Shareholders,

Welcome back to another weekly edition of The Saturday Sendout from !

Like always you can use the button below to tell me what you’d like to see more of — I cannot see who writes these, but I do read them and try to implement them in my writing!

Upcoming Newsletters

New Contrarian Bet Coming

The Upcoming Paid Subscriber Giveaway

A Market Beating Model Portfolio

Of course, if you’ve been a paying subscriber from the beginning, you have followed all these trades and seen their value.

What’s Below…

And much more!

The Weekly Recap

This section tracks 🟢Buy Opportunities🟢 I saw in last week’s newsletter. These opportunities are recorded in all of the sections below this one for the upcoming week!

We treat each opportunity as a “one-week-only” investment and track them as such. That being said, many of the stocks we discuss are EXCEPTIONAL long-term buys! You do not have to copy this weekly newsletter 1:1 to make money in the market and doing so should be done at your own risk!

Here is how we have performed historically:

Up above you’ll notice we lost to the SPY this week… it’s like a curse, I just can’t seem to go on a winning streak here!

This week we lost to the market by -1.41%

Over 12 Weeks we have beat the market by 10.11%

Annualized we are expected to beat the market by 43.82%

The graph shows the growth of a $10K investment which began on July 20, 2024.

We are currently averaging a 12.16% return over 12 weeks! That translates to 52.71% a year.

Just over 1% a week! Not too shabby!

Again, I want to reiterate how proud I am to be the most transparent weekly newsletter you can find on this topic.

If you are finding all of this valuable you can support me and my work by clicking that fancy button below!

Politician Trading Report & Politician ETFs

This report tracks the five most recent politician trades and two large holdings in my portfolio — ETFs NANC 0.00%↑ (which tracks democrat trading) and KRUZ 0.00%↑ (which tracks republican trading).

NANC is up 2.77% this week, 5.97% over the past month, and up 25.68% YTD.

KRUZ is up 1.51% this week, 6.09% over the past month, and up 16.32% YTD.

What’s fueled those sweet returns? Well, over the past 30 days, 10 politicians have made 140 trades moving over $2.64 million.

The most interesting part?

Republican Marjorie Taylor Green was buying up everything in sight (again) and she also had the five most recent trades.

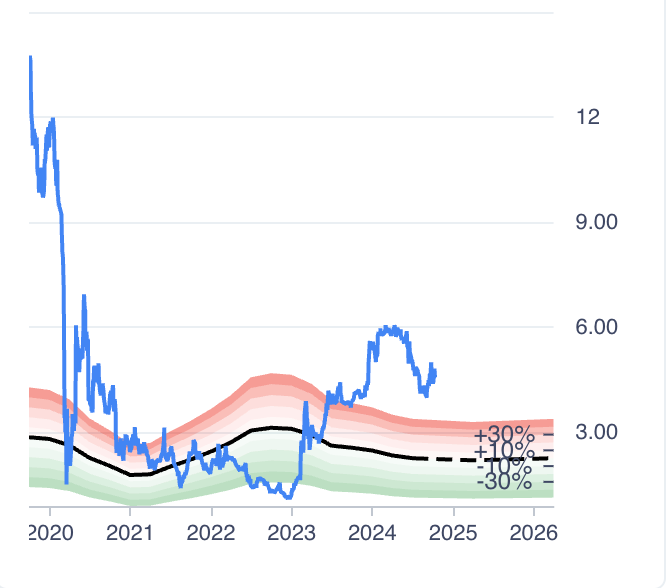

While those trades aren’t too interesting, there was something I saw. Mark Green sold a massive stake ($500K - $1M) in NGL Energy Partners (NGL). This is so out of the ordinary that I have to call this a 🔴SELL OPPORTUNITY🔴

The stock is significantly overvalued according to my models (by as much as 50%) and has no redeeming qualities.

Here are the other most recent politician trades:

Insider Trading Report

This report tracks the five largest insider buys from the past week and a new ETF in my portfolio — ticker SURE — which tracks insider trading.

SURE is up 1.29% this week, 6.41% this month, and 15.42% YTD.

The most interesting insider buyer this week was Opaleye Management. They bought Eton Pharma (ticker: ETON) at its 52-week high... I’ll be honest, I have no idea what the strategy is here. While there have been other buyers in the market, I don’t see the relevance. I have no rating on the stock, but I believe it to be significantly overvalued.

Here are the other four largest trades:

Still wondering if premium is worth it? Hundreds of people say that it is — you can join them here:

Executive Trading Report

This report tracks the five most recent stock trades from company executives.

Total executive ownership in our reported companies grew by over 400%. This increase was driven by Laurilee Kearnes. She is the CFO of Byrna Tech — a company making less lethal self-defense weapons. Her ownership increase was, well… 400%

The company is down 20% after a poor earnings call and while I don’t think the drop is justified, I am not 100% certain of its recovery next week. I still see a lot of upside in the stock and analysts do too. The stock’s expected returns over the next year are 50%; however, due to the volatility of the stock, I can only put it on my 🟡WATCH LIST🟡 for next week.

Let’s take a look at the other four executive trades:

📈 Weekly Highs & Lows 📉

📈Top Two Gainers📈

========================================

Name: Top Wealth Group Holding Limited

1 Week Change: 332.73%

Stock Price: 7.14

----------------------------------------

Name: Scholar Rock Holding Corporation

1 Week Change: 257.28%

Stock Price: 26.51

----------------------------------------

📉Bottom Two Losers📉

========================================

Name: CPI Aerostructures, Inc.

1 Week Change: -58.85%

Stock Price: 1.40

----------------------------------------

Name: Fangdd Network Group Ltd.

1 Week Change: -49.41%

Stock Price: 1.28

----------------------------------------

Weekend Reads For Weekday Trades

Let’s get into some of the most intriguing market-moving activities: mergers and acquisitions, top investment ideas for the upcoming week, upcoming contrarian bets, and earnings price volatility.

Did I mention all of the buy, watch, and sell opportunities?

Typically, information like this costs hundreds a month, but you can get it all here (plus more) for $20 a month. Did I happen to mention that our last two contrarian bets averaged 60% and 100% returns? Subscription starts to pay for itself real quick with numbers like that!

Listen to this episode with a 7-day free trial

Subscribe to The Simple Side to listen to this post and get 7 days of free access to the full post archives.