No Investment Advice or Brokerage; Disclaimer. For the avoidance of doubt, The Simple Side does not provide investment, tax, or legal advice. The value of any asset class can go up or down and there can be a substantial risk that you lose money buying, selling, holding, or investing in any asset. You should carefully consider whether trading or holding assets is suitable for you in light of your financial condition.

Good afternoon, simple investors! See below for some quick updates before we get into this week's returns.

Quick Updates

The daily newsletter is almost up to 10,000 users: Check it out by clicking here!

The discussions with the brokerage to build the one click portfolio are going well. I am working on getting a “ready to go” date for you all.

I am working on building out our 2024 letter to investors — I think this will release within the next couple of weeks along with a Q&A and newsletter FAQs

The new 2025 long-term stock picks (The Flagship Portfolio) will be released after I can get access to most companies Q4 reports.

I WANT TO KNOW WHAT KIND OF CONTENT YOU WANT TO SEE IN 2025! Please click the button below to send me a message about it, or respond to this email, or email me at thesimplesidenews@gmail.com

Paying subscribers also have access to this spreadsheet that shows our long-term and short-term buys and performance.

Past Performance: A Rough Week…

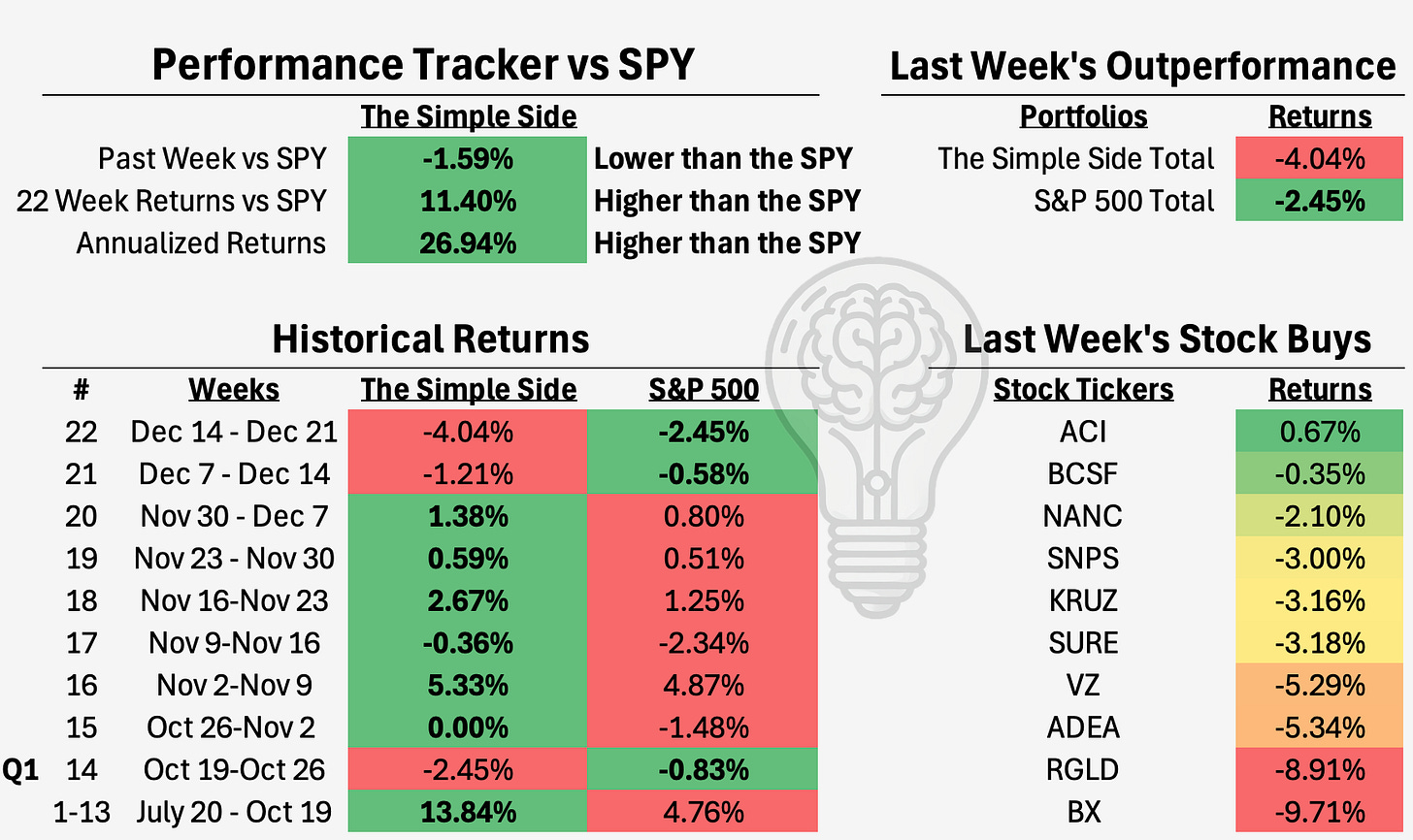

This section of the newsletter tracks the past performance of this weekly newsletter. As you will see, on average we have outperformed the S&P 500 from Monday to Friday, market open to market close.

The graph shows the growth of a $10K investment which began on July 20, 2024. You can find every newsletter dating back to July 20th here by CLICKING HERE.

Here is a summary of the past few weeks of performance and a comparison of returns that this newsletter has had relative to the SPY.

If you haven’t joined already, you can click this button below to join the paid newsletter and get these weekly picks sent to your inbox every Saturday!

Today’s Reporting Overview

Politician Trading Report

Politician Stock Highlight

Insider Trading Report

Insider Stock Highlight

Executive Trading Report

Executive Stock Highlight

Investing for Next Week (For Paying Subscribers)

Next Week’s Buy Opportunities *Updated Format*

Now includes predicted returns.

Mergers and Acquisitions

Top Investment Ideas

Contrarian Bets

Flagship Portfolio Updates

Micro-Cap Picks

Expected Stock Movements From Options Trading

Politician Trading Report

This report tracks the five most recent politician trades and two large holdings in my portfolio — ETFs NANC 0.00%↑ (which tracks democrat trading) and KRUZ 0.00%↑ (which tracks republican trading).

NANC is down 2.10% this week, up 2.10% this past month, and 31.80% YTD.

KRUZ is down 3.16% this week, 3.70% this past month, and 15.42% YTD.

Contributing to these gains — over the past 30 days — 10 politicians made 83 trades moving over $1.55 million.

Politician Stock Highlight

This week, only 3 trades were reported from politicians: 2 sells and 1 buy. Nothing here was terribly surprising. The only reported buy was Pete Sessions purchase of Microsoft (MSFT) for between $15 and $50 thousand.

My models puts Microsoft at a 9.7/10 with a fair valuation — only overpriced by about 2%. Analysts predict the stock will return over 14.57% over the next year. Microsoft’s return on invested capital is nearly 22% and their weighted average cost of capital is 10.13%. Thats bunch of jargon, but think about it like this: if it costs you $1 to borrow $5 then your cost of capital is $1. Now, if you can take that $5 you borrowed and make $7 with it then you cover your cost of capital ($1) and make an extra $1. We want the spread between ROIC and WACC to be as large as possible — and Microsoft does just that.

Microsoft is absolutely a long term hold, and will hit the weekly charts this week. MSFT is a 🟢BUY OPPORTUNITY🟢

Here are the most recent politician trades:

Insider Trading Report

This report tracks the five largest insider buys from the past week and a new ETF in my portfolio — ticker SURE — which tracks insider trading.

SURE is down 3.18% this week, 3.00% this month, and up 12.94% YTD.

Insiders were net sellers this week with an approximate buy/sell ratio of 1:1.16

Insider Stock Highlight

Occidental Petroleum Corp (OXY), which recently saw a significant vote of confidence with Berkshire Hathaway's purchase of 8.90 million shares for $409.17 million. The stock is currently priced at $47.13, up 3.90% for the day, indicating positive market momentum. Notably, the company has maintained profitability over the past decade, a testament to its robust operational framework. The PE ratio stands at 12.27, paired with an operating margin of 21.11%, highligts its efficiency relative to industry peers.

The MACD remains above the signal line, indicating potential upward price movement, the stock shows a 30.07% upside according to recent analyst targets, despite a current negative trend of -10.99% in the three-month price target. However, key momentum metrics are compelling with the stock outperforming, with 3-1 month momentum at -1.25% gowing slightly from the 6-1 month momentum at -1.41%.

OXY has experienced elevated volatility recently, however, which puts the stock in a unique position. It’s a stock set for recovery and growth — espicially with names like Buffet behind it. However, this week I think OXY 0.00%↑ is a 🟡RISKY BUY🟡.

Here are the largest trades from this past week:

Our premium subscribers get access to long-term, mid-term, and short-term strategies that all beat the market. You can too, join now!

Executive Trading Report

This report tracks the five most recent stock trades from company executives.

Total executive ownership in our top 5 companies grew by over 18% — and included a new purchaser!

Executive Stock Highlight

This week I want to highlight an executive stock purchase that I have on my long term watch list and one that might make the 2025 Flagship Fund — ConocoPhillips (COP).

ConocoPhillips boasts a solid financial strength rating of 7/10 and an equally robust profitability rank of 7/10 — both demonstrate the comapnies ability to maintain high operational and financial standards. The recent acquisition of Marathon Oil makes the company even more intriguing. There has also been consistent profitability over the past decade, with a PE ratio of 11.31 and an impressive operating margin of 25.17%, signaling efficient management and strong profitability relative to its peers.

The stock has experienced a 3.24% momentum increase over the last six months, supporting a positive medium-term outlook. Despite some fluctuation, the stock's 1-Year Sharpe Ratio of -0.48 indicates moderate risk-adjusted returns, which are appealing given the current uncertain market conditions.

Technical indicators favor a jump in stock price:

MACD is currently above the signal line, suggesting a potential upward price movement in the near term. The 1-month price target trend shows a modest increase of 0.37%, with a significant analyst-set price target upside of 40.52% for the coming months, despite a slight negative trend in the 3-month price target. With a price positioned just above its 200-day SMA and recent technical signals favoring growth, COP is a smart pick and makes itself a 🟢BUY OPPORTUNITY🟢.

Let’s take a look at the other executive trades:

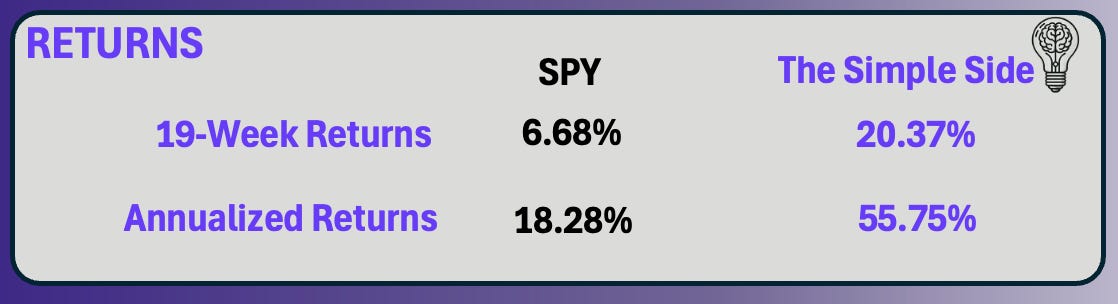

You can join the +100 others who have seen our returns go from 0 to this…

Next Week’s Trades

Key Opportunities and Insights

The TLDR Summary

Quick PSA: We treat the trades as buys on Monday’s Market open and sells on Friday’s Market close.

**IMPORTANT**

I have added recommendations to these stocks for “take profit percentages” labeled as “Expected Max Weekly Return.” These are returns I would be happy taking profit at and moving on. Let me know if you need more clarification on these buys!

Listen to this episode with a 7-day free trial

Subscribe to The Simple Side to listen to this post and get 7 days of free access to the full post archives.