Stocks are down and investors are weary

But bonds are up

So Simple Side investors are cheery

Hey Shareholder, welcome back to the The Saturday Sendout from The Simple Side! And yes I am going to try to get more “s”-es into the intro.

We are going to jump into the newsletter quickly today, but I wanted to first mention some exciting upcoming posts that will be going out to paying subscribers soon.

Releasing The Simple Side Stock Portfolio(s)

The ‘How To Trade My Newsletters’ Article

My Investing Strategies Updates

Profit Sharing w/ Founding Members

Due to the massive outperformance of our portfolio, we have decided to increase prices to $200 annually. This weekend will be the last available time to get grandfathered in at the current rate of $125 a year.

‘The Weekly Recovery’

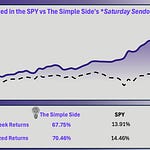

We again outperformed the S&P 500 this week, recovering from the poor performance last week.

- This week we beat the S&P 500 by 2.53% which translates to a 131.56% annualized outperformance.

- Over the past seven weeks, we have averaged an outperformance of 1.02%.

Average S&P 500 Outperformance:

The Weekly, 7 Week, and Annualized numbers in this section show how much the picks in the Saturday Sendout have outperformed the S&P 500.

This Week’s Outperformance:

This section highlights the comparison between my picks and the S&P from the past week.

Historical Returns

This section shows the performance of the past two months of weekly returns.

Stocks From Last Saturday:

These are the 🟢Buy Opportunities🟢 that you can get access too by becoming a shareholder of "The Simple Side."

Politician Trading Report & Politician ETFs

This report tracks the five most recent politician trades and two large holdings in my portfolio — ETFs NANC 0.00%↑ (which tracks democrat trading) and KRUZ 0.00%↑ (which tracks republican trading).

NANC is down 6.03% this week, up 1.44% over the past month, and 14.83% YTD.

KRUZ is down 2.16% this week, up 1.80% over the past month, and 9.17% YTD.

What’s fueled those returns? Well, over the past 30 days, 11 politicians have made 38 trades moving over $520K. It’s been a slow month for politician trading. It’s almost like they knew things were about to drop so they held off on their buys.

Let’s take a look at some of the largest buys/sells from this past month:

Politician Performance

Marjorie Taylor Greene’s portfolio performance since May 2024 has been around 4%. This is neither impressive nor underwhelming and I don’t think it deems any of her trades to be worthwhile of replicating. That being said I have been vocal about my long position in “screen” or “glass” companies like GLW. I sold positions in OLED and GLW earlier in the year, but have been keen on picking these stocks back up as their valuations have come down in recent months/weeks.

Insider Trading Report

This report tracks the five largest insider buys from the past month and a new ETF in my portfolio — ticker SURE — which tracks insider trading.

SURE is down 1.96% this week, up 3.56% this month, and 7.89% YTD.

Here are the top largest trades:

The most sold stock by insiders over the past 60 days is TEAM — down 32% YTD — with over 86 sales with 0 buys. The most bought stock has been TPL — up 50% YTD — and has 40 buys with 0 sells!

I also want to point out the buy of Pbf Energy and Talos Energy. The buyer is the family office of Latin America’s richest man, Carlos Slim. Given the weeks of buying, the tens of millions of dollars, and the consistent buying that has occurred I will be adding SMALL long positions in both stocks.

🟢BUY OPPORTUNITY (PBF & TALO)🟢 This graphic shows how both stocks are fairly valued in the market. The insider buying from Slim’s family office cements the fact that both companies likely have a good thing coming soon. I am looking to enter into trades on the market open Monday investing about 50% of the total value I am looking to buy with. I would like to see what happens with the rate cut on the 18th before making any further investing decisions.

Want to see more 🟢Buy Opportunities🟢 that I spy in the market?

Become a Simple Side shareholder!

Executive Trading Report

This monthly report tracks the five most recent company executive stock trades.

This week we have a total ownership change of -12 % which is NOT typical. The most recent buy came from Michael Taglich who bought INLX which is now up over 92% YTD. I find the company to be grossly overvalued and do not see it as a buy opportunity.

🔴SHORT OPPORTUNITY🔴 Multiple ARES executives reduced their positions in the company by 13% in total. I see the selloff as justified and wouldn’t buy into the company until the stock price comes down to $70 a share.

Let’s take a look at this month’s executive trades:

I removed the top and bottom weekly stocks for this week. I want to get your opinion on what you would like to see take its place! Help me out by filling out this form:

The TLDR Summary

Listen to this episode with a 7-day free trial

Subscribe to The Simple Side to listen to this post and get 7 days of free access to the full post archives.