No Investment Advice or Brokerage; Disclaimer. For the avoidance of doubt, The Simple Side does not provide investment, tax, or legal advice. The value of any asset class can go up or down and there can be a substantial risk that you lose money buying, selling, holding, or investing in any asset. You should carefully consider whether trading or holding assets is suitable for you in light of your financial condition.

Welcome back to The Simple Side — we are like your best friend, except the stocks we talk about actually return profits.

If this is your first time here, we are glad to have you! If you’re one of the nearly 300,000 returning subscribers, welcome back (we are glad to have you too)!

I have switched up the newsletter format today and have decided to throw an outline of the newsletter in the forefront of the article. This will let you skip around to the parts you want to read!

Also, I would love it if you could tell me what you love, hate, and want to see added to this newsletter by clicking the button below. This lets me know how I can improve your reading experience!

Today’s Newsletter

FREE CONTENT

Quick Updates

Subscriber raffles are back!

Website Updates

Copy Trading

Weekly Trades Performance

YTD Returns are over 9% now

Weekly Politician Trading Report

Weekly Insider Trading Report

Portfolio Updates

Key Updates Related To My Contrarian Bets Portfolio (39% YTD)

PAID ACCESS ONLY — Thank you so much for all the support!

Stock Buy Summary

These picks that have returned +9.71% YTD.

Mergers & Acquisitions Stocks

Top Stock Investment Ideas

Micro Cap Stock Picks

Earnings & Options

Quick Updates

Subscriber Giveaways are back!! Last year, we gave away over $4,000 to subscribers here and we want to do it again this year!

Will will be giving away items from our shop (click here) and over $2,000 to a paying subscriber! There is nothing you have to do to enter but join our paid (coupon code below in the article).

The Simple Side website is in the process of being updated. We just have a few tweaks before we will shift all info to this website!

We are in the final sprint of copy trading, I have signed documents with a group and we are building the onboarding experience now.

This will allow subscribers to copy my exact portfolios (the same ones that have returned over +312% since 2020.

Reminder: paying subscribers have access this spreadsheet with all of our trades and their returns.

When you request access, please tell me the email address that holds the paying subscription with The Simple Side so I can add you faster!

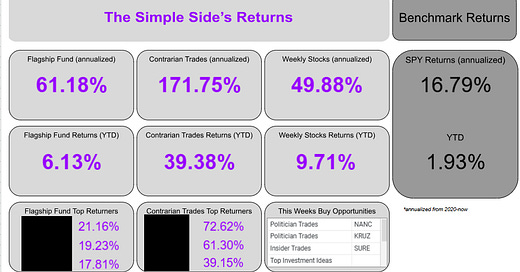

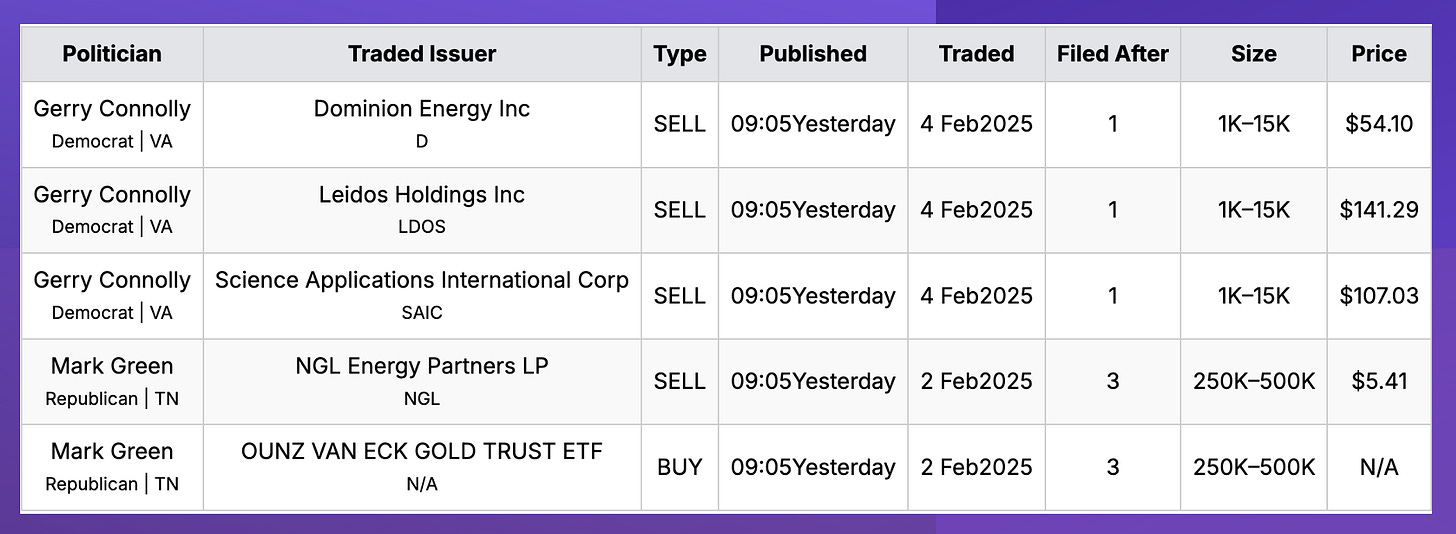

Here is what the dashboard looks like!

Weekly Trades Performance

This section of the newsletter tracks the past performance of this weekly newsletter. As you will see, on average we have outperformed the S&P 500 from Monday to Friday, market open to market close.

The graph shows the growth of a $10K investment which began on July 20, 2024. You can find every newsletter dating back to July 20th here by CLICKING HERE.

Here is a summary of the past few weeks of performance and a comparison of returns that this newsletter has had relative to the SPY.

If you haven’t joined already, you can click this button below to join the paid newsletter and get these weekly picks sent to your inbox every Saturday!

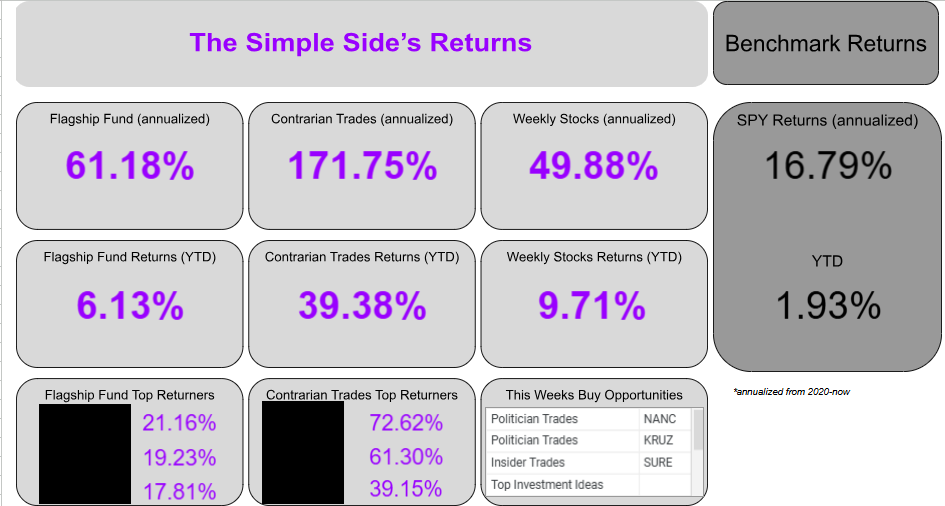

Politician Trading Report

Politician trading matters… a lot. In 2024, the top-gaining politician was republican David Rouser who returned 104.1% — followed closely by democrat Pelosi who returned 70.9% over the year.

This report tracks the five most recent politician trades and two large holdings in my portfolio — ETFs NANC 0.00%↑ (which tracks democrat trading) and KRUZ 0.00%↑ (which tracks republican trading).

NANC was up 2.60% this week, 3.10% this past month, and 4.44% YTD.

KRUZ is up 1.94% this week, 3.29% this past month, and 4.18% YTD.

Over the past 30 days, 9 politicians made 36 trades with a total trade volume of $4.51million.

Politician Stock Highlight

Over the past two weeks, politician trading has had one of the most interesting runs I have ever seen. Currently, politician buyers are outpacing sellers by a factor of 9:1.

The most interesting trader was Mark Green this week. He bought into a gold trust ETF amid selling millions of dollars worth of NGL Energy Partners (NGL). He has been selling down his holdings in NGL since early 2024 and hasn’t show signs of stopping.

Mark’s gold purchase makes it one of two holdings in his portfolio — the other being the declining NGL position. Gold recently hit all time highs and it might seem like buying now is a fools game — but not everyone thinks so.

I took a look at Barrick Gold Corp and found some other interesting news… massive and consistent insider buying. Next week, I will be buying gold, looking to capitalize on it’s current historic run.

Paying subscribers know that they will get to see the ticker GOLD in the 🟢Buy Opportunity🟢 section below.

Here are the most recent politician trades:

Insider Trading Report

This report tracks the five largest insider buys from the past week and a new ETF in my portfolio — ticker SURE — which tracks insider trading.

SURE is up 0.5% this week, up 3.44% this month, and 2.83% YTD.

The monthly buy/sell ratio is currently 0.22 which is below the average of 0.40 and lower than last week’s ratio of 0.29. This indicates a slight sell from insiders in the markets.

Insider Stock Highlight

Last week, we highlighted KDP as our insider buy… and the returns were disappointing at best. The stock we decided not to buy was TKO Group Holdings (the owners of the UFC and WWE).

This week, we are going to follow the money and see how it plays out. TKO holdings is topping the charts this week in the world of insider buying again with Ariel Emanuel purchasing over $81 million worth of shares.

I am starting to see why so many people are starting to get interested in purchasing shares of TKO. The company has been driving up great revenue growth numbers since late 2023. From 2020 to 2022 the company was only able to grow revenue 28% — the same % growth that some companies might see in a single year.

However, from Q2 of 2023 to Q2 of 2024 their revenue more that doubled. That is a 100% gain in a single year, and that is why investors have started to pay attention. Sadly, the companies EBITDA and Net Income have struggled to follow the staggering revenue growth.

In the end, I think TKO is increasingly catching investors attention and the stock will continue to benefit from that attention.

Paying subscribers can check out the buy for TKO in buy summary below.

Here are the largest trades from this past week:

Our premium subscribers get access to long-term, mid-term, and short-term strategies that all beat the market. You can too, join now!

Portfolio Updates

All our portfolios have been outperforming the SPY which is only up 1.93% YTD.

Our flagship portfolio remains strong at 6.13% returns YTD. Top performers have returns of 21%, +19%, and +17% while the worst performers have -11%, -6%, and -3% returns.

The contrarian trades portfolio has remained strong with 39.38% returns YTD. Our portfolio leader (which makes up half the portfolio) up over 72% YTD. I expect these returns to continue, but am actively watching the stock looking to exit with total returns sitting at over 157% from our initial buy in 2024. Other top performers have returns of 61.3% and 39.15%

The weekly stock picks remain a good solution for anyone who is paying close attention to the markets daily — returns sit at 9.71% YTD. The market remains volatile which makes these picks continually valuable. We are able to capture the premiums from stocks running high while capping individual losses at -1%.

Key Portfolio Updates: Contrarian Trades Portfolio

I have recently been getting tons of questions about my contrarian portfolio, and I haven’t found the time to write a full blown article, so this will have to suffice for now. A deeper dive article is on the way but here is a quick overview of the 2024 performance:

In 2024 we traded a total of 7 stocks, held each for an average of 3 months and 23 days and averaged a 59% return per trade.

So, if you recently joined the simple side as a paying or free subscriber, you should know that the contrarian portfolio is what everyone loves. The portfolio has a simple thesis: buy stocks that are set to capitalize on world trends. We purchase stock sporadically based on trends we think a company can capitalize on.

What does that mean?

Well, for example, last year we noticed that something called GLP-1 (Ozempic) was gaining popularity as the race to get skinny in the easiest way possible took off. We knew this would be a major trend since the obesity rates have been climbing in every country across the world. We then bought two GLP-1 makers LLY and HIMS.

In this instance, LLY was our bet on one of the largest providers in the market while our bet on HIMS focused on growth. LLY returned 50% when we sold and we still own HIMS at a 157% return.

Now you know how the strategy works; but what are the bets for 2025?

Well, we have two, as you have seen me discuss before, HIMS makes up 50% of the contrarian portfolio. The other half consists of stocks that I call the “Secondary Effects of AI Trade”

This part of the trade hinges on…

… ideas that are available to paying subscribers (what a cheeky upsell that is). If you are a paying subscriber just keep on reading to see all of our current contrarian trades!

In all seriousness, paying subscribers are what give me the time to spend those months researching stocks. All of that research creates incredible results for those of you that support me!

The Secondary Effects of AI Trades

Currently, this part of the contrarian portfolio houses 22 individual stocks and one ETF. The stocks range from water companies that will benefit from the 26 million liters of water used per 1-megawatt data center in the US — to companies building nuclear plants to power the estimated 90 terawatt-hours (TWh) of power needed annually to run an AI data center. The ETF and 22 stocks are..

Listen to this episode with a 7-day free trial

Subscribe to The Simple Side to listen to this post and get 7 days of free access to the full post archives.