Welcome back to a special monthly edition of The Saturday Sendout from !

Here is today's cheesy poem:

If you’ve got cash and you’re wondering where to park it

Read The Simple Side letter below

And learn to beat the market

Before we jump into the pod and newsletter I want to let you know that I am putting together a “How To Trade My Newsletters” post that will be available to all subscribers on my website and homepage. I am looking to get this out this upcoming week.

Remember that my typical weekly insights will be reported ‘monthly’ in today’s special edition; but before we get into the monthly insights, let’s talk about this past week.

‘The Weekly Recovery’

The Weekly Recovery is a showcase of the actionable insights we provide to paying subscribers. In our “Saturday Sendout” newsletters I provide my paying “investors” with 🟢Buy, 🟡Watch, and 🔴Sell opportunities.

I then track the weekly returns of our 🟢Buy Opportunities and present the return here the following week. Sadly we lost to the market this week due to the poor bond returns from ZROZ. I do not expect this trend to continue into the future.

Over the past month, we averaged a return of 1.53%, beating the market which only returned 1.32% over the same period.

August’s Performance

Over the past month, we have done over 2 million views on our newsletter. I want you all to know that those of you who invest in me and this content are receiving unmatched information.

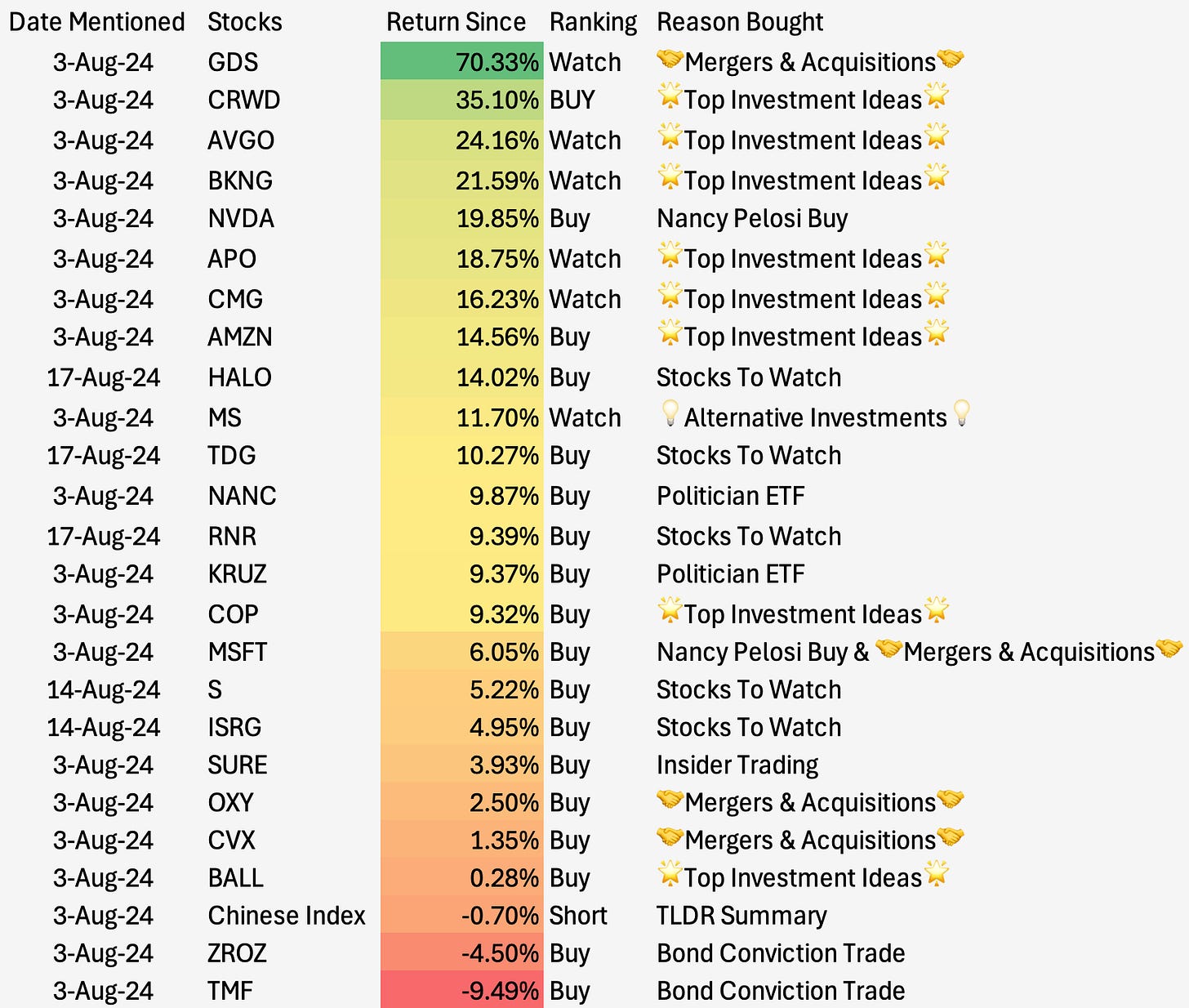

I went through every newsletter I sent over this past month and pulled every stock that I gave a rating. I have recorded them all and tracked their returns over their holding period (from the “Date Mentioned” until Friday at close).

I value transparency and as you can see I have included the section where I discussed the stock, the date of the newsletter, my rating, and the stock’s return.

Now, I am sure you are probably wondering, “How did these returns compare to the S&P 500?”

My paid subscribers and I smoked the S&P 500 in August.

My best-performing portfolio was my “watch” portfolio which returned 27.13%. As I have stated in earlier newsletters, my “watch” stocks are ones I think are good buys, but carry more risk. My “Total Buy & Watch” followed with a return of 17.51%. Again beating the S&P 500. This was then followed by the S&P 500 at a total of 9.35% which was ahead of my short portfolio, which consisted of the Chinese stock market index.

Complete and total transparency on my performance?

A weekly, monthly, and annually outperforming portfolio?

Access to more market insights with twice-weekly 10-minute reads?

AND 20% OFF?? Need I say more?

Alright, now let’s jump into the monthly reports for politician, insider, and executive trading from this past month. Typically I report on all of this weekly, but today we will be going through the largest buys and sells from the past month!

I am also going to be covering all of the premium metrics in the premium section at the end of this article. I am going to do quick summaries for each as this is already quite a lengthy article.

Politician Trading Report & Politician ETFs

This report tracks the five most recent politician trades and two large holdings in my portfolio — ETFs NANC 0.00%↑ (which tracks democrat trading) and KRUZ 0.00%↑ (which tracks republican trading).

NANC is down 1.38% this week, up 1.56% over the past month, and up 20.24% YTD.

KRUZ is up 0.31% this week, 1.42% over the past month, and up 13.39% YTD.

What’s fueled those returns? Well, over the past 30 days, 6 politicians have made 74 trades moving over $2.23 million. The largest sale this month came from Scott Franklin who sold QQQ on August 6th. Since their original trade, the stock has returned 9%. Maybe this poor trade was the reason he didn’t report this trade until August 21st.

Let’s take a look at some of the largest buys/sells from this past month:

Stock Performance Since Buying/Selling

SBUX (SELL): -0.81%

ACN (BUY): +6.80%

APD (BUY): -0.69%

AMGN (BUY): +3.9%

CB (BUY): +6.6%

Insider Trading Report

This report tracks the five largest insider buys from the past month and a new ETF in my portfolio — ticker SURE — which tracks insider trading.

SURE is up 2.39% this week, 1.42% this month, and 11.26% YTD.

The most interesting insider buyer this month was an anonymous buyer who sold COR on 8/01/2024 which has since returned -1.8%. Just another reason to be following The Simple Side.

Here are the top largest trades:

You can join paid here or keep reading for a super special 20% discounted offer!

Executive Trading Report

This monthly report tracks the five largest stock trades from company executives.

The largest buyer over the past month was Henry Schuck who bought ZI stock for $8.49 on August 7. Their shares have returned 16.5% since their original purchase. Just another reason to follow The Simple Side.

Let’s take a look at this month’s executive trades:

📈 Monthly Highs & Lows 📉

📈Top Three Gainers📈

========================================

Name: Big Tree Cloud Holdings Limited

1 Week Change: 417.48%

Stock Price: 5.33

----------------------------------------

Name: Applied DNA Sciences, Inc.

1 Week Change: 396.10%

Stock Price: 1.91

----------------------------------------

Name: BAIYU Holdings, Inc.

1 Week Change: 377.05%

Stock Price: 5.82

----------------------------------------

📉Bottom Three Losers📉

========================================

Name: Bolt Projects Holdings, Inc.

1 Week Change: -87.27%

Stock Price: 1.41

----------------------------------------

Name: Citius Oncology, Inc.

1 Week Change: -84.53%

Stock Price: 1.77

----------------------------------------

Name: iLearningEngines, Inc.

1 Week Change: -83.52%

Stock Price: 1.39

----------------------------------------

The TLDR Summary

Listen to this episode with a 7-day free trial

Subscribe to The Simple Side to listen to this post and get 7 days of free access to the full post archives.