Welcome back to The Weekly Quintet from !

You’re reading about the only newsletter in the world that gives retail investors access to politician, insider, and company executive trading in one place. PLUS, we are the only newsletter that profit shares with its readers through raffles. We are currently raffling off a total of $1,000 and will draw the three winners in August!

Read more about the raffle here.

Now with The Simple Side, you can keep up to date with the latest market news, get actionable trading insights, and win some investment money!

And in case you didn’t know, you can get access to even more information with my premium subscription — plus premium subscribers win double the raffle money! What does premium get you access to? All of the following and more:

Stocks To Watch — Find hidden value!

Market Heat Maps — Follow the green!

Fear & Greed Index — When should you buy?

Rate Tracking — Inflation & interest rates + more!

Upcoming Market News — What’s on the horizion?

Daily Market Winners — Dollars making more dollars!

Mid-Week Congressional Trading — Politicians money makers!

Meme Stocks — Try to capitalize on short term trends!

Crypto Coins — The largest daily crypto winners!

This is the LAST WEEK to take 20% off our premium plan!

We are currently planning on doing the raffle when Substack rolls out the live video feature. If this isn’t done by early August I will pick a random time in August to do it!

The Weekly Recovery

I have decided to add something new to showcase how valuable this weekly send-out can be if you take action with my reports. I will be covering the weekly returns for a portfolio that would have bought the stocks I discussed in this report last week.

The Simple Side weekly newsletter portfolio outperformed the S&P 500 averaging a 1.01% return while the S&P 500 averaged a -1.74% return.

Annualized, The Simple Side Newsletter Portfolio would return 52.99% and the S&P 500 would return -90.48%. These will become more normalized as we track more weeks!

Politician Trading Report & Politician ETFs

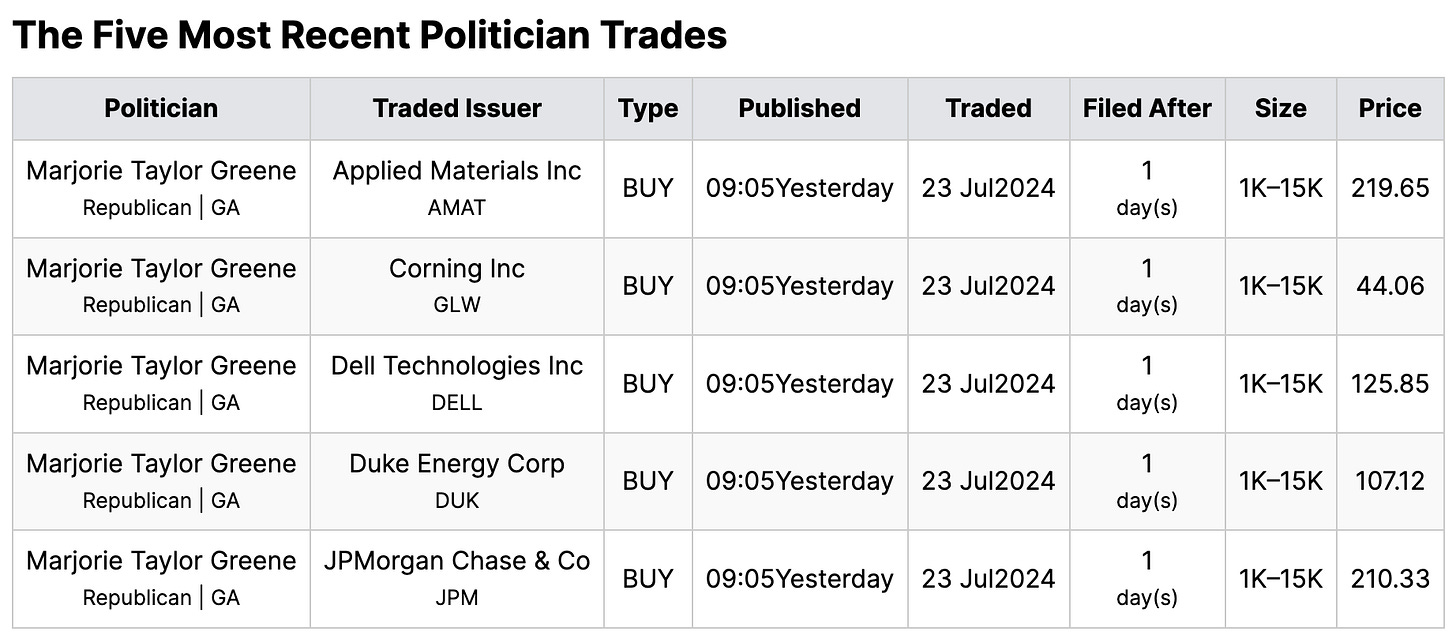

This report tracks the five most recent politician trades — two large holdings in my portfolio — ETFs NANC 0.00%↑ (which tracks democrat trading) and KRUZ 0.00%↑ (which tracks republican trading).

NANC is down 3% this week, 2.61% over the past month, and up 17.25% YTD.

KRUZ is up 0.1% this week, up 1.44% over the past month, and up 10.63% YTD.

What’s fueled those returns? Well, over the past 30 days, 20 politicians have made 51 trades moving over $2.21 million.

One of the buys I was happiest to see from politicians this week was ticker: GLW. I wrote about buying companies that make displays and screens for electronics a while ago and have since returned over 20% on both GLW and OLED. Read more about that here:

Here are the five most recent politician trades:

Insider Trading Report

This report tracks the five largest insider buys from the past week.

The most interesting buyer this week was Abdiel Capital Advisors who bought over $6.7 million worth of Appian (ticker: APPN 0.00%↑). The stock is currently trading in the middle of its 52-week range. Depending on how long you have been following us you may remember us reporting on Appian multiple times this month. Well, the stock is currently up over 28% this month alone.

Here are the other four largest trades:

Executive Trading Report

This report tracks the five most recent stock trades from company executives.

Total executive ownership in our reported companies grew by 27%. Northwest Bancshares NWBI 0.00%↑ had the most notable increase in ownership as the CFO increased his ownership by over 18%.

This couldn’t have been a better time for them to buy as the stock is currently down 10% over the past week and 15% YTD.

Let’s take a look at the other four executive trades:

📈 Weekly Highs & Lows 📉

📈Top Three Gainers📈

========================================

Name: CareMax, Inc.

1 Week Change: 304.43%

Stock Price: 6.39

----------------------------------------

Name: MIRA Pharmaceuticals, Inc.

1 Week Change: 293.44%

Stock Price: 2.71

----------------------------------------

Name: Regencell Bioscience Holdings Limited

1 Week Change: 259.36%

Stock Price: 12.29

----------------------------------------

📉Bottom Three Losers📉

========================================

Name: Fly-E Group, Inc.

1 Week Change: -83.52%

Stock Price: 1.04

----------------------------------------

Name: PS International Group Ltd.

1 Week Change: -58.50%

Stock Price: 1.42

----------------------------------------

Name: MaxLinear, Inc.

1 Week Change: -46.62%

Stock Price: 12.78

----------------------------------------

Weekend Reads For Weekday Trades

Let’s get into some of the most intriguing market-moving activities: mergers and acquisitions, alternative investments, significant news, top investment ideas, and earnings price volatility.

Did I mention the TLDR summary with buy, watch, and sell opportunities?

Typically websites or newsletters charge HUNDREDS monthly for this information. I pay and subscribe to them all, sift through all the BS, and simplify it for all you paying folk.

Listen to this episode with a 7-day free trial

Subscribe to The Simple Side to listen to this post and get 7 days of free access to the full post archives.