No Investment Advice or Brokerage; Disclaimer. For the avoidance of doubt, The Simple Side does not provide investment, tax, or legal advice. The value of any asset class can go up or down and there can be a substantial risk that you lose money buying, selling, holding, or investing in any asset. You should carefully consider whether trading or holding assets is suitable for you in light of your financial condition.

Welcome to The Simple Side — one of the only financial newsletters that keeps track of everything they discuss.

Good morning, Shareholder — here are today’s quick updates!

The Simple Side website is in the process of being updated. The final version may be a few months out, but it is incoming!

We are in the final sprint of copy trading being released!

This will allow subscribers to copy my exact portfolios (the same ones that have returned over +280% since 2020.

Check out our letter to investors for news about the 2025 investing year

Reminder: paying subscribers have access this spreadsheet with the 2025, out weekly portfolio, and a new dashboard with returns!

When you request access, please tell me the email address that holds the paying subscription with The Simple Side so I can add you faster!

LOOK AT OUR TOP PERFORMERS BELOW!

Past Performance of Weekly Trades

This section of the newsletter tracks the past performance of this weekly newsletter. As you will see, on average we have outperformed the S&P 500 from Monday to Friday, market open to market close.

The graph shows the growth of a $10K investment which began on July 20, 2024. You can find every newsletter dating back to July 20th here by CLICKING HERE.

Here is a summary of the past few weeks of performance and a comparison of returns that this newsletter has had relative to the SPY.

If you haven’t joined already, you can click this button below to join the paid newsletter and get these weekly picks sent to your inbox every Saturday!

Today’s Reporting Overview

Politician Trading Report

Politician Stock Highlight

Insider Trading Report

Insider Stock Highlight

Portfolio Updates

Premium Content (paid subscribers only) — Thank you all so much for the support!

Weekly Buy Opportunities

Includes take profit %’s

Mergers and Acquisitions

Top Investment Ideas

Micro-Cap Picks

Expected Stock Movements From Options Trading

Politician Trading Report

Politician trading matters… a lot. In 2024, the top-gaining politician was David Rouser who returned 104.1% — followed closely by Pelosi who returned 70.9% over the year.

This report tracks the five most recent politician trades and two large holdings in my portfolio — ETFs NANC 0.00%↑ (which tracks democrat trading) and KRUZ 0.00%↑ (which tracks republican trading).

Over the past 30 days, 13 active politicians made 92 trades with a total trade volume of $25.96 million.

NANC was up 3.93% this week, down 1.55% this past month, and up 1.68% YTD.

KRUZ is up 5.16% this week, 0.49% this past month, and 4.05% YTD.

Politician Stock Highlight

Let’s talk about the stock I see as the most undervalued on today’s list, and that stock is Airbnb (ABNB). Airbnb is a well-known company in the hospitality sector. Currently, my model — based on profitability, growth, intrinsic value, momentum, and financial strength — says that ABNB is undervalued by 20%, and it ranks the company as an 8.5/10.

These numbers are impressive, but ABNB has two issues that may scare investors away. The source of these issues? Risk-adjusted returns. Risk-adjusted returns are a fancy way of calculating how much a stock is likely to grow based on its volatility.

The stock market has a few metrics we can use to track risk-adjusted returns: the Sortino and Sharpe ratios.

A Sortino ratio tells you how much “extra” return you will receive for downside risk.

A Sharpe ratio tells you how much “extra” return you will receive for total risk.

In ABNB’s case, things don’t look good for either. It has a Sortino ratio of -0.20 and a Sharpe ratio of -0.15. This means that you are taking on negative “extra” returns and are experiencing more risk!

Airbnb looks much too risky right now — safe investors should treat it like that weird van you always see at the park and stay far away…

Here are the most recent politician trades:

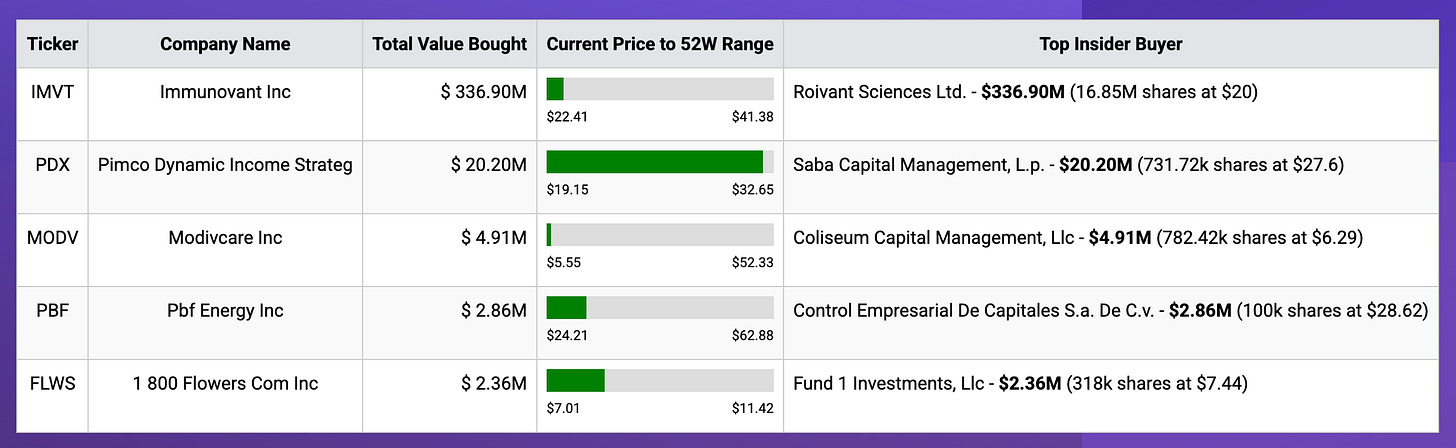

Insider Trading Report

This report tracks the five largest insider buys from the past week and a new ETF in my portfolio — ticker SURE — which tracks insider trading.

The monthly buy/sell ratio is currently 0.29 which is below the average of 0.40. This indicates a slight sell in the markets.

SURE is up 2.68% this week, 0.35% this month, and 3.88% YTD.

Insider Stock Highlight

Roivant Sciences Ltd. topped the charts with the largest buy this week — a 300 million dollar purchase of Immunovant (IMVT). The stock is up 4.60% over this past week but is down over 5% YTD.

Now, this is an extremely interesting buy. For one, the company is sitting at a 52-week low. However, the company is up over 600% from its 3-year low of $3.38.

My model ranks the stock at a 3.4/10 with the company lacking in every department except its financial strength.

The large buy could indicate insider knowledge of improving metrics within the company and analysts seem to agree. The average analyst prediction puts the price of IMVT at over $50 by year’s end — a 111% upside.

Using the same metrics we looked at with ABNB earlier, however, we see a bit of a different picture. The company is staring down the barrel of a -1.83 Sortino and a -1.84 Sharpe ratio.

This is a risk not worth playing with.

Here are the largest trades from this past week:

Our premium subscribers get access to long-term, mid-term, and short-term strategies that all beat the market. You can too, join now!

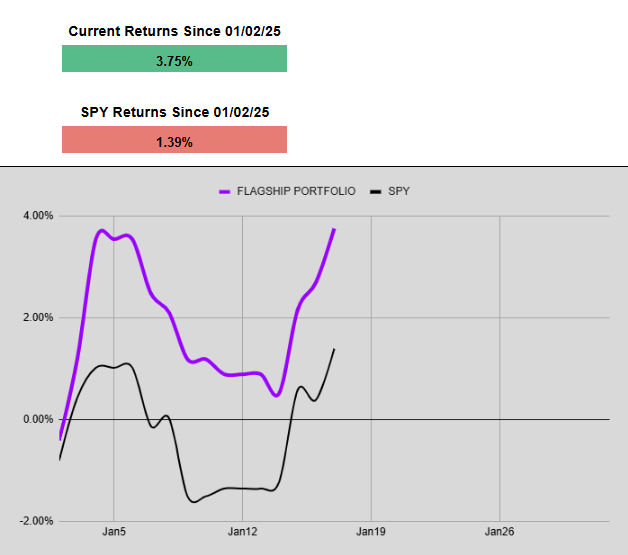

Flagship Fund Update

We have a stock being put on the watchlist for sale this week in the portfolio. See the Key Change below.

Currently, our flagship fund is handily outperforming the SPY. Our current returns sit at +3.75% YTD while the SPY sits at +1.39%.

We are only a few weeks into the trading year so things are likely to change, but I am happy with the current portfolio positioning. Paying subscribers can see all of the portfolio updates by heading to our Google sheet!

Last week I talked about my top pick for 2025: KLAC Corp (KLAC). The company specializes in optimizing the production of semiconductor chips. Last week when I mentioned the stock, it was up a cool 7.62% YTD. Now, just 7 days later the company has surpassed double-digit returns (nearly twice over).

KLAC is up 19.34% YTD.

Key Portfolio Change

The stock I am putting on the chopping block (or the buy more block) operates as one of the leading fixed-income trading platforms, connecting investors to broker/dealers. Basically, they work in the bonds industry — a $140 trillion industry.

The stock is…

Listen to this episode with a 7-day free trial

Subscribe to The Simple Side to listen to this post and get 7 days of free access to the full post archives.