No Investment Advice or Brokerage; Disclaimer. For the avoidance of doubt, The Simple Side does not provide investment, tax, or legal advice. The value of any asset class can go up or down and there can be a substantial risk that you lose money buying, selling, holding, or investing in any asset. You should carefully consider whether trading or holding assets is suitable for you in light of your financial condition.

If this is your first time here, welcome! If you’re one of the nearly 300,000 returning subscribers, welcome back — we are glad to have you all!

Before we get into today’s newsletter I want to hear from you… yes you! I want to know what could make this newsletter better for you!

Click that survey button below and let me know now!

So far, subscribers who have answered that survey have gotten me to add a gold tracker in this newsletter and a summary of my weekly stock analysis.

They have also gotten daily technical analyses here:

Today’s Newsletters Content

FREE CONTENT

Quick Updates

Weekly Trades Performance

YTD Returns are over 9%

Weekly Politician Trading Report

Weekly Insider Trading Report

Gold Report

Buffet’s Pick Of The Week

Portfolio Updates

COPY TRADING BETA TEST ANNOUNCEMENT (50% YTD)

PAID ACCESS ONLY — Thank you so much for all the support!

Stock Buy Summary

Mergers & Acquisitions Stocks

Top Stock Investment Ideas

Micro Cap Stock Picks

Over 20% returns YTD

Earnings & Options

Quick Updates

We are finally releasing our Beta Test of copy trading to a few lucky paying subscribers!! See our portoflio updates section for a bit more information! If you are a paying subscriber and want the chance to be one of the first able to copy trade with me this year, click the link or button below: https://thesimpleside.substack.com/survey/2353194

Subscriber raffles are back!! Last year, we gave away over $4,000 to subscribers here and we want to do it again this year!

We will be giving away items from our shop (click here) and $2,000 to a paying subscriber! There is nothing you have to do to enter but join our paid subscriber list!!

Reminder: paying subscribers have access this spreadsheet with all of our trades and their returns.

Here is what the dashboard looks like!

We will soon be shifting the newsletter over to a custom website for ease of use! You can already see politician and insider trades being tracked there.

If you want to setup a free account now, do so below. I will upgrade paying subscribers for free soon!

Weekly Trades Performance

This section of the newsletter tracks the past performance of this weekly newsletter. As you will see, on average we have outperformed the S&P 500 from Monday to Friday, market open to market close.

The graph shows the growth of a $10K investment which began on July 20, 2024. You can find every newsletter dating back to July 20th here by CLICKING HERE.

Here are the current performance metrics:

If you haven’t joined already, you can click this button below to join the paid newsletter and get these weekly picks sent to your inbox every Saturday!

Politician Trading Report

Politician trading matters… a lot. In 2024, the top-gaining politician was republican David Rouser who returned 104.1% — followed closely by democrat Pelosi who returned 70.9% over the year.

This report tracks the five most recent politician trades and two large holdings in my portfolio — ETFs NANC 0.00%↑ (which tracks democrat trading) and KRUZ 0.00%↑ (which tracks republican trading).

NANC was down 2.51% this week, 2.73% this past month, and up 1.01% YTD.

KRUZ is down 1.27% this week, 2.03% this past month, and up 1.88% YTD.

Both indexes are outperforming the SPY year to date, up only 0.83%.

Over the past 30 days, 19 politicians made 106 trades with a total trade volume of $7.44 million. The buy/sell ratio is now 2.3, which shows a bullish sentiment from politicians.

Here are the most recent politician trades:

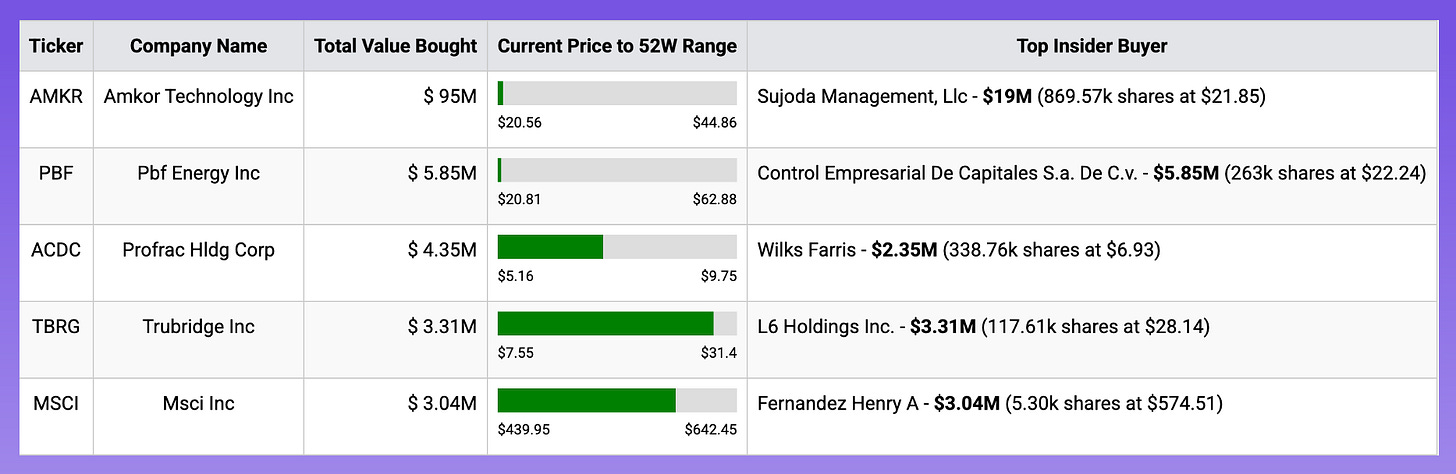

Insider Trading Report

This report tracks the five largest insider buys from the past week and a new ETF in my portfolio — ticker SURE — which tracks insider trading.

SURE is down 3.88% this week, 4.79% this month, and 0.92% YTD.

The monthly buy/sell ratio remains at 0.23 which is below the median of 0.34.

This indicates a slightly bearish sentiment from insiders.

Here are the largest trades from this past week:

Our premium subscribers get access to long-term, mid-term, and short-term strategies that all beat the market. You can too, join now!

The Gold Tracker

Technical

Gold has fallen below $2,840, hitting a fresh three-week low and snapping an eight-week winning streak. After starting the week near its all-time high of $2,956, it now shows a loss of nearly 3%. Despite the drop, longer-term momentum may still favor buyers if they can stem the current sell-off.

Key support emerges around $2,835 and extends down to the $2,800–$2,790 region, where dip-buying interest is likely to intensify. On the upside, the daily pivot at $2,888 marks the first obstacle, followed by heavier resistance at $2,900 and $2,909.

A more significant recovery would then target $2,941—though that looks less likely without a strong catalyst.

Fundamental

Uncertainty around President Trump’s trade policies has fueled a USD rally, pressuring Gold as investors pivot toward the US Dollar for safety. Markets had hoped for a reprieve in the implementation of tariffs, but the White House reconfirmed its plan to move forward with new levies against Mexico, Canada, and China on March 4.

This escalates risk-off sentiment yet paradoxically supports the Greenback at Gold’s expense. Meanwhile, China vows retaliation, raising fears of a deeper trade standoff between the world’s two largest economies. Month-end flows and a general run into cash-like instruments further weigh on Gold, despite historically robust fundamentals in the form of ongoing geopolitical tension and supportive ETF demand.

Scenarios & Strategy

Traders looking to bottom-fish may wait for Gold to stabilize closer to $2,800–$2,790 before stepping in, especially if renewed risk aversion or central-bank easing bets resurface.

Should the US Dollar continue strengthening amid tariff headlines, Gold might remain under pressure and slip further below current supports. Conversely, if cooler heads prevail on trade policy or if US data disappoints—particularly on the employment or inflation fronts—XAU/USD could bounce back toward $2,888 and even retest $2,900.

In either case, managing risk around key technical levels remains vital, as short-term volatility is likely to remain high.

The Buffett Buy Weekly Summary

CENTENE (CNC)

Centene is a large managed care organization specializing in Medicaid, Medicare Advantage, and ACA plans, serving over 25 million members across all 50 states. While it shows steady revenue growth and wide-reaching government contracts, its recent profitability trends and return on invested capital are less encouraging. Here’s how it fares on five key Buffett-style criteria:

Understandable Business Model: Fail – Healthcare’s heavy regulations and complex reimbursement structures make CNC’s model less straightforward.

Proven Earnings: Pass – Consistent revenue expansions and decent returns on equity indicate an ability to generate ongoing profits.

Economic Moat: Pass – Deep Medicaid involvement and large-scale government contracts provide moderate barriers to entry.

Low Debt Growth: Fail – Centene’s ROIC lags its cost of capital, suggesting its use of debt hasn’t yet translated into net value creation.

Fair or Undervalued: Neutral – While the stock trades at historically low multiples (P/E near 9.8 and P/B ~1.15), declining operating margins introduce caution.

Overall, Centene’s fundamentals and scale could offer attractive upside if management can improve margins and capitalize on membership growth. However, the regulatory complexity and debt usage keep this from being a straightforward Buffett-style buy.

Portfolio Updates: COPY TRADING BETA TEST

First I would like to say thank you to everyone for being patient with my release of copy trading. I have finally gotten the “go-ahead” to release a beta test to a few of my paid followers! If you would like to be one of the 5 beta testers for our copy trading system, please fill out this survey below.

It is going to ask you two quick questions: how much capital are you going to deploy on the platform, and the email your paying subscription is under! Once I select a few of you to join the platform, I will email you a link to join the platform and start copying!

As for the key portfolio updates this week, I am going to be adding a bond ETF to the Flagship Fund. This addition will be a minor portion of the portfolio — the weighting is yet to be determined. However, this move reflects a strategic shift based on the current investing landscape.

We have record high valuations on stocks and volatility that skews negative. I am watching companies hit crazy growth targets and the stock hardly moves, however, when the same comapny misses a massive growth target, the downside is astronomical.

Even NVDA had “on-par” earnings and ended the week down nearly 6% — what?

You will see an update on the portfolio soon!

Next Week’s Trades

The TLDR Summary

Listen to this episode with a 7-day free trial

Subscribe to The Simple Side to listen to this post and get 7 days of free access to the full post archives.