Welcome back to the 8th episode of The Weekly Quintet from ;

Another week, another insider trading on information you don’t have.

But that’s why The Simple Side brings you weekly updates on their trades.

Our reports on politician, insider, and executive trading show up every Saturday, so you can ponder which moves to make on Sunday and trade on Monday! Now you can be a fly on the wall when Nacy Pelosi, Warren Buffett, or any other insider makes a valuable move in the market.

And in case you didn’t know, you can get access to even more with my premium subscription. This includes access to our $1000 paid subscriber raffle (you can read more about that HERE)!

Market Heat Maps — Follow the green!

Fear & Greed Index — When should you buy?

Rate Tracking — Inflation & interest rates + more!

Upcoming Market News

Daily Market Winners

Mid-Week Congressional Trading

Meme Stocks — Try to capitalize on short-term trends!

Crypto Coins — The largest daily crypto winners!

If you want all that and more, join now and take 20% off our premium plan!

We are currently planning on doing the raffle when Substack rolls out the live video feature. If this isn’t done by August I will pick a random time in August to do it!

Politician Trading Report & Politician ETFs

This report tracks the five most recent politician trades — two large holdings in my portfolio — ETFs NANC 0.00%↑ (which tracks democrat trading) and KRUZ 0.00%↑ (which tracks republican trading).

NANC is down 3.25% on the week, down 1.99% over the past month, and up 18.82% YTD.

KRUZ is down 1.42% on the week, up 1.13% over the past month, and up 10.45% YTD.

What’s fueled those returns? Well, over the past 30 days, 16 politicians have made 250 trades moving over $11.83 million.

Here are the five most recent trades:

Insider Trading Report

This report tracks the five largest insider buys from the past week.

The most interesting buyer this week was Braden Leonard who bought over $1.5 million worth of Adverum Biotech (ticker: ADVM 0.00%↑). The stock is currently trading at the lowest of its 52-week range.

Here are the other four largest trades:

Executive Trading Report

This report tracks the five most recent stock trades from company executives.

Total executive ownership in our reported companies grew 24%. Charles Schwab SCHW 0.00%↑ had the most notable increase in ownership as both the president and CEO made trades. Their ownership increases totaled 10%.

This couldn’t have been a better time for them to buy as the stock is currently down 18% over the past week and down 8% YTD. This trade has put the stock on my watchlist. Note that Schwab recently acquired TD Ameritrade.

Let’s take a look at the other four executive trades:

📈 Top 3 Weekly Stock Highs & Lows 📉

Top Three Weekly Gainers

========================================

Name: Serve Robotics Inc.

1 Week Change: 229.69%

Stock Price: 7.55

----------------------------------------

Name: Personalis, Inc.

1 Week Change: 131.93%

Stock Price: 3.85

----------------------------------------

Name: Autonomix Medical, Inc.

1 Week Change: 128.16%

Stock Price: 1.41

----------------------------------------

Top Three Weekly Losers

========================================

Name: Agenus Inc.

1 Week Change: -61.60%

Stock Price: 5.99

----------------------------------------

Name: Crown LNG Holdings Limited

1 Week Change: -58.89%

Stock Price: 1.41

----------------------------------------

Name: ConnectM Technology Solutions Inc

1 Week Change: -49.44%

Stock Price: 1.79

----------------------------------------

Read Today, Plan Sunday, Trade Monday

Let’s get into some of the most intriguing market-moving activities: mergers and acquisitions, alternative investments, significant news, top investment ideas, and earnings price volatility.

Typically websites or newsletters charge HUNDREDS monthly for this information. Well, I subscribe to them all, sift through all the BS and filler, and simplify it for all you paying folk.

🤝Mergers & Acquisitions🤝

(July 19) BUY OPPORTUNITY Ares (ARES 0.00%↑) Leads $1.8 Billion Private Financing for AffiniPay Deal

I have owned Ares stock for a few years, and it has done well. It is up over 423% in the past five years and isn’t showing signs of slowing. The AffiniPay purchase is interesting because of its massive market share with law firms (over 52,000 firms).

Other Interesting News

🌟Top Investment Ideas🌟

What you’re looking at here is a bubble graph. There are four metrics shown below are the stocks are the best ones out there.

The x-axis and bubble color is the year-over-year revenue increase.

The y-axis is 3-year revenue growth.

The bubble size represents 1-year performance.

Something that can be extremely lucrative in equity markets is finding what retail investors will find, but finding it first. I know, I know it sounds completely revolutionary (sarcasm). Finding stocks that might not be in the news yet, but could be in the future because of their astounding growth means you could capitalize on the same “investor-spasm" that launched Nvidia to its height.

The Outlier Stocks

NVDA 0.00%↑

SQM 0.00%↑

KKR 0.00%↑

APO 0.00%↑

LVS 0.00%↑

BX 0.00%↑

CLR 0.00%↑

💡Alternative Investments💡

In the world of alternative investments, we are paying attention to some big things:

(LINK): Will Boeing ever get back into good graces?

Boeing seems to think the commercial plane market will double over the next 20 years to over 50,000 aircrafts. Currently, there are over 27,000 commercial planes in operation, and of that number over 2/3 will be inoperable in 20 years. Profits for Boeing or will they continue to freefall?

(LINK): Wondering how valuable copper is?

Well, look no further than the firm trying to buy back their old copper mines for over $246 Million. Copper is currently up over 15% year to date and 60% since five years ago. Given inflation, interest rates, and the dying dollar, commodities could continue their massive run-up in value.

Other Significant Articles

📰Significant News (AI Ranked)📰

On Friday, ChatGPT read 743 news stories and gave 1 of them a significance score of over 6 (typically, anything over 3 is considered extremely abnormal).

Summary (LINK): Global Microsoft outage disrupts flights, banks, and media worldwide. MSFT 0.00%↑ CRWD 0.00%↑

A global Microsoft outage disrupted flights, banks, and media outlets worldwide. DownDetector recorded outages at Visa, ADT, Amazon, and airlines like American Airlines and Delta. New Zealand, UK, Europe, India, and Australia faced disruptions. Airlines like United, American, and Ryanair were grounded. Hospitals, banks, and media in various countries were affected. The outage caused delays, manual operations, and system failures at airports globally.

📊Implied Options Price Movements📊

In other news, we have found some interesting earning reports you should be on the lookout for due to some higher-than-normal predicted price movements.

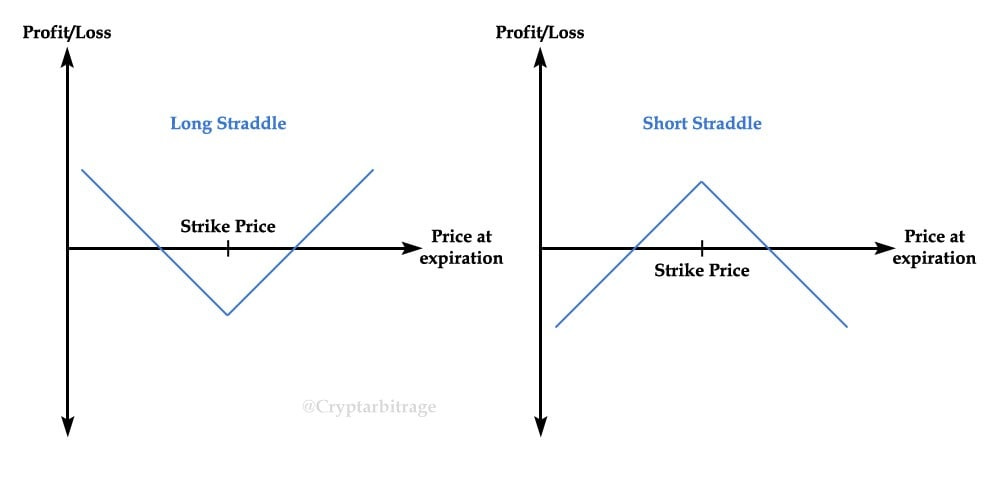

We are looking at trading straddle options on these stocks

Monday

Check out SMBC 0.00%↑ where the implied price movement is 10%.

Tuesday

Watch TSLA 0.00%↑ where the implied price movement is 8%.

Wednesday

Lookout for FLEX 0.00%↑ where the implied price movement is 31%.

Thursday

We have SNY 0.00%↑with implied movement over 6%.

Friday

We expect BMY 0.00%↑ to move by 5%.

“Markets are super strange right now, lots of capital on the sidelines”

- ¢, Founder of The Simple Side

Share this post