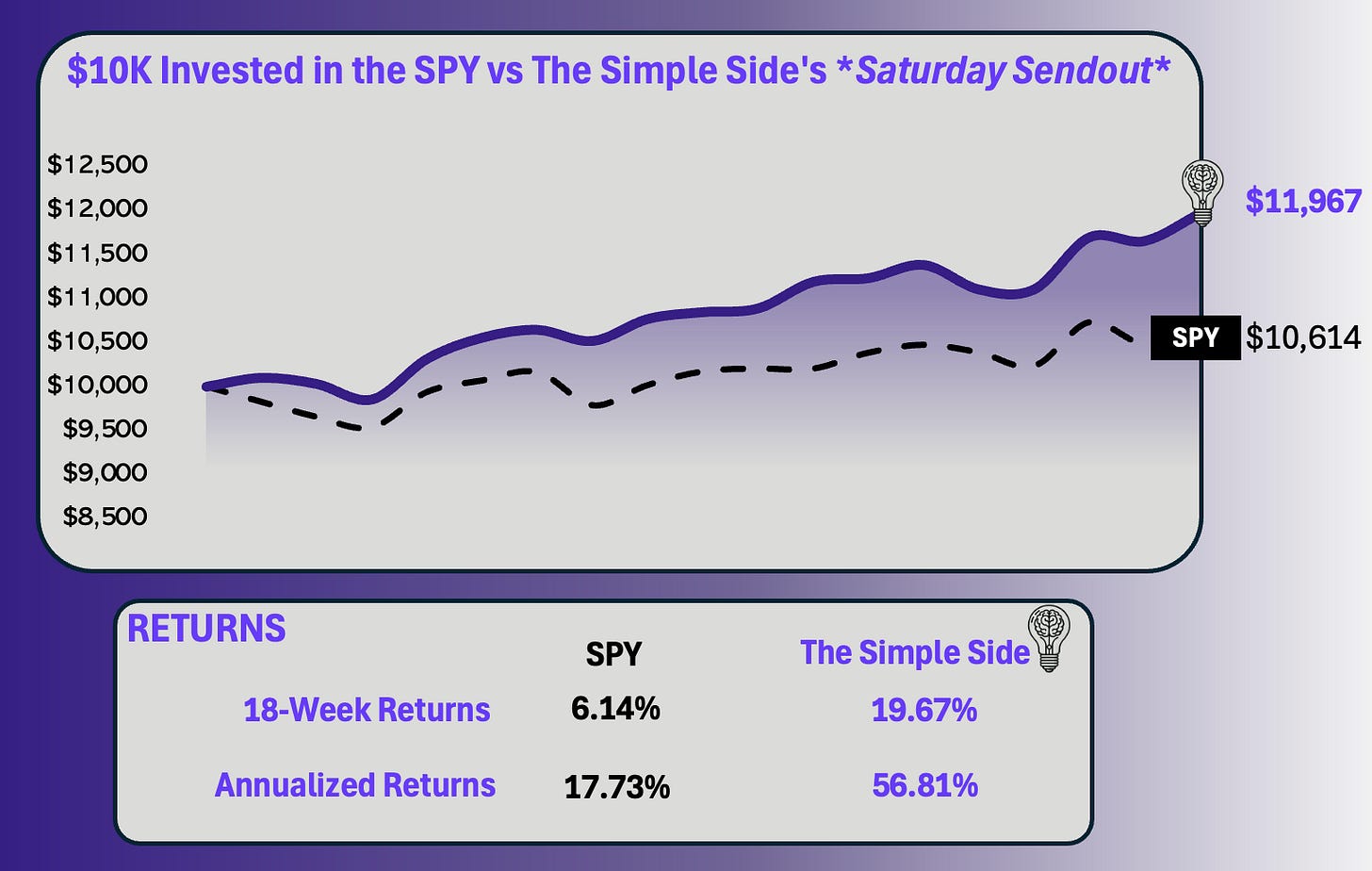

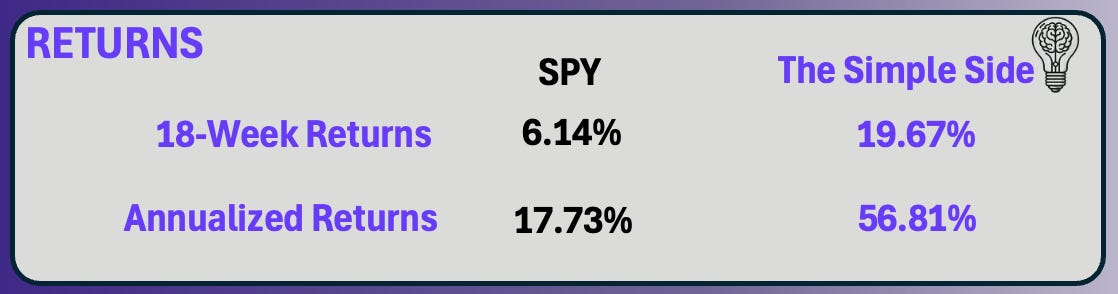

Past Performance: Averaging 1.09% Weekly

This section of the newsletter tracks the past performance of this weekly newsletter. As you will see, we have (on average) outperformed the S&P 500 from Monday to Friday, market open to market close. Take a look:

The graph shows the growth of a $10K investment which began on July 20, 2024. You can find every newsletter dating back to July 20th here by CLICKING HERE.

Here is a summary of the past few weeks of performance and a comparison of returns that this newsletter has had relative to the SPY.

You can click this button below to join the paid newsletter and get all of these weekly picks sent to your inbox every Saturday!

Today’s Reporting Information

Quick Overview

Politician Trading Report

Politician Stock Highlight

Insider Trading Report

Insider Stock Highlight

Executive Trading Report

Executive Stock Highlight

Investing for Next Week (For Paying Subscribers)

Next Week’s Buy Opportunities

Mergers and Acquisitions

Top Investment Ideas

Contrarian Bets

Flagship Portfolio Updates

Micro-Cap Picks *NEW*

Expected Stock Movements From Options Trading

Politician Trading Report & Politician ETFs

This report tracks the five most recent politician trades and two large holdings in my portfolio — ETFs NANC 0.00%↑ (which tracks democrat trading) and KRUZ 0.00%↑ (which tracks republican trading).

NANC is up 2.01% this week, 3.96% this past month, and 31.29% YTD.

KRUZ is up 1.87% this week, 4.44% this past month, and 20.57% YTD.

Contributing to these gains — over the past 30 days — 20 politicians have made 170 trades investing over $3.38 million.

Politician Stock Highlight

This was another week highlighted by Marjorie Taylor Green lighting up the buying section with over eight buys being initiated Tuesday. As is typical, all of her purchases remained within the 1K-15K range and none seemed out of the ordinary.

There was, however, a perfectly timed buy that was reported this week. Tina Smith, a Democrat out of MN, bought Tactile Systems Tech (TCMD) stock last Monday and didn’t report on it until yesterday at noon. Well, the stock jumped over 13% this week. (No wonder that Democrat ETF NANC is doing so well). Analysts predict the stock will return 17.65% over the next year while my models say the stock is currently overvalued by 26%. The stock would need to experience a 48% growth in free cash flow over the next year to be worth the current stock price. I do not see the stock as a purchase at the current valuation.

Here are the most recent politician trades:

Insider Trading Report

This report tracks the five largest insider buys from the past week and a new ETF in my portfolio — ticker SURE — which tracks insider trading.

SURE is down 0.09% this week, 2.88% this month, and 16.30% YTD.

Insider Stock Highlight

Insiders made a few interesting buys this week, and if you’ve been following this newsletter for a while then you know that PBF Energy (PBF) has been experiencing a massive amount of insider buying from the largest family office in Mexico. They were active buyers again this week, so let’s take another look at the stock to see how I feel about it this week.

The last time we analyzed the stock it had a rating of 7.0/10 driven by great value and financial strength rankings. Since then, the financial strength ranking dropped from an 8 to a 6, free cash flow has continued to decline, and company financials have been in a downturn. On poor results last quarter, however, the company opted to raise dividends by 10% which came as a surprise to me. The dividend raise leads me to believe that the comapny sees a strong future ahead. I think PBF is a 🟡Watch List🟡 stock this week. See a quick one-pager below.

Here are the largest trades from this past week:

Our premium subscribers get access to long-term, mid-term, and short-term strategies that all beat the market. You can too, join now!

Executive Trading Report

This report tracks the five most recent stock trades from company executives.

Total executive ownership in our top 5 companies grew by over 155%.

The largest increase came from a director at Ohio Valley Banc Corp (ticker OVBC). They increased their ownership by +95% at a purchase price of $25.34 and the stock currently sits at $27.75.

Executive Stock Highlight

I also want to highlight OVBC this week. The stock is about 4% overvalued by my model’s predictions, but based solely on free cash flow numbers the stock is undervalued by around 26%. If based on earnings per share then this value drops to 2.67%.

The company has been around since the late 90’s but their stock didn’t explode until around 2018 when the stock hit a price of 51.80 per share. It now sits at around 50% below that. I ran some backtests on my value models and the stock is sitting at an impressive total score of 7.4/10 (which is one of the highest scores it has had in its history). The problem is that the stock has been overbought over the past couple of weeks which puts it in the perfect place to dip in the coming weeks. That being said, I am not completely sold on the idea of buying the stock for this next week. I am going to 🟡Watch List🟡 OVBC unless it comes up again with better financials and a lower price tag.

Let’s take a look at the other executive trades:

Investing For Next Week

Let’s get into the good stuff. Paying subscribers can see below for the buy opportunities I see in the coming weeks.

You can join the +100 others who have seen our returns go from 0 to this…

Typically, information with returns like that costs hundreds a month, but here? Well, you get it all for $200 annually.

**With our current predicted annual returns, a $400 investment in the stock market pays for the subscription!

The TLDR Summary

You pay for my research, my time, and most of all the saving of your time. That’s why we have a summary of everything below right here:

Listen to this episode with a 7-day free trial

Subscribe to The Simple Side to listen to this post and get 7 days of free access to the full post archives.