Welcome back to another weekly edition of The Saturday Sendout from!

I have had lots of new subscribers come in over the past month and I want to give everyone the opportunity to let me know what they think my newsletter needs!

Upcoming Newsletters

Releasing The Simple Side Stock Portfolio(s)

The ‘How To Trade My Newsletters’ ArticleMy Investing Strategies Updates

Profit Sharing w/ Founding Members

The Upcoming Paid Subscriber Giveaway

I don’t want to skimp on these newsletters so they may take some time to get out; however, they will be valuable. My current contrarian bets have returned over 17% monthly! This is something I am quite proud of and excited to share with you all!

Of course, if you’ve been a paying subscriber from the beginning, you have followed all these trades and seen their value.

The Weekly Recap

For those of you who don’t know, “The Weekly Recap” tracks the weekly 🟢Buy Opportunities🟢 contained within this newsletter. We treat each of the recommendations as a “one-week-only” investment and track them as such. We also report on the returns of these holdings monthly and in August these newsletters returned 27%.

What you see below are the total returns if you were to buy our 🟢Buy Opportunities🟢 on Monday and sell on Friday. The graph shows the growth of a $10K investment.

It has been 8 weeks since we began tracking the returns from this weekly newsletter. In that time I have returned over 7.7% during these weekly sendouts. If I manage to continue at this rate then I will end the year with 50% returns. While I find this to be unlikely, however, I feel confident I can keep the current pace.

The newsletter portfolio outperformed the S&P 500 again this week averaging a 2.38% return while the S&P 500 averaged a 2.36% return. We are still outperforming the market by vast margins. That being said, we expect these returns to normalize in the future as we collect more data!

This week we beat the market by 0.02%

Over 8 Weeks we outperform by 7.70%

Annualized means we outperform by 50.05%

If you are finding all of this valuable you can support me and my work by clicking that fancy button below!

Politician Trading Report & Politician ETFs

This report tracks the five most recent politician trades and two large holdings in my portfolio — ETFs NANC 0.00%↑ (which tracks democrat trading) and KRUZ 0.00%↑ (which tracks republican trading).

NANC is up 2.94% this week, 3.37% over the past month, and up 20.24% YTD.

KRUZ is down 2.45% this week, 2.60% over the past month, and up 11.21% YTD.

What’s fueled those poor returns? Well, over the past 30 days, 15 politicians have made 233 trades moving over $2.29 million. The best part of this week?

Now, you may be thinking “233 trades in a month seems like quite a bit” and you are right. Wanna know what else is strange? Over 100 of those trades were SELL orders made by Michigan House Representative John James. You heard that right, his trust sold over 100 different stocks on September 4th. This could mean that something sketchy is on the horizon.

John James sits on the Foreign Affairs and Energy & Commerce Committees within the House. For this reason, I am looking at short positions in energy stocks for the upcoming month.

Here are the other most recent politician trades:

Insider Trading Report

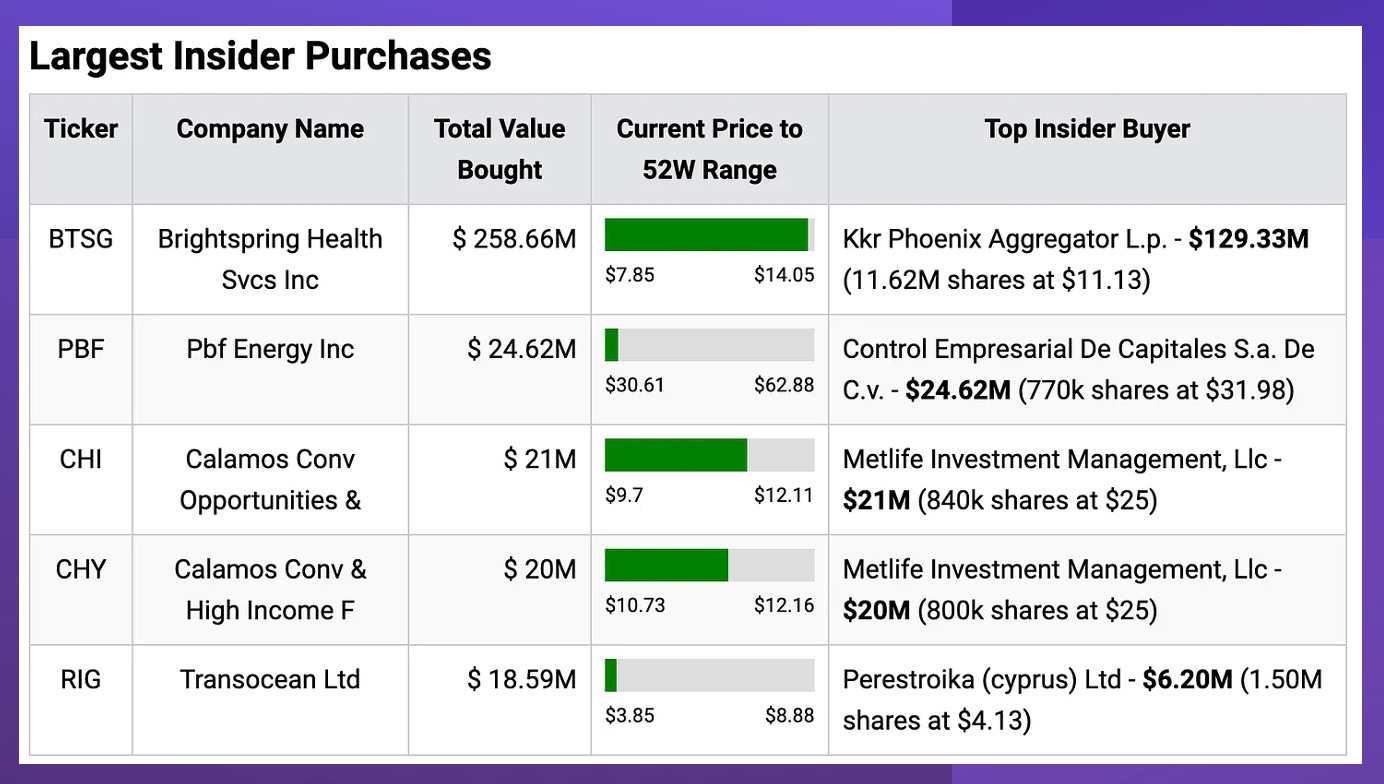

This report tracks the five largest insider buys from the past week and a new ETF in my portfolio — ticker SURE — which tracks insider trading.

SURE is up 1.16% this week, 3.64% this month, and 9.72% YTD.

The most interesting insider buyer this week was Control Empresarial De Capitales who has now been the most interesting buyer for four-ish weeks in a row. They have been throwing MILLIONS into PBF Energy (ticker: PBF). This week, they spent another $24 million. The stock is up 1.55% over the past week and is down 25% YTD.

Last week I said this was a Buy Opportunity and I am not sure how to feel about it this week. Any company that is pouring tens of millions into a single stock for weeks like this is either insane or a genius. Now, I feel comfortable entering into a small position here just because I find it that interesting. In the same vein, I have seen analysts downgrade the stock to sell.

Here are the other four largest trades:

Still wondering if premium is worth it? Hundreds of people say that it is — you can join them here:

Executive Trading Report

This report tracks the five most recent stock trades from company executives.

Total executive ownership in our reported companies grew by 197%. Steven Demetriou had the most notable increase in ownership as the Director increased his ownership by over 152%.

The stock, Arcosa (ticker: ACA), looks modestly overvalued to me at the current price and it seems that other insiders agree. There have been 2 recent insider buys and 3 recent insider sells, so this buy represents quite a notable increase in executive ownership. I don’t think the stock is a buying opportunity currently.

Let’s take a look at the other four executive trades:

📈 Weekly Highs & Lows 📉

📈Top Three Gainers📈

========================================

Name: Instil Bio, Inc.

1 Week Change: 493.12%

Stock Price: 84.52

----------------------------------------

Name: Quhuo Limited

1 Week Change: 224.49%

Stock Price: 1.04

----------------------------------------

Name: Nova Vision Acquisition Corporation

1 Week Change: 207.06%

Stock Price: 37.00

----------------------------------------

📉Bottom Three Losers📉

========================================

Name: Ryde Group Ltd

1 Week Change: -88.92%

Stock Price: 1.92

----------------------------------------

Name: Garden Stage Limited

1 Week Change: -63.04%

Stock Price: 2.99

----------------------------------------

Name: Fulcrum Therapeutics, Inc.

1 Week Change: -62.76%

Stock Price: 3.18

----------------------------------------

Weekend Reads For Weekday Trades

Let’s get into some of the most intriguing market-moving activities: mergers and acquisitions, top investment ideas for the upcoming week, upcoming contrarian bets, and earnings price volatility.

Did I mention all of the buy, watch, and sell opportunities?

Typically, information like this costs hundreds a month, but you can get it all here (plus more) for less annually than they cost monthly.

Listen to this episode with a 7-day free trial

Subscribe to The Simple Side to listen to this post and get 7 days of free access to the full post archives.