Happy Saturday and a happy late Halloween from The Simple Side.

I want to quickly say that you should listen to today’s podcast as I spoke about things quite a bit more today!

We are now almost 300,000 readers strong and I want to make sure I am writing about what you want to read so, feel free to send me an email at thesimplesidenews@gmail.com. You can also click the button below and let me know anonymously about anything!

Updates and Recent Newsletters

If you have been subscribed here for a while then you know that I was out on vacation last week without internet access. I am back in action now and have lots of catching up, and updating to do!

The first order of business is to check out this $2,000 giveaway happening in December. This is our second giveaway and is double the size of our first giveaway! This also helps me with lowering my tax bill which is huge!

Past Performance

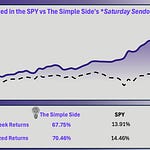

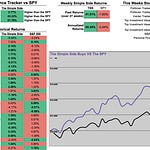

This section of the newsletter tracks the past performance of this weekly newsletter. As you will see, we have (on average) outperformed the S&P 500 from Monday to Friday, market open to market close. Take a look:

Of course, you’ll notice we had no stock picks this week due to my no-internet-middle-of-nowhere vacation.

The graph shows the growth of a $10K investment which began on July 20, 2024.

If you are finding all of this valuable you can support me and my work by clicking that fancy button below!

Today’s Reporting Information

Quick Overview

Politician Trading Report

Insider Trading Report

Executive Trading Report

Investing for Next Week (For Paying Subscribers)

Mergers and Acquisitions

Top Investment Ideas

Contrarian Bets

Flagship Portfolio Updates *NEW* PODCAST ONLY

Expected Stock Movements From Options Trading

Politician Trading Report & Politician ETFs

This report tracks the five most recent politician trades and two large holdings in my portfolio — ETFs NANC 0.00%↑ (which tracks democrat trading) and KRUZ 0.00%↑ (which tracks republican trading).

NANC is down 0.21% this week, up 2.33% this past month, and up 24.57% YTD.

KRUZ is down 0.41% this week, up 0.86% this past month, and up 14.82% YTD.

What’s fueled those sweet returns? Well, over the past 30 days, 6 politicians have made 24 trades moving over $375 thousand.

Now, this is extremely unusual. I don’t think we have ever seen less than 10 politicians trading in a month and I also don’t think we have seen less than $1 million traded in a month. Why could that be? It’s the election. Everyone has their attention elsewhere.

That being said, nothing was too standout this week other than Majorie Green making tons of stock buys. Now, we have analyzed her in the past and her portfolio doesn’t perform spectacularly well so we don’t recommend following her trades.

Here are the most recent politician trades:

Insider Trading Report

This report tracks the five largest insider buys from the past week and a new ETF in my portfolio — ticker SURE — which tracks insider trading.

SURE is down 0.84% this week, 1.16% this month, and 11.84% YTD.

The most interesting insider buyer this week is the oracle himself: Warren Buffett. He bought $60 million worth of shares 2.23M shares to be exact at a price of 27.25. The stock is currently trading at $27.65.

While I think many people would be inclined to follow Buffett, I just can’t find a reason to want to own Sirius XM (SIRI) shares. The stock recently completed a reverse stock split bringing the price from under $5 a share to over $20. Typically reverse stock splits are seen as a bad omen by investors. When a stock reverse splits, the share price is usually below $1 and the stock is in trouble of being delisted. Sirius XM, however, wasn’t in this position. So why split? Well, SIRI is looking for Institutional money. Institutional investors tend to stay far away from stocks under and around the $5 range.

I think long-term there is likely some value to capture here. If you want a 5-10+ year hold then buy the hell out of SIRI, but you’re likely in for quite a long journey of poor performance.

My ranking of SIRI stock is 7.6/10. There is poor momentum and financial strength after the purchase/merger with Liberty Media. A moderate outlook on growth and value, however, the comapny is extremely profitable (most likely the reason for Buffett’s purchase). I think SIRI is a 🟡Watch List🟡 stock for now.

Here are the largest trades from this past week:

Still wondering if premium is worth it? Hundreds of people say that it is — you can join them here:

Executive Trading Report

This report tracks the five most recent stock trades from company executives.

Total executive ownership in our reported companies grew by over 27%. Robert Wilson, a director at Calcimedica has the largest increase in share ownership. He grew his ownership percentage by 15%.

Now, let’s talk stocks. Out of everything we see here, nothing stands out to me. All of these stocks are relatively mediocre. The best of the three is Capital Bancorp (CBNK) with a score of 8.0/10, but even then their performance isn’t astounding.

What I want to do for the following week of buys is this: after trading on Monday, if CBNK drops by >1% then I will consider it a buying opportunity. Until that happens I will have to keep it on my 🟡Watch List🟡

Let’s take a look at the other four executive trades:

Investing For Next Week

Let’s get into some of the most intriguing market-moving activities: mergers and acquisitions, top investment ideas for the upcoming week, upcoming contrarian bets, and earnings price volatility.

Did I mention all of the buy, watch, and sell opportunities?

Typically, information like this costs hundreds a month, but you can get it all here (plus more) for $20 a month. Did I happen to mention that we are currently beathing the market? Subscription pays for itself real quick with numbers like that!

Listen to this episode with a 7-day free trial

Subscribe to The Simple Side to listen to this post and get 7 days of free access to the full post archives.