Afternoon, this is The Weekly Quintet from ;

I have something I need to get off my chest… I am sick and tired of watching insiders and politicians outperform the market leaving retail investors in the dust.

That’s why The Simple Side is here — we get you information on those insiders!

The Simple Side’s weekly report on politician, insider, and officer trading is getting delivered to your inbox every week! Now you can be a fly on the wall when Nacy Pelosi, Warren Buffett, or any other insider makes a valuable move in the market.

And in case you didn’t know, you can get access to even more with my premium subscription — we will soon be giving away $1000 of stock to one of our lucky readers (post coming Wednesday). Get weekly access to the same information I use to trade with!

(p.s — we will be rolling out a mid-week letter to premium subscribers, monthly giveaways, and the ability to invest in my portfolio)

Politician Trading Report & Politician ETFs

This report tracks the five most recent politician trades — two large holdings in my portfolio — ETFs NANC 0.00%↑ (which tracks democrat trading) and KRUZ 0.00%↑ (which tracks republican trading).

NANC is up 0.29% on the week, 3.77% over the past month, and 23.71% YTD.

KRUZ is up 1.66% on the week, 3.44% over the past month, and 11.58% YTD.

What’s fueled those returns? Well, over the past 30 days, 15 politicians have made 310 trades with a total volume of $13.43 million dollars.

Here are the five most recent trades:

Insider Trading Report

This report tracks the five largest insider buys from the past week.

The most interesting buyer this week was William C. Martin who bought nearly a million dollars worth of Barnes & Noble (ticker: BNED 0.00%↑). The stock is currently trading at the lowest of its 52-week range.

Here are the other four largest trades:

Executive Trading Report

This report tracks the five most recent stock trades from company executives.

Total executive ownership in companies grew 799% between 4 companies. The most notable trade was made by Kenneth Seipel who increased his ownership share in Citi Trends (ticker: CTRN 0.00%↑) by 766%. His trade price was $19.03.

After seeing such a drastic ownership change I looked at the stock and my consensus is that it’s undervalued but I have no long-term play on the stock. It could be a profitable short-term hold (3 months - 1 year time horizon).

Let’s take a look at the other four executive trades:

📈 Top 3 Weekly Stock Highs & Lows 📉

Top Three Weekly Gainers

========================================

Name: Inspire Veterinary Partners, Inc.

1 Week Change: 609.40%

Stock Price: 10.57

----------------------------------------

Name: Zapp Electric Vehicles Group Limited

1 Week Change: 182.56%

Stock Price: 11.50

----------------------------------------

Name: NaaS Technology Inc.

1 Week Change: 176.97%

Stock Price: 4.21

----------------------------------------

Top Three Weekly Losers

========================================

Name: HilleVax, Inc.

1 Week Change: -87.55%

Stock Price: 1.75

----------------------------------------

Name: Monterey Capital Acquisition Corporation

1 Week Change: -68.42%

Stock Price: 3.54

----------------------------------------

Name: MicroAlgo Inc.

1 Week Change: -59.19%

Stock Price: 3.44

----------------------------------------

Investor News Watch

Let’s get into some of the most intriguing market-moving activity: mergers and acquisitions, interest rates and the FED, IPO calendars, alternative investments, and earnings price volatility.

These incredible investor insights are limited to paid subscribers this week. Typically websites charge HUNDREDS a month to get this information and require 10 different subscriptions. Suddently you’re getting hundreds of emails a week, and end up never reading a thing.

Do the simple thing and get all your information here. Check out today’s article right here FOR FREE:

Wondering if it’s worth it? Our portfolio is on track for 50% annual returns!

🤝Mergers & Acquisitions🤝

We all know that the current world of M&A has been weak as the government blocks all possible deals like Shaq in the damn paint; in fact, they have broken a record for the most M&A deals blocked. However, the tides have slowly begun to turn — maybe Biden is looking to collect checks and votes from CEO’s. We recently saw Paramount merge with Skydance. The deal isn’t considered life-changing and there is little to capitalize on in the short term. PARA 0.00%↑ up 10% this month but is down over 20% YTD. We anticipate M&A activity to pick up with a governmental shift.

(July 12) BUY OPPORTUNITY ConocoPhillips (COP 0.00%↑) to acquire Marathon Oil (MRO 0.00%↑) in a $22.5 billion deal.

I have owned Conoco stock in the past as it was the only gas station in the small town I grew up in. That being said I am very interested in sending some more capital their way. Conoco has 6,098 locations in 44 states (largely California, Colorado, and Missouri). Their acquisition of Marathon would be huge as they would acquire over 7,200 more locations across the nation with a heavy eastern focus (Florida, Georgia, Alabama).

(July 12) BUY OPPORTUNITY Bain Capital (BCSF 0.00%↑) to buy financial software company Envestnet in a deal worth over $4.5 billion.

Whether you are interested in the Bain purchase or not, the company is performing incredible this year. They are up over 11% YTD and pay a dividend of 10.13%. You read that right. Their annualized yield would be over 30% if they continue on this current path. Oh, and if you are interested in the merger here are some stats that Envestnet has: $6 trillion in assets, 20 million accounts, >100,000 wealth advisors, and 800 asset managers.

Other M&A to watch:

🏛️The FED (Inflation & Interest Rates)🏛️

Inflation- came down slightly in June but I want to issue a caution to everyone parting up on the “inflation is gone” train — you’re about to derail. Dropping to 3% is a step in the right direction but is nowhere near where we need to be at least when you consider the MASSIVE inflation we have experienced over the past 3 years.

Consumers won’t feel like things have turned around for months or years (depending on how the Fed decides to operate). Rate cuts in September are expected, but not overly likely. I would bet that they will maintain the current rates for as long as possible, but if the pressure is on, we might see a small shift.

📅IPO Calendar📅

I want to quickly highlight an IPO that will perform well on its release date: ARDT. Ardent Health is valued at over $3 billion and will run HOT on July 18th. The company disclosed a 5% rise in annual revenue when filing for IPO which means investors will be RUNNING to invest — a bunch of Usain Bolts all of a sudden. Healthcare is the biggest and fastest-growing sector in the US and if you think investors aren’t looking to capitalize on IPOs like this then you’re wrong. JP Morgan, BofA, and Morgan Stanley are underwriting the deal.

Some other future IPOs to look for are ‘bacon producer’ Smithfield and ‘hydrogen energy company’ Huture. Both deals are expected to be valued at over $1 billion.

💡Alternative Investments💡

In the world of alternative investments, we are paying attention to some big things:

(LINK): Corn is being shorted by more hedge funds than ever before. This is the part of the story where I tell you that when others are fearful you should be greedy and when others are greedy you should be fearful. I wouldn't join in the “corn shorting,” but if corn prices do drop I would be the first to buy in. Corn is becoming increasingly valuable and will continue upwards. CORN 0.00%↑

(LINK): Airbus is starting its cost-saving strategy at the… well what kind of time is it in the flying markets? On one hand, you have Boeing who seems to have a plane fall apart mid-air every other week; but on the other wouldn’t you want your plane builder not to skimp out when your competitor had done just that? $EADSY

Other Significant Articles

📰Significant News (AI Ranked)📰

Today ChatGPT read 927 top news stories and gave 2 of them a significance score of over 6 (typically, anything over 3 is considered extremely abnormal).

Summary (LINK): AT&T data breach exposes 'nearly all' wireless customers. T 0.00%↑

AT&T experienced a significant cyber security breach, with hackers accessing call and text data of "nearly all" wireless subscribers. Over 11 days in April, records from several months in 2022 and January 2, 2023 were compromised. The breach affected over 100 million wireless subscribers. AT&T is cooperating with law enforcement and has implemented additional security measures. The incident did not materially impact operations or finances.

Summary (LINK): AIIMS develops early Alzheimer's detection blood test.

AIIMS researchers developed a blood test to detect Alzheimer's early, identifying biomarkers 10-15 years before symptoms appear. Currently, 55 million people over 60 worldwide suffer cognitive impairments, with 60-70% developing dementia. The test could revolutionize Alzheimer's management, offering hope for better symptom management and dignity for patients. Early detection is crucial as the disease progresses over 15-20 years.

📊Implied Options Price Movements📊

In other news, we have found some interesting earning reports you should be on the lookout for due to some higher-than-normal predicted price movements.

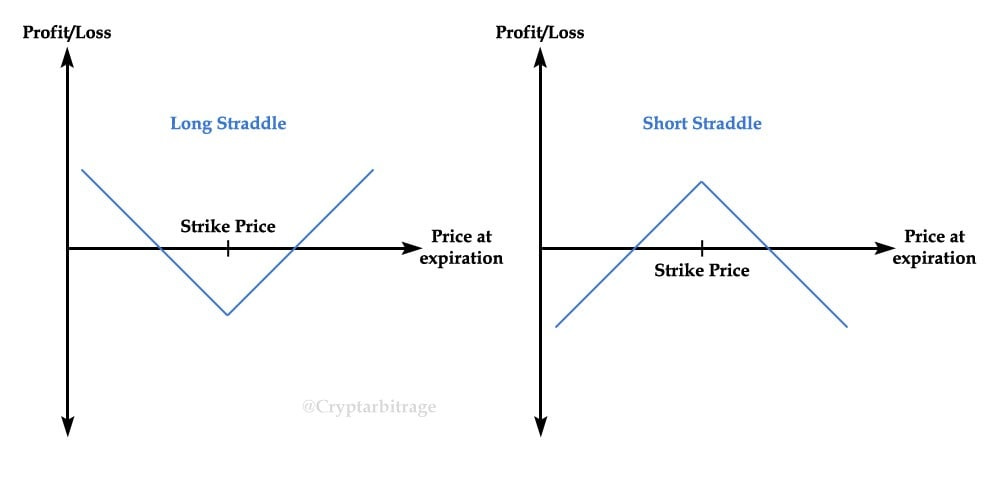

We are looking at trading straddle options on these stocks

Monday

Check out GNTY 0.00%↑ where the implied price movement is 22%.

Tuesday

Watch UNH 0.00%↑ where the implied price movement is 5%.

Wednesday

Lookout for EFX 0.00%↑ where the implied price movement is 9%.

Thursday

We have HUGE 0.00%↑ implied movement is over 1,000%.

This is super risky and probably won’t have profitable returns.

Friday

We expect ABIO 0.00%↑ to move by 61%.

“Markets are super strange right now, lots of capital on the sidelines”

- ¢, Founder of The Simple Side

Share this post