Welcome back to The Weekly Quintet from ; also known as the only place you can find trades from Nancy Pelosi and Warren Buffet.

Today’s send-out is a bit different than usual. Find the Table of Contents below:

Big Updates

The upcoming $1,000 raffle date is Aug 17th

Paying subscribers get a chance at $2,000

Poll to select the website I’ll use to pick the winner

This Weeks Unraveling

Godzilla Strikes Japan?

A rising rate fake-out

Why did it affect the US?

Welcome To The Yen Carry Trade

What does the future look like?

Markets Go Up? Down?… Sideways??

The Saturday Sendout

Weekly S&P 500 & Simple Side comparison

Charts

Politician Trading

Insider Trading

Executive Trading

Top & Bottom Stocks

Big Updates

The $1,000 being raffled away is happening on August 17th. I have been debating the best way to do the raffle and I have decided that I will use one of three websites to select the winner. I also want to give you the option to pick the website I use to select the winner: here is a list of three I would prefer. That being said I can also build a random selector in Excel if you would like!

A quick reminder, if you want to win double the money you can become a paying subscriber for $12.50 a month or $125 annually! You also get access to a multitude of other things including bi-weekly market insights and paid-subscriber-only giveaways in the future! Now, if you are already a paying subscriber, but want to get someone else in on the action, you can now gift them a subscription!

The Weekly Unraveling

So the markets this week have been strange at a minimum. We had a Japan disaster, a US “skinny dip,” and a future that seems unsettling… or does it? Instead of taking you all into the weeds with me, I have traversed the depths alone and have created (what I believe to be) the best summation of what happened this week in the markets.

Godzilla Strikes Japan

While it may not have been a true Godzilla, the way Japan’s market when sure makes it look like one. If you are unaware of what I am talking about, here are the quick bits:

Japan’s version of the federal reserve raised interest rates by 25 basis points (aka .25% points).

This raising of rates led to an investment tactic called a “carry trade” to lose tons of value and investors were forced to sell shares to pay for their losses.

This is the rate hike that caused the global markets to freak out.

I want to say that carry trades go much more in-depth than this and I will cover it in the United States section following this one. Nonetheless, the selloff in Japan has brought their version of the S&P 500 (the Nikkei 225) to 3-month and 6-month lows down 8% and 5% respectively. Year-to-date the index is still up around 4% and since my position in the index still sits at a 7% return since mid-December. Due to the enormous volatility I saw from the rate hike and the growing issues within the country I am going to sell this position. Regardless, I want to discuss the issues I see with the country now, and then I will parlay this into the discussion on the US markets.

Japan Has Issues… Big Ones

So, what makes Japan a market I no longer want to be a part of… and no it isn’t their emotional complexity, although that would be 100% better than the real reasons. In reality, they have massive amounts of debt, ridiculous spending levels relative to GDP, a central bank that owns over half of government bonds, and the government cannot service said bonds. Good Lord have mercy there is a lot to get into there. I’ll make it short, sweet, and hopefully painless (unlike Japan’s current economy).

Their debt-to-GDP levels have reached 263% which, believe it or not, is twice as high as the USA. Unreasonable. They also are spending irrational amounts of money at the federal level. They spend around 20% of GDP annually — which is less than the US at 34%. Of Japan’s annual spending, around 5% goes to servicing debt, and honestly, that isn’t too terrible! Well, it isn’t terrible until you realize that they are servicing debt obligations with interest rates that are around 0%. That means that as soon as you bring interest rates up — even by the slightest amount — the cost to service debt skyrockets.

Now, wait a minute. If the Japanese Fed owns half of government bonds, and they control the rates then don’t they want the rates to go up?

Yes.

And what about inflation, with rates sitting so low for so long won’t inflation be high?

Also yes.

But if the rates are brought up will it crush the government whose purchasing power will have to entirely be focused on debt repayment?

Yes again.

So, isn’t there a complete conflict of interest for the country now because the Fed needs to raise rates to combat inflation, but doing so could cripple the government?

The answer to everything is yes.

Now, that isn’t even mentioning the aging population and the government’s increasing cost of social security that go hand-in-hand.

So here is the summary.

The government is paying off ridiculous levels of debt at some of the lowest interest rates of all time.

The debt rates have been so low for so long that it has created insane levels of inflation.

To combat inflation the Fed needs to raise rates.

Raising rates means the government will have to pay more to service more debt.

More money towards debts means the government needs to raise more money.

To raise money they need to issue more debt or collect more taxes.

Both of these options either take more money out of the economy or raise their debt payments.

There then becomes less money to bolster the economy and the government has more debt.

Then the cycle repeats.

So, it makes sense that a rate cut would have a large effect on Japan, but why did the minuscule cut cause such a major splash on a global scale?

This is a reader-supported publication and we provide tons of value to paying subscribers. Please consider supporting me using the button below!

Welcome the Yen-Carry Trade

The yen-carry trade is actually quite simple, and has relatively no major risk — well, at least typically there is no major risk… The yen carry trade is a fancy pants way of saying people are taking out loans in yen currency at interest rates of nearly 0% and then investing that money in their own country’s bonds that have returns of around 3-5%. This helps to avoid the risk of the stock market and still manage a moderate return. What a simple and non-risk-filled arbitrage opportunity, and yet, it managed to make everyone think the US was headed for a recession. Why is that?

Well, the yen carry trade doesn’t make investors a lot of money. I mean 5% over a year is less than the S&P 500. Plus, to market whales, hedge funds, and similar sorts these returns aren’t that great. But there is one way to make them great… leverage. That’s right, to make more money all you have to do is borrow more money.

Let’s say that you are JP Morgan you decided to make a yen carry trade. They would head on over to the Bank of Japan and say “I want to borrow $500 million worth of yen.” The bank would say “Sure, but we need some collateral in case you can’t pay us back.” JPM will then put up $500 million worth of stock as collateral. They then take the yen and invest it in American bonds.

They profit by making the 5% interest that bonds they bought pay minus the interest they owe to the Bank of Japan which is around 1%. This means that can profit a risk-free 4% annually. Now, if the stock market averages 10% annually it makes more sense for them to take the American dollars and invest in the market — that is unless they leverage more. So maybe they borrow $1 billion instead of $500 million.

This works out great for JP Morgan until the interest on their $1 billion loan gets high enough that they have to start selling the stock they put up as collateral to pay for it. Now, THIS is what drove the sudden economic drop earlier in the week. JPM selling massive amounts of stock to pay back their loan drops the market, then more people sell on the drop, and the spiral downward starts.

Now, Back To The Future

So, in all reality, we are looking at a not-so-smooth landing. The Fed’s decree is to have “2% inflation and maximum employment” and I don’t think Powell has done horribly. Inflation is currently coming down but he is struggling with the employment part. You can see below the current unemployment trend. We are on a steady course… just in the wrong direction.

If this trend continues the Fed will have to, regardless of inflation, continue to drop rates. Now, if you aren’t a graph fan I have some other statistics I can throw at you — in July around 70% of millennial workers were preparing to be laid off and I think now that number has risen to around 88%.

Those numbers are so unreasonably high that it almost seems like people know something bad is coming. What did Ben Shapiro get famous for: “Facts don’t care about your feelings.” Well, in this case, they sure as hell agree with the facts. Something else I have been following closely are the revisions to all of the reported numbers coming from the Fed right now. It seems that everything coming out of the fed right now is being adjusted in the direction investors DO NOT want. For example, unemployment rates have been adjusted up, inflation numbers have been adjusted up, and so on.

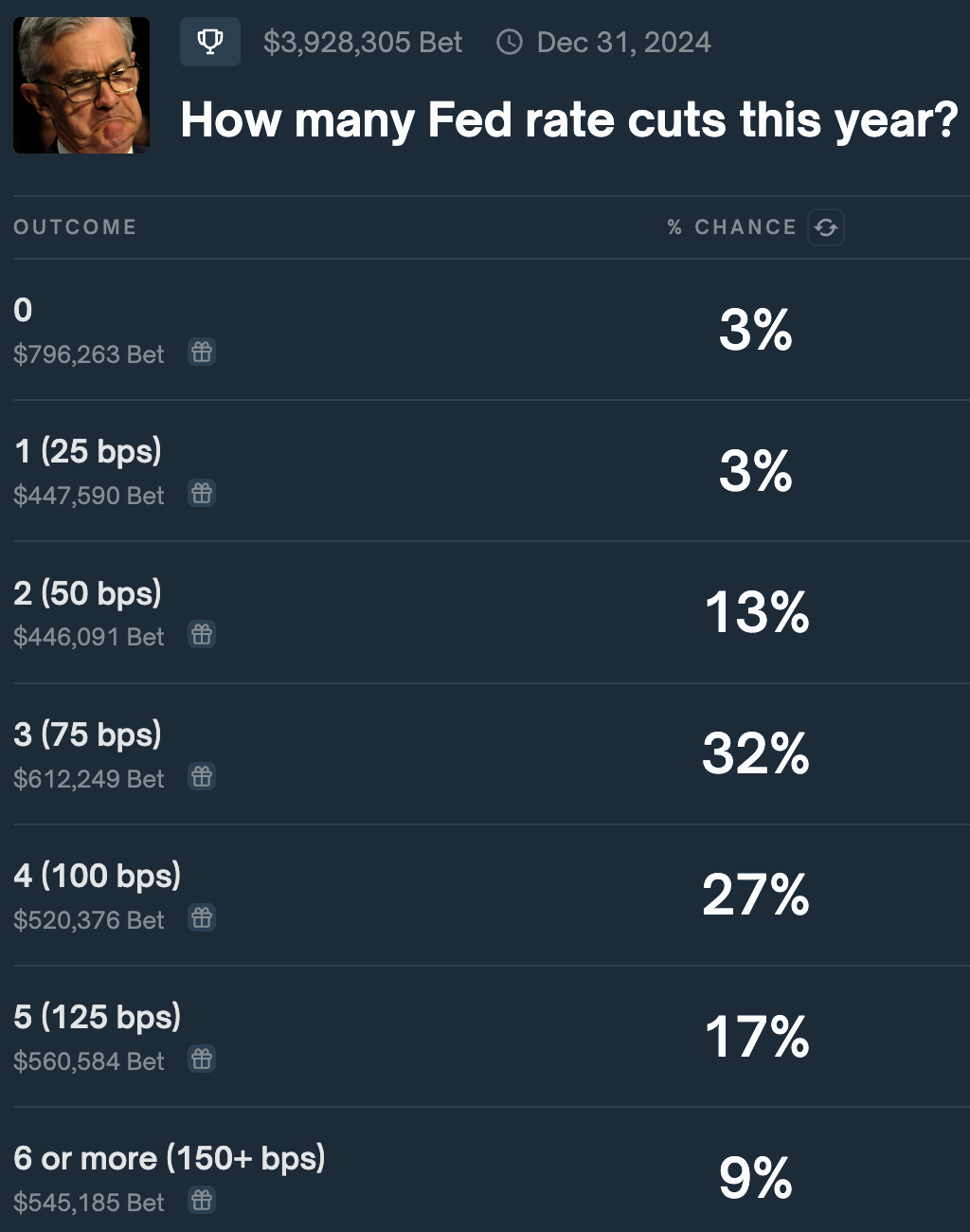

We also now have prediction markets like

showing rate cuts now most likely being predicted to be between 75bps and 100bps (currently 59%) — something that was not expected last month.So I guess what I am getting at is we will likely see a bit of a pullback in the market given the current global volatility and uncertainty around the current Japanese carry trades and their economy’s strength.

Watching revisions of old data is going to be VERY important. If we see the same dropping trend continue into the near future the likelihood of a recession occurring slowly increases. This does make it hard to get excited about the incoming numbers. YOU CANNOT TAKE THE NUMBERS COMING OUT OF THE FED AT FACE VALUE.

Now, whether we actually tip over into recession territory is to be determined. I think there is a lot of cash on the sidelines that could keep the market from going full bore recession. Again, I also think there is a lot of room for rate cuts from the Fed. This is one of many reasons I have been investing in bonds since October and increased my positions this week. I think these positions will see short-term returns through September and also will pay a portion of their 5% dividend sometime in October. If I continually expect rate cuts I will maintain my positions until I feel yields are at their lowest before exiting these positions.

The Weekly Recovery

This week we lost to the S&P 500 by 0.54% as we watched both Chevron and Bonds take major hits. We expect bonds to turn around, and after the Berkshire Occidental Petroleum, we will shift towards more buying here. Currently, we are still on track for weekly S&P 500 outperformance.

Weekly this means we outperform by 1.09%

Over 3 weeks we are beating the market by 3.27%

Annualized means we outperform by 56.68%What did our paying subs get to see buying opportunities for? Well…

Politician Trading Report & Politician ETFs

Insider Trading Report

Still wondering if premium is worth it? Hundreds of people say that it is — you can join them here:

Executive Trading Report

📈 Weekly Highs & Lows 📉

📈Top Three Gainers📈

========================================

Name: TenX Keane Acquisition

1 Week Change: 229.00%

Stock Price: 40.50

----------------------------------------

Name: MGO Global, Inc.

1 Week Change: 132.70%

Stock Price: 6.12

----------------------------------------

Name: Lumen Technologies, Inc.

1 Week Change: 81.43%

Stock Price: 5.57

----------------------------------------

📉Top Three Weekly Losers📉

========================================

Name: Actinium Pharmaceuticals, Inc.

1 Week Change: -66.77%

Stock Price: 2.05

----------------------------------------

Name: AN2 Therapeutics, Inc.

1 Week Change: -60.08%

Stock Price: 1.03

----------------------------------------

Name: FibroBiologics, Inc.

1 Week Change: -59.55%

Stock Price: 1.97

----------------------------------------

“The key to making money with stocks is not being scared of them”

- ¢, Founder of The Simple Side

Share this post